US companies now have to disclose how much more their CEOs make than regular employees

American CEOs are about to face even more scrutiny over how much they get paid in relation to their employees.

American CEOs are about to face even more scrutiny over how much they get paid in relation to their employees.

The Securities and Exchange Commission passed a rule Wednesday (Aug. 5) requiring companies to disclose the pay gap between CEOs and their employees.

To get a sense of what to expect, an analysis by the Economic Policy Institute says the CEO/worker pay ratio currently stands at about 300 to one, up from just 30 to one in the late 1980s.

The move to require more disclosure comes after five years of intense debate and delays over the new rule, which was mandated by Congress as part of the mega package of financial reforms passed after the 2008 financial crisis known as Dodd-Frank.

When the law was passed in 2010, many Americans were unemployed and saw their homes in foreclosure. They saw big Wall Street banks getting bailed out, even as executives took home huge payouts. Economists pointed to the rise of income inequality as one factor causing the financial crisis (although that point has been debated heavily (pdf)), and worker advocates said outsized pay encourages executives to take excessive risks.

Many companies and business groups fought back against the pay-ratio disclosure, arguing requirements represented a burdensome overreach of government and that the numbers could be easily skewed. The SEC received over 287,000 comment letters over the rule.

Like all statistics, there’s no doubt these numbers will be massaged in myriad ways. As part of the new rule, the SEC said companies can select methodology that “works best for their own circumstances” and determine median pay based on a sampling of their employees, rather than total employee population.

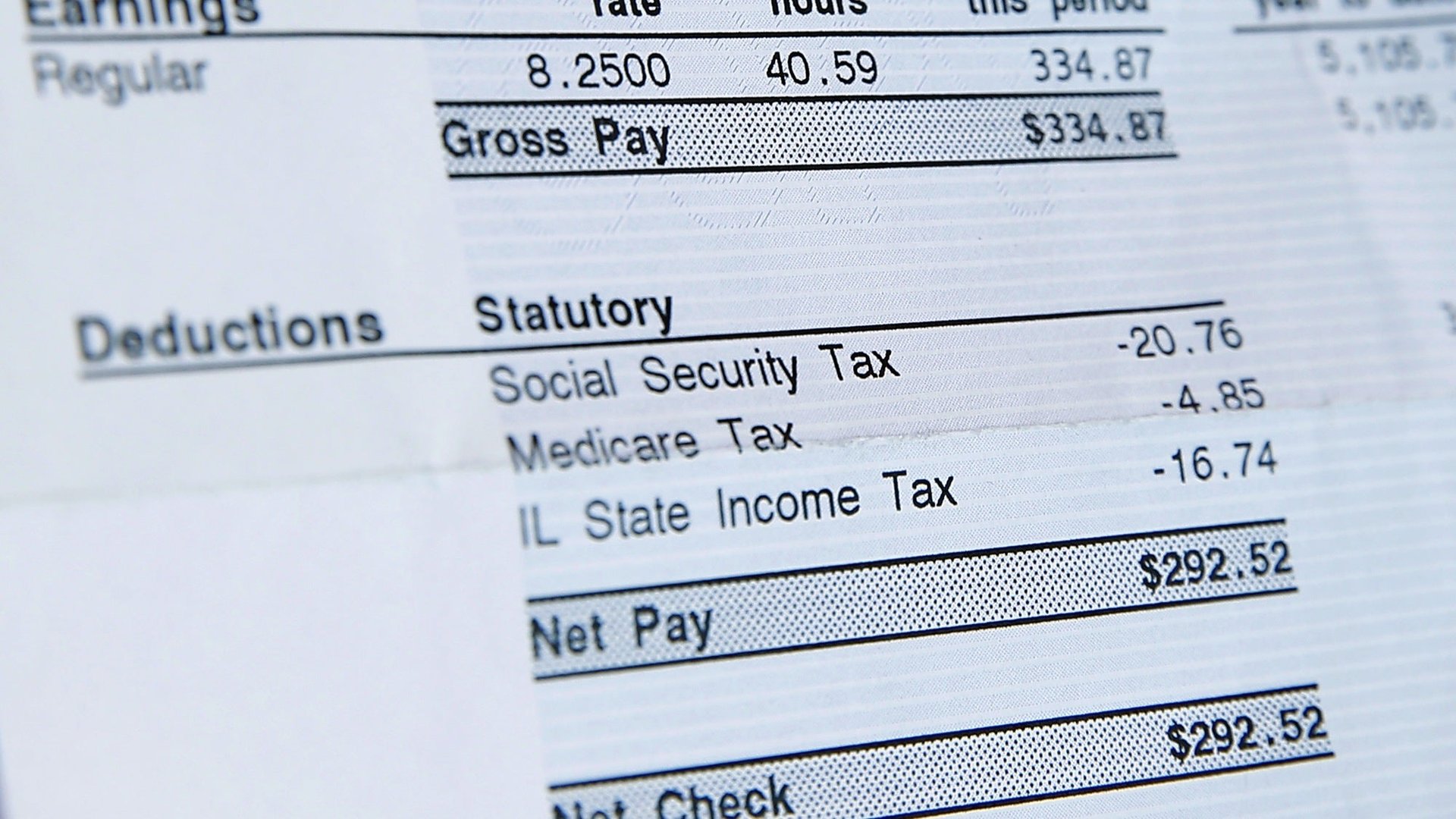

Plus, a big chunk of executive compensation is delivered in company stock awards that can be paid out over time. These awards are often tied to how well the company is performing and can disappear during down times. As for the typical worker, much of total compensation comes from their health benefits rather than their salaries.

Still, pay gaps among companies—especially between businesses in the same industry—can be telling.

This chart from Payscale, which used its own data of worker pay along with CEO compensation data from Equilar, shows how big the disparity can be.

Perhaps more interesting than shining another light on what the CEO gets paid (which has long been disclosed in financial filings), the new rule, which takes effect in 2017, will give a view into how much a typical worker is paid—a figure companies are reticent to share.

As an investor, you could see whether pay differences among, say, retail workers at Walmart, Costco, and Target have led to better sales over time. And as a consumer, it would be great to buy goods and services equipped with information on how much companies are paying their workers.