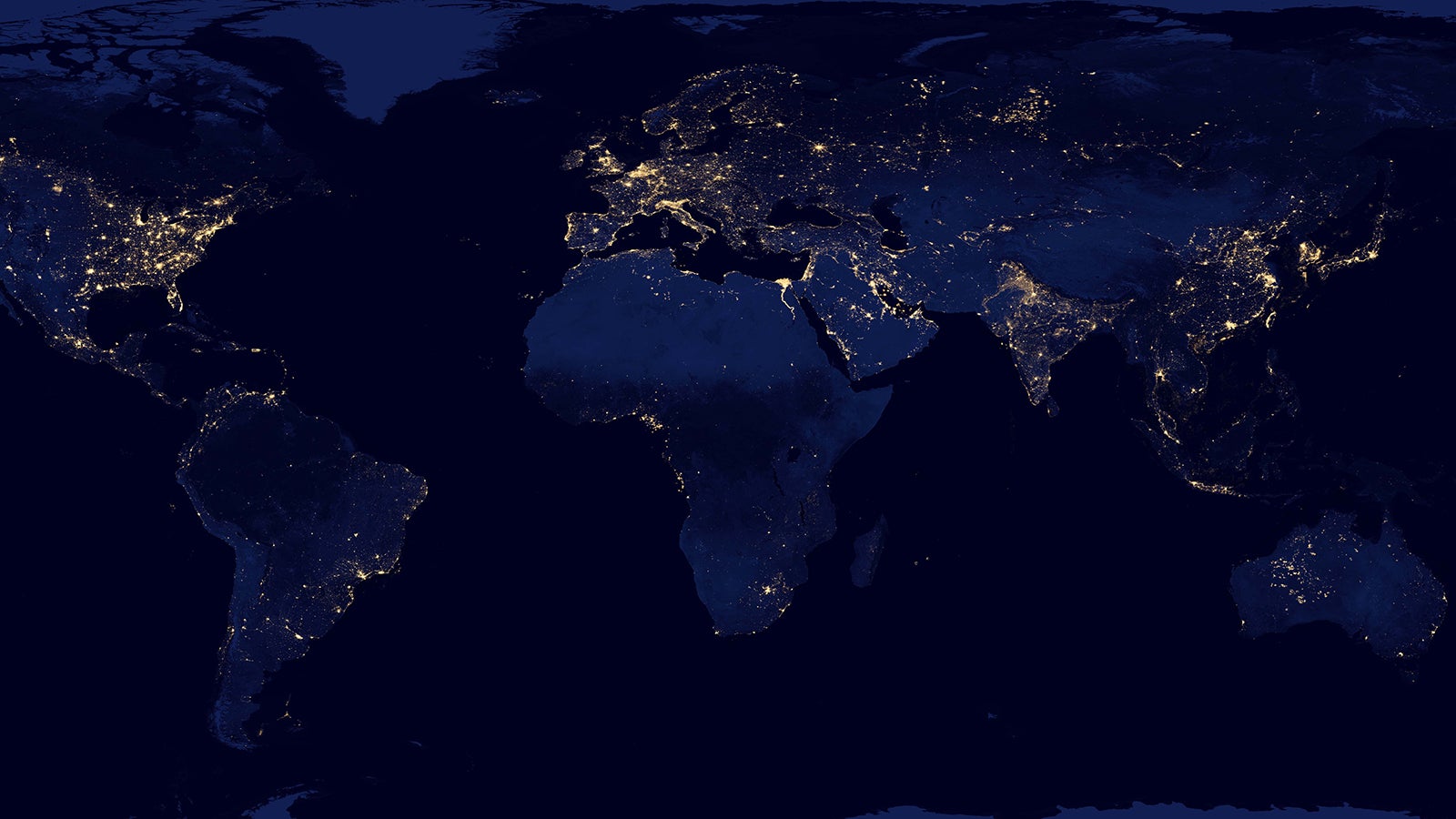

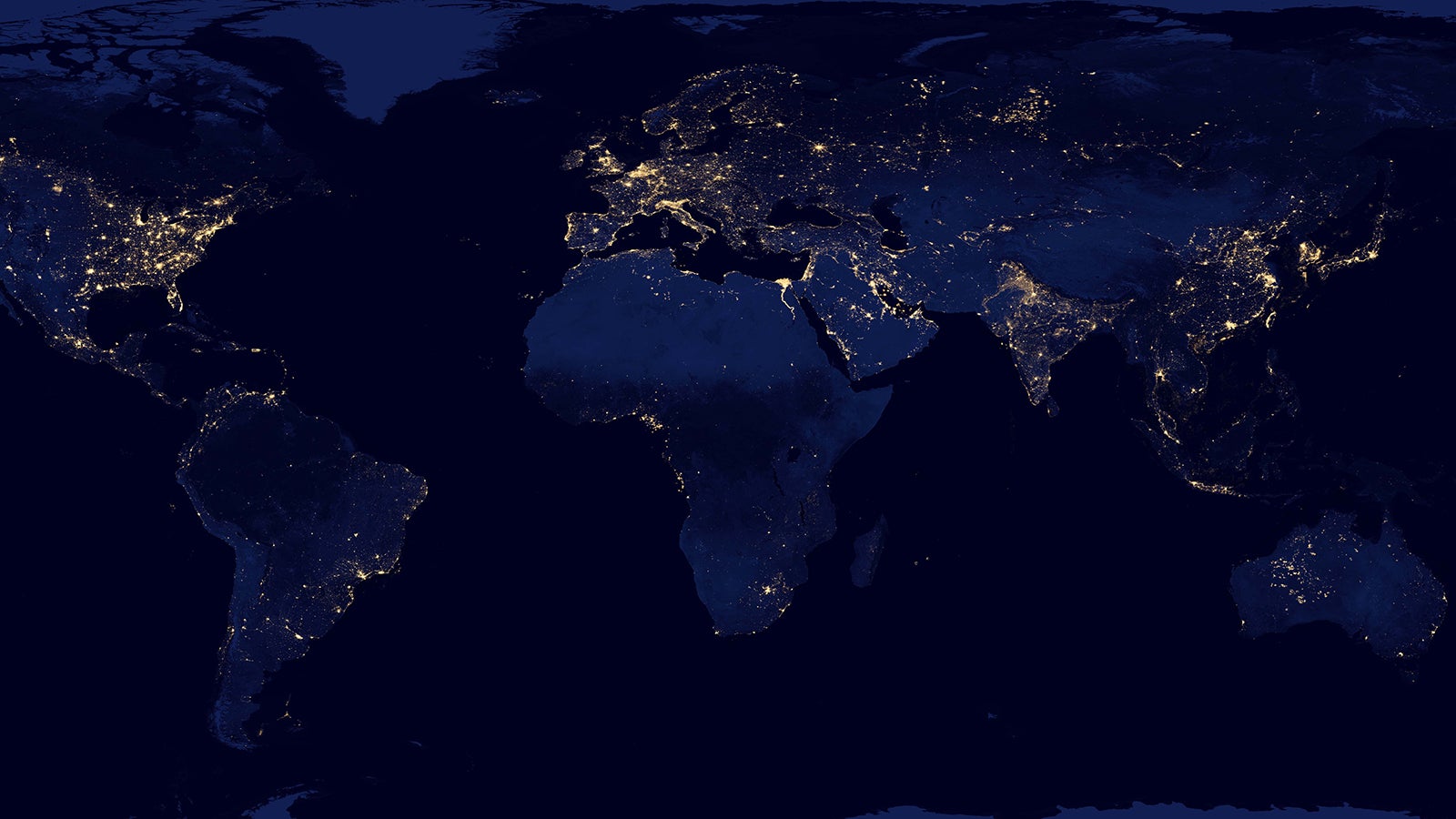

Keeping the lights on could increase GDP by 2% in sub-Saharan Africa

If you look at the right data, sub-Saharan Africa has enjoyed rapid, healthy economic growth over the last decade. An emergent middle class, youthful labor force, quickly scaling ICT industry, rising GDP, and slowing inflation all bode well for the region.

If you look at the right data, sub-Saharan Africa has enjoyed rapid, healthy economic growth over the last decade. An emergent middle class, youthful labor force, quickly scaling ICT industry, rising GDP, and slowing inflation all bode well for the region.

It’s all the more impressive that this kind of growth has taken place in the absence of sufficient infrastructure development. All across the globe, more people are moving into cities. And Africa is urbanizing faster than most regions: Despite its outsized rural population, Africa is projected to become 56 percent urban by 2050.

But this escalating demand for livable cities—and along with it, the requisite power and water supply necessary to sustain it—has revealed a huge gap in sub-Saharan Africa’s infrastructure needs as well as a gap in the financing to fill it. According to the Africa Infrastructure Country Diagnostic (AICD), that deficit stands at over $93 billion annually over the next decade—only half is financed, leaving a gap of more than $50 billion to fill each year. The World Bank notes that the continent is losing 2 percentage points of GDP because of this deficit.

