The world’s most dangerous banks, ranked

If the financial world goes into meltdown again, one of these banks will probably be at the center of it. They are the so-called global systemically important banks, or G-SIBs, identified by regulators as any institution “whose distress or disorderly failure, because of its size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and economic activity.”

If the financial world goes into meltdown again, one of these banks will probably be at the center of it. They are the so-called global systemically important banks, or G-SIBs, identified by regulators as any institution “whose distress or disorderly failure, because of its size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and economic activity.”

There are 30 such banks that have earned the title, which requires them to maintain an extra-large buffer of loss-absorbing capital that will be phased in starting next year. (Predictably, they’re not happy about it.) Overall, the world’s most important bank—in terms of the damage it would do to the global economy if it blew up—is JPMorgan Chase:

The bank run by Jamie Dimon also tops four of the five sub-rankings that feed into the overall G-SIB score.

The calculations that regulators use to determine whether a bank is “systemically important,” and how big its capital surcharge should be, are complex and obscure, not unlike the banks’ balance sheets themselves. But a new report by the Office of Financial Research (pdf), an independent arm of the US Treasury, helpfully unpacks the methodology, and sheds light on how banks rank along various subcategories of size, complexity, and interconnectedness.

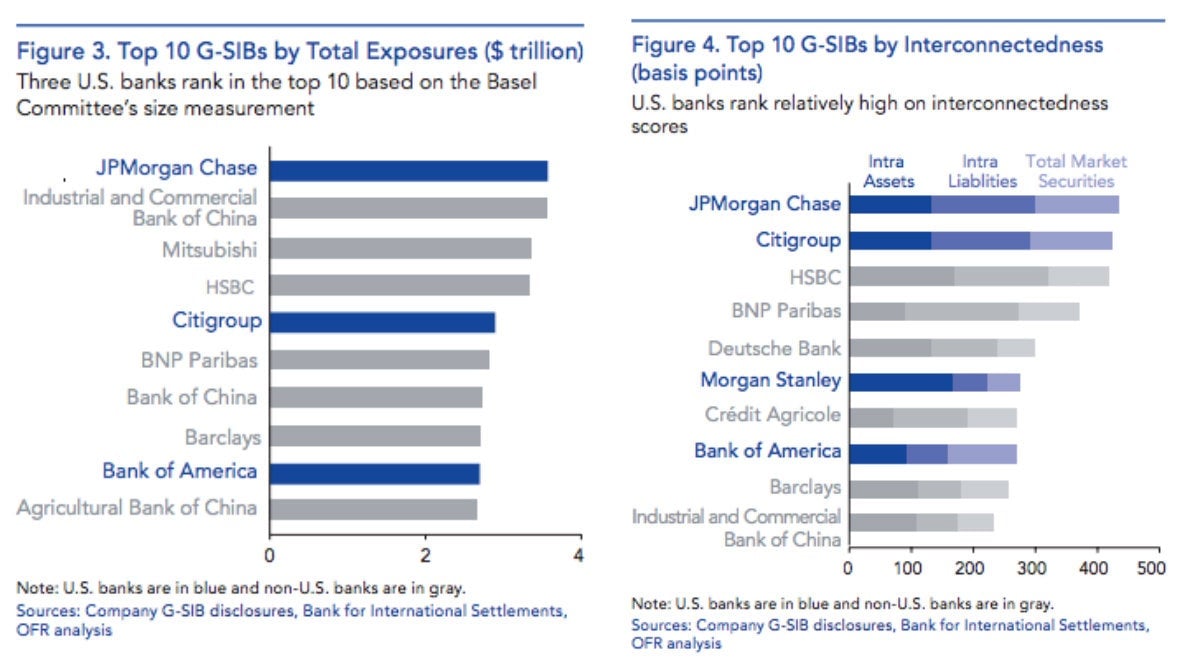

In terms of size, JPMorgan is only the fifth-largest bank by assets, behind a clutch of Chinese banks. But the American bank’s assets, laden with exposure to derivatives and other racy market securities, are deemed more dangerous by regulators, and thus JPMorgan rises to the top of the rankings of the “total exposures” that matter most to global financial stability. “Interconnectedness” is measured by the size of intra-financial exposures, and here JPMorgan is also narrowly in the lead, ahead of Wall Street rival Citigroup:

