China needs to get its people to spend—and that’s a lot harder than it sounds

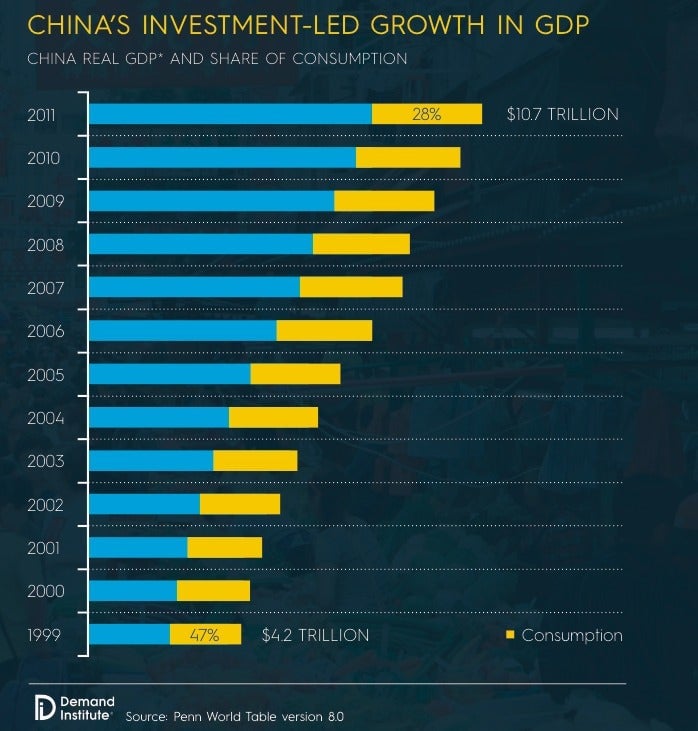

There’s one really big problem with China’s 1.3 billion customers: They don’t spend enough. Even as China’s economy has soared, the share of output coming from consumption has nosedived. Over the last decade or so, that’s sapped many trillions of dollars from the global economy.

There’s one really big problem with China’s 1.3 billion customers: They don’t spend enough. Even as China’s economy has soared, the share of output coming from consumption has nosedived. Over the last decade or so, that’s sapped many trillions of dollars from the global economy.

It has also left China in a pickle. Its low consumption rate is thanks largely to the government’s growth model, which forces up household savings in order to finance rapid industrialization. That artificially cheap, credit-fueled wealth transfer has powered China’s awe-inspiring growth—but it has also saddled the country with roughly $30 trillion in debt. The Xi Jinping administration vows that imminent reforms will uncork bottled-up consumer spending, buoying growth so China can stop investing so much.

On paper, “rebalancing,” as this process is known, sounds logical and natural, an effortless economic arabesque. However, a new report by the Demand Institute suggests this transition could be deceptively tough to pull off in the next decade.

A big reason is that China must reverse two separate trends suppressing consumption—a distinctive challenge, says Louise Keely, president of the Demand Institute, a research initiative jointly operated by the Conference Board and Nielsen.

“In our examination of cross-country historical data, China is unique in having a period of sustained decline in consumption’s share of GDP that was due both to the decline in household income’s share of GDP and a rise in the household savings rate,” says Keely, who co-authored the report, by email. “That point is under-appreciated.”

That means that for the Chinese government to “rebalance,” it must both shift a bigger share of output to households and convince households to save less. Analyzing China’s development path alongside those of 160-0dd other nations, the report concluded that even by 2025, it’s likely that Chinese consumption will contribute no greater a share of GDP than the 28% it does today.

Chinese consumption wasn’t always so feeble a part of growth. Back in 1952, it accounted for 76% of China’s economy, according to the Demand Institute, which based its analysis on the Penn World Table.

The blistering pace of Chinese industrialization since the 1980s and 1990s was made possible by government policies—notably financial repression and shoddy social welfare—that compelled households to salt away their money.

By 1999, consumption’s share had slipped to just 47%. And it didn’t stop there.

Even as China’s economy boomed, consumption’s share of GDP fell nearly 20 percentage points, hitting 28% in 2011, the last year for which there was globally comparable data.

This, explains the report, is the longest slide in recorded history—and an expensive one, too. Had consumption stayed flat after 1999, China would have consumed nearly $11 trillion more by 2011.

The report’s data might not seem to square with the Chinese government’s upbeat reports about “rebalancing” of late. In 2014, it reported that 37.7% of GDP (link in Chinese) came from consumer spending, up from 35.9% in 2010. However, once adjusted for purchasing-power parity and inflation, that’s still equivalent to around 28%, says Keely.

Other factors making consumption look rosier than it is are at play as well, says Ho-fung Hung, associate professor at Johns Hopkins University, who was unaffiliated with the research. ”Recently, consumption’s share seems to start growing but it is not because of accelerated consumption growth,” says Hung. “[Rather it’s] because of slowdown in investment. Consumption growth needs to be larger to pick up the slack.”

He adds that the obstacles for China’s transition to a consumption-led economy are both institutional and political—and therefore not a mere evolution of consumer habits.

The Demand Institute’s research lends support to the conclusion that large systemic constraints are to blame. Other countries have grappled with upping either household income’s share of GDP or consumption’s share of household income—but not both. But as Keely mentioned, China alone has left itself with a double-whammy of those challenges to fix.

“That does make China’s transition more complex—those two big underlying forces need to be reversed,” says Keely. “It also means there’s a bigger range of [policy] levers that can be pulled to affect that transition.”

And though other countries have struggled to up their consumption share—including Singapore, Bangladesh, and Sweden, to name a few—among those countries with economies similar to China’s, consumption’s share of output typically stayed flat for a long time before finally rising, says the report.

The Demand Institute makes a compelling case that a consumer spending explosion won’t be as easily sparked as many assume, says Christopher Balding, associate professor at Peking University HSBC Business School, Shenzhen, who was unaffiliated with the research. In particular, the report’s cross-country analysis squares with what seems to be slow progress on reform.

“[We] have heard all this talk of rebalancing but in terms of tangible policies, there is very little evidence. The government still drives policy towards extremely high savings, [state-owned banks], fixed asset investment, and credit growth,” he tells Quartz. “I think the potential is there but I really don’t see the political willingness to make changes to boost consumption.”

To be fair, the government has made some changes over the last half-decade. But so far, these have been less than encouraging, says the report. Despite a slew of reforms to social welfare, education, and the one-child policy, household savings rates haven’t budged. Certain policies designed to boost household consumption have even backfired.

For both companies and the global economy, there’s now even more at stake. The report modeled two scenarios: one in which consumption’s share of GDP stays at 28% until 2025, the other in which it rises to 46% (both models are based on the Conference Board’s predictions that economic growth will slow to 4% by 2019 and remain there until 2025).

The difference is considerable: If China’s consumption share of GDP stays flat, it stands to lose $15 trillion in consumer spending—a sum that would be an enormous boost to the global economy.

Getting it right will start to unlock that $15 trillion, rather than shifting it through the banking system to be squandered on some Podunk city’s airport, or similar wasteful infrastructure projects. With its investment-led growth model cutting out quickly—and debt piling up just as fast—China needs these reforms more than ever. Ultimately, though, giving its people back their wealth will cost the state and its cronies, and that’s possibly not yet a price the government is willing to pay.