The hidden danger of China’s stock market bubble

In the year since June 2014, around 23 trillion yuan ($3.7 trillion) suddenly appeared in the Chinese stock markets. And then, even more quickly than they gushed in, trillions of those yuan simply evaporated.

In the year since June 2014, around 23 trillion yuan ($3.7 trillion) suddenly appeared in the Chinese stock markets. And then, even more quickly than they gushed in, trillions of those yuan simply evaporated.

But where did those trillions of yuan come from? Not from corporate earnings; sagging sales have crushed profit growth of late. And not from wealth shifted from property sales or bank deposits; both are rising. And not from foreign inflows either.

A good chunk of it, as J Capital Research explains in a recent note, came from a surge in lending on the interbank market, through which banks and other financial institutions borrow cash when they’re running low.

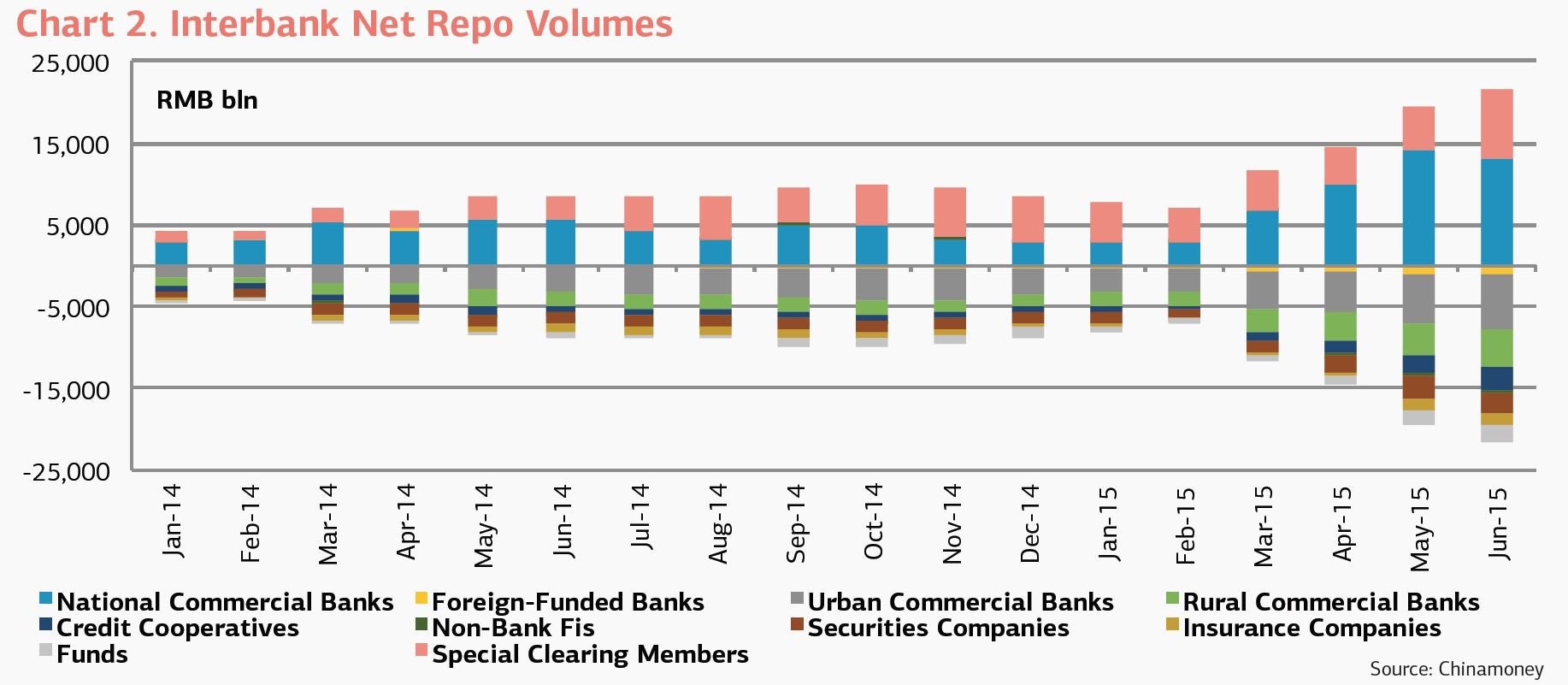

“This is basically a one-way flow of capital from centrally controlled banks to smaller players who rely on this funding to turn it over and prop up the stock market,” Carlo Reiter, macroeconomic analyst at J Cap, tells Quartz.

