Sorry, laid off Western bankers. Asia cannot hire you now

Since late 2008, getting a well-paid job in fast-growing Asia has been the great white hope of laid off Western bankers. It should not be anymore.

Since late 2008, getting a well-paid job in fast-growing Asia has been the great white hope of laid off Western bankers. It should not be anymore.

Some analysts predict Barclays will cut up to 40% of its investment bankers in Asia. Bloomberg puts the figure at a more modest 15%, while also reporting Morgan Stanley is trimming 55-60 investment banking jobs in Asia Pacific.

Further layoffs are likely to follow, because of a sharp downturn in Chinese companies conducting IPOs.

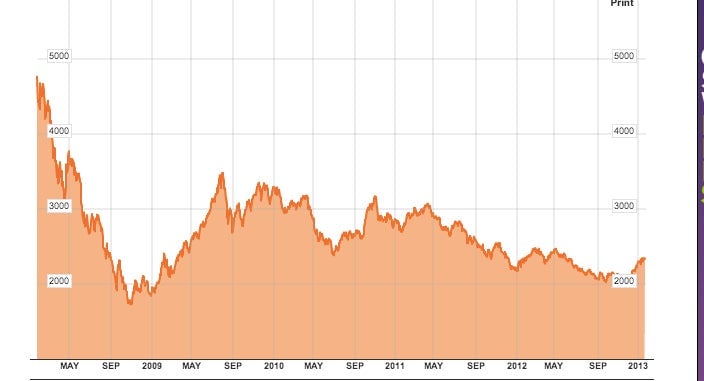

As Reuters reports, Chinese banks are cutting bonuses and firing staff because China’s stock market regulator has frozen IPO approvals. The reason for that is unclear, but may be due to the terrible performance of Chinese shares in recent years (see below chart). The Beijing government owns majority stakes in most large Chinese companies, and would want them to debut on the stockmarket at decent valuations.

China’s IPO freeze is hurting Hong Kong, and that is really bad news for global banks’ Asian businesses.

Large M&A deals are relatively thin on the ground in Asia—high concentrations of family or government ownership means fewer opportunities for private equity or foreign buyers—so banks rely on Hong Kong’s IPO market for a huge share of their work in the region.

That market, in turn, is inextricably linked to China. Big mainland Chinese companies that go public domestically tend to do parellel fund-raisings in the former British territory. (The Hong Kong share sales allow the companies to raise US dollars from international investors, who themselves are greatly restricted from buying Chinese shares in China because the yuan is not freely traded.)

And Hong Kong IPOs have slumped. Last year represented a four year low in terms of money raised. Other reasons for Hong Kong’s deal decline included China’s economic slowdown and high profile cases of accounting fraud involving Chinese companies that have made international investors wary.

Hong Kong’s securities regulator is also running a high-profile campaign to clean up lax due diligence practices at investment banks who sponsor IPOs on the city’s stock exchange. The effort has been welcomed by investors, but also underscores the dangers of investing in Chinese companies at a time when this issue is high on the news agenda.

As a reflection of Hong Kong’s IPO downturn, law firm Herbert Smith has redeployed associates who formerly advised investment banks on capital markets deals to other teams, such as dispute resolution.

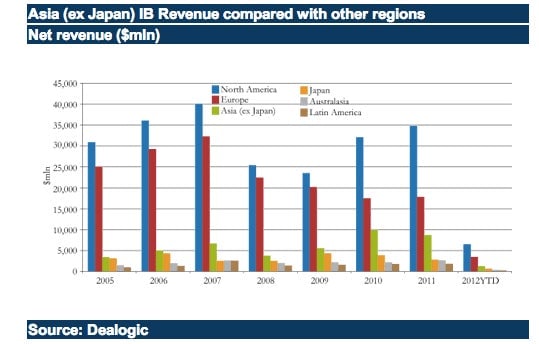

And as this excellent article from financial magazine Euromoney outlined in detail last April, global banks have never made much money in Asia compared with the US and Europe. They survive in this region when Chinese capital markets activity is booming. When it is not, they have to choose between shedding staff or working extremely hard to convince Indonesia’s huge business families or the heads of South Korean chaebols to work up an appetite for selling their companies to outsiders.

“For all Asia’s promise, investment bankers in the region face a host of challenges,” the Euromoney article said.

“Asian investment banking is unhealthily tilted towards equity capital markets, making it especially vulnerable to times… when those markets are closed.”

“It’s also far too focused on China.”

The author, Chris Wright, studied in detail how much deal action the global banks that expanded heavily into Asia were really getting. The results were astounding.

Here is Euromoney’s chart, produced in partnership with investment banking data compiler Dealogic, that shows how small Asia’s contribution is to banks’ top lines.

So laid off Western bankers should probably look to other careers, instead of to Asia.