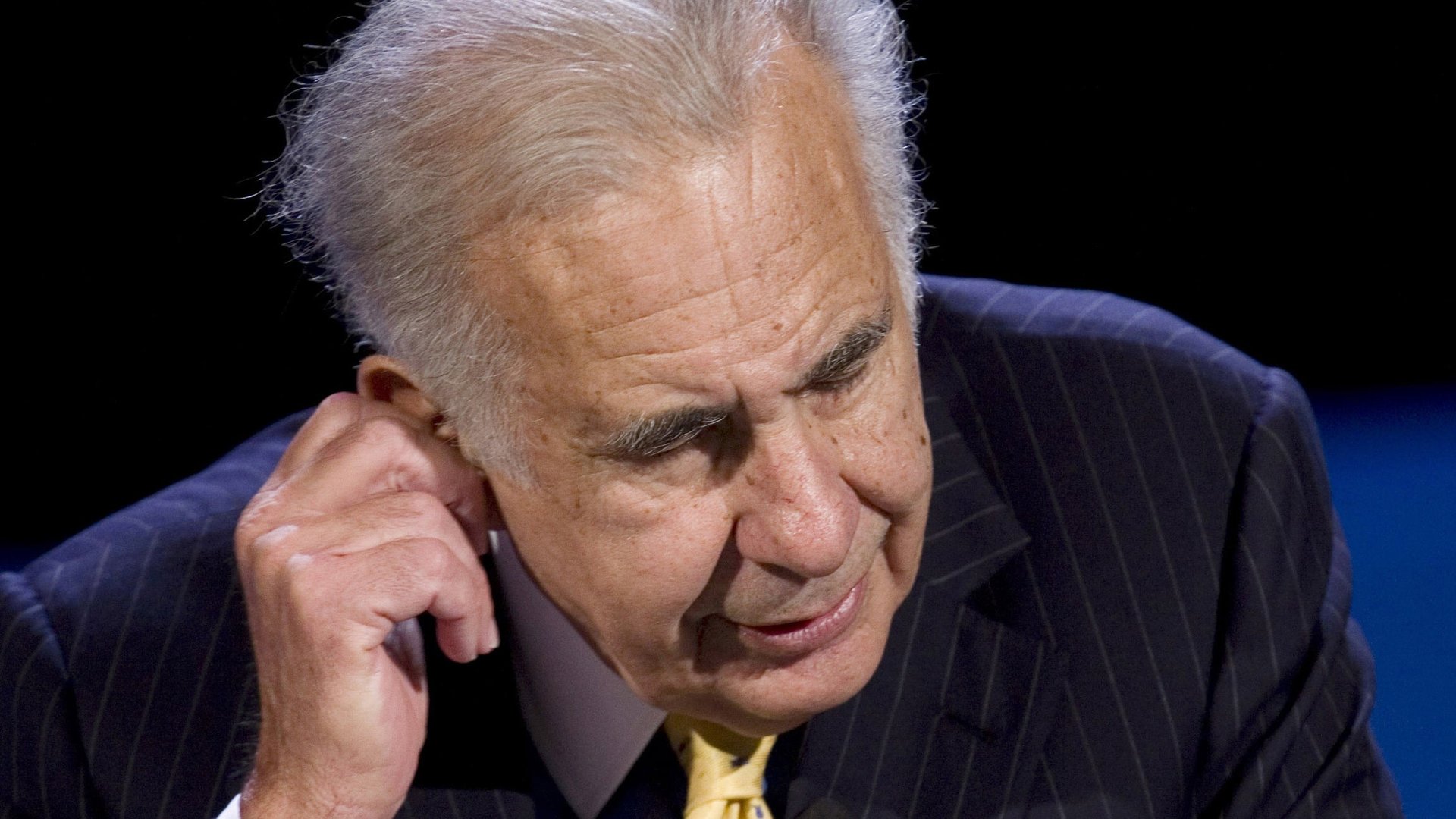

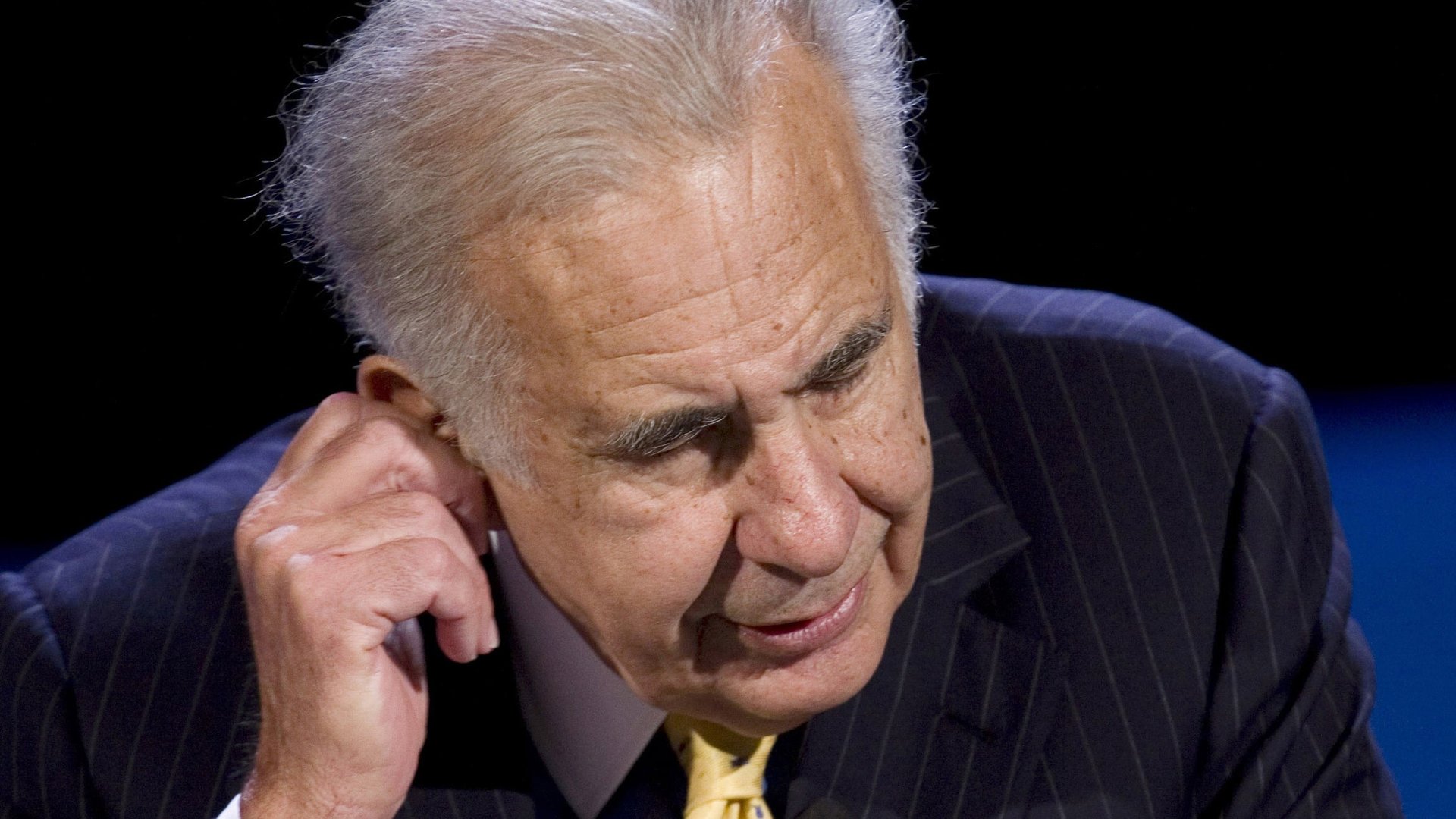

Dear Carl Icahn: you’ve made $490 million on Netflix

Yesterday, Netflix revealed that activist investor Carl Icahn bought a 10% stake in the company in late October. News of his investment (he had to file a 13F at the time) sent shares of NFLX up 14%, but they soon fell back to $60.12 later in the month before rallying to end the year. By yesterday at market close, Icahn had made a tidy sum on the company—$252 million, in fact.

Yesterday, Netflix revealed that activist investor Carl Icahn bought a 10% stake in the company in late October. News of his investment (he had to file a 13F at the time) sent shares of NFLX up 14%, but they soon fell back to $60.12 later in the month before rallying to end the year. By yesterday at market close, Icahn had made a tidy sum on the company—$252 million, in fact.

Today, he might as well pop the bubbly, because he’s about doubled that sum. Icahn has made nearly $490 million since he purchased the holding at around $58 per share.

And supposedly, he didn’t even have to do very much at all. Typically Icahn takes a large stake in companies to order their management team into making better decisions. Although the company said it had talked with Icahn, it doesn’t sound like he has any plans to take more sweeping measures to restructure the business. Management revealed in the earnings statement (pdf):

Carl Icahn became a 10% investor last quarter at approximately $58 per share. We have no further news about his intentions, but have had constructive conversations with him about building a more valuable company.