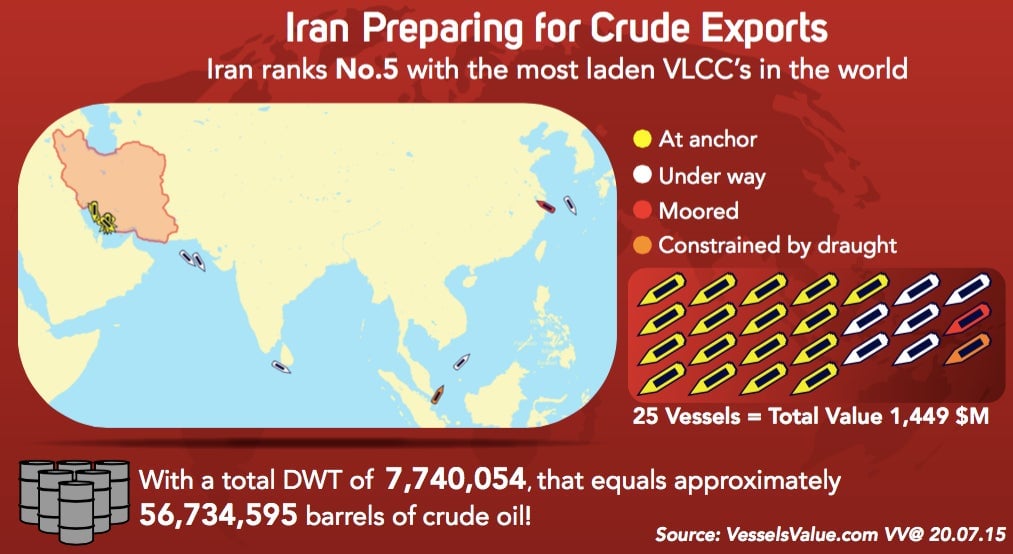

Here are the 25 Iranian oil tankers waiting to ship out somewhere in the world

Most analysts expect Iran to be able to step up its oil production only next year in the wake of its nuclear agreement with world powers. By that reckoning, any big new plunge in oil prices may also wait until at least the first few months of 2016.

Most analysts expect Iran to be able to step up its oil production only next year in the wake of its nuclear agreement with world powers. By that reckoning, any big new plunge in oil prices may also wait until at least the first few months of 2016.

But Iran’s oil isn’t only in the ground. While the country has been under stern sanctions for more than two years, it’s been pumping oil and storing it in humongous tankers known as Very Large Crude Carriers (VLCCs) in various places.

Iran hasn’t disclosed how much oil is in these tankers, but it’s been variously estimated between 30 million and 50 million barrels. If parceled into the already-saturated market in, say, 250,000-barrel-a-day dollops, that would make oil prices even softer for the four to five months until it was all sold.

Here’s a chart from Vessels Value, a UK firm that values and maps the location of the ocean-going shipping fleet. It counts 25 Iranian VLCCs on the water with a capacity of 56.7 million barrels of crude.

Again, there’s no way of knowing with certainty how much oil the tankers contain, but the calculations here suggest the estimates at the high end of the range (50 million barrels) are plenty plausible. They also suggest that the market, which currently has Brent crude priced at about $56 a barrel, better get prepared to absorb more supply.