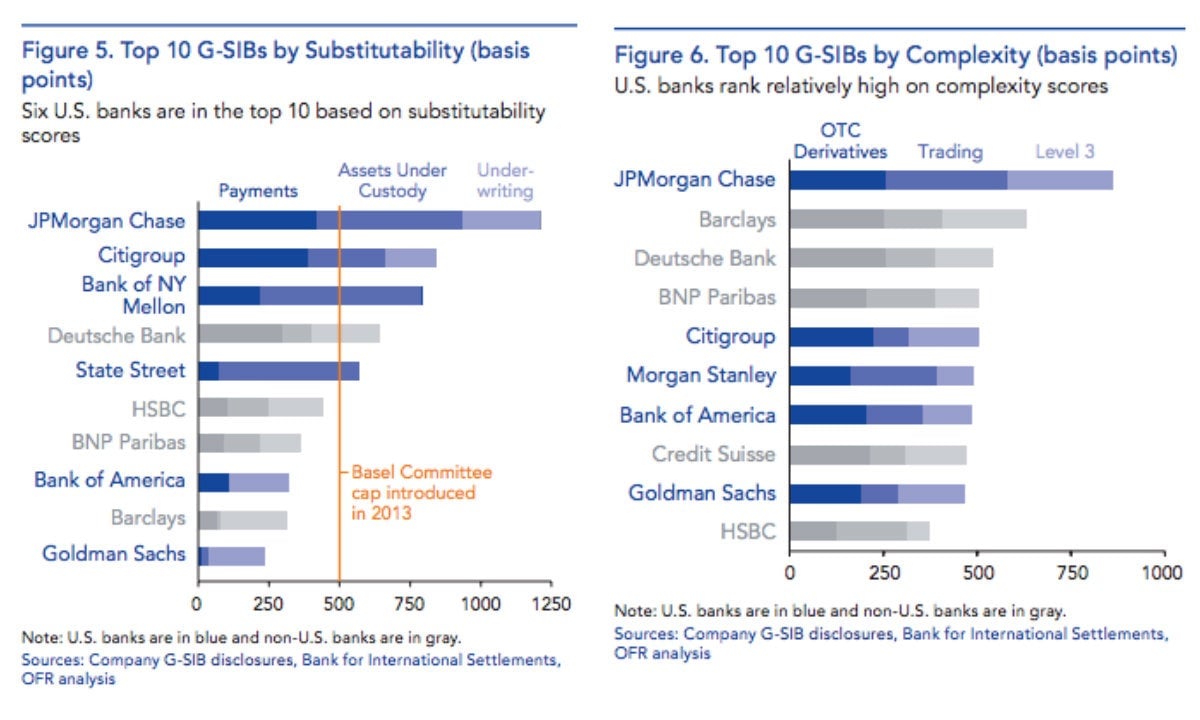

“Substitutability” is gauged by how important a bank is to the fundamental infrastructure of the financial system—banks with large market shares in payments, assets under custody, and underwriting businesses would be hard to replace if they went under. “Complexity” is scored by how many hard-to-value derivatives and illiquid assets a bank holds. JPMorgan is far ahead of all other banks on both of these dimensions:

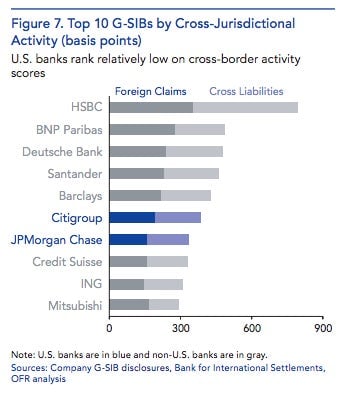

The only category JPMorgan doesn’t top is “cross-jurisdictional activity,” which is dominated by globe-trotting European banks, with HSBC far ahead of the others in terms of its cross-border links.

It will come as news to no-one that if JPMorgan or HSBC were to suddenly collapse, the global economy would be in bad shape. But the nature and scope of these and other big banks’ exposures and connections are important to understand.

And as this report points out, the banks that pose the biggest threat to financial stability (cough, JPMorgan, cough) aren’t currently holding more capital, relative to their risk-weighted assets, than banks with less worrying risk profiles.

What’s more, “the trade-offs between the potential benefits of scale and scope, and the potential costs from the failure of systemically important institutions, are not well understood,” the researchers conclude, ominously.