In the wake of the 2008 financial crisis, there’s been a trend toward fiscal austerity in governments that have typically provided official development assistance to Africa. Eyeing an opportunity, private investments in African infrastructure projects have taken on a larger role in helping to fill that financing need. Further, sovereign wealth funds in resource-hungry China and India have taken an increased capital interest in the sub-Saharan. Some estimate that China has outpaced global development banks, such as the World Bank, as the largest backer of African infrastructure development.

Building a more robust infrastructure would help nations in the sub-Saharan region to scale up the production and refinement of untapped domestic resources, and allow them to export those resources more efficiently. But to begin scaling industrial capacity to achieve that goal, the lights need to be kept on: According to the International Energy Agency (IEA), only about 290 million out of 915 million people in the region have access to electricity.

As a founding partner of the Power Africa initiative, GE in Africa committed to provide new electric generation capacity in cooperation with the initiative and other private sector partners across six countries, including Nigeria. As part of that commitment, over the next few years GE in Africa’s Distributed Power business will supply aeroderivative gas turbines in Nigeria to increase grid reliability. That will help to generate uninterrupted power at the state refinery, supplying a reliable source of energy from which to draw upon.

The UN predicts that the sub-Saharan region’s population will swell to 1.5 billion in size by the time that 56% will be living in urban areas (2050), making the push for sound, sustainable development all the more pressing. If African economies can grow at the pace they have been in the face of a sizable energy dearth, imagine what they will do when they are fully powered.

This article was produced on behalf of GE by the Quartz marketing team and not by the Quartz editorial staff.