This interbank borrowing boom is worrying not only because of the precarious stock market bubble it inflated. The bigger concern, says Reiter, is who exactly will be on the hook if these risky stock bets go bad—namely, big state-owned banks.”Fundamentally, it’s putting riskier assets on bank balance sheet,” he says.

In many other countries, interbank markets facilitate very short-term loans between banks to round out liquidity needs. Not so in China. All kinds of dodgy things are traded on the interbank market, making it a once key source of shadow lending—and, these days, credit for stock investments.

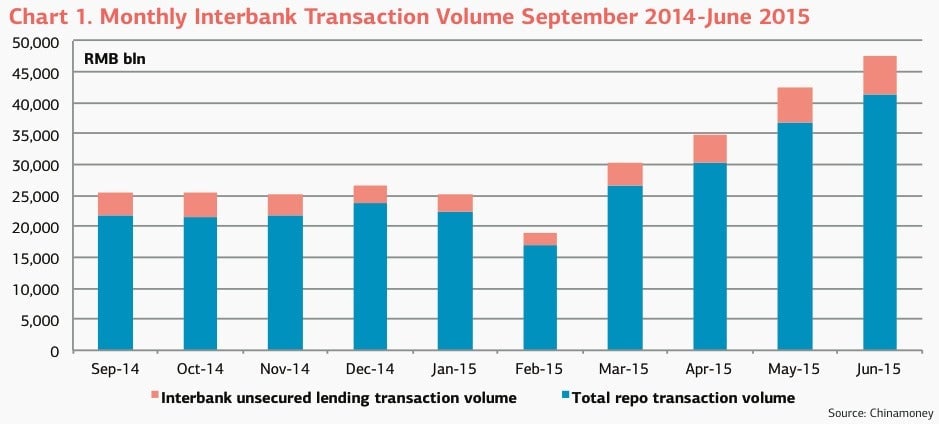

Starting this year—at the same time as Chinese stocks were taking off—an explosion in repurchase agreements (a.k.a. “repos,” these are kind of like pawnshop deals between banks, where one bank sells a bond to another bank, agreeing to buy it back at a set date) lit up the interbank market.

For instance, in June 2015, Chinese financial institutions borrowed 41 trillion yuan via interbank repos, 19 trillion yuan more than in the first month of the year. This increase compares with a rise of only 7.6 trillion yuan between January and June in 2014.

Where do those loans then go? Margin trading is the most obvious channel, though only as little as half is tracked by official data. Other hidden layers of leverage underlie Chinese share prices—including corporate loans, wealth management products (WMPs), and WMP derivatives like Alibaba’s and Tencent’s online money-market funds could also be at risk, says J Cap.

This interbank boom didn’t happen all by itself. The major lenders by a wide margin are big state-owned banks, says Reiter. It’s probably no coincidence that as the government-engineered stock market started losing steam earlier this year, they started cranking out the cash. In June, when the market lost 30%, they loaned out 10 trillion yuan more in repos than they borrowed. (For a sense of context, the Big Five state-owned banks’ reported assets add up to about 80 trillion yuan.)

There are signs that effort hasn’t abated. In the first two weeks of July, the big state-owned banks have lent out a combined 1.3 trillion yuan just to China’s margin-trading clearinghouse, reports the Financial Times (paywall). That sum, along much of the other interbank credit, will be passed on to brokerages—or invested directly—pumping many trillions more into Chinese stocks.