Indian smartphone users are gobbling up mobile data

Blame the country’s frequent electricity blackouts. As smartphones get cheaper, Indians are increasingly using their phones as home entertainment centers. And that means the country’s 44 million smartphone users are gobbling up internet data. (There are many more users of older cell phones on top of that.)

Blame the country’s frequent electricity blackouts. As smartphones get cheaper, Indians are increasingly using their phones as home entertainment centers. And that means the country’s 44 million smartphone users are gobbling up internet data. (There are many more users of older cell phones on top of that.)

“Because our power supply is idiosyncratic, the mobile phone screen can be your single most viewed screen on a daily basis,” says Shudeep Majumdar, general manager and head of communications at Indian telecom tower company Viom Networks.

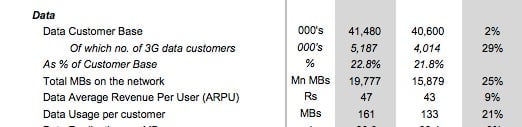

Bharti Airtel, India’s biggest mobile network operator, released third quarter results today. And while rising operating costs meant the company posted its 12th successive quarterly profit decline, big jumps in customers’ data usage were remarkable to note. As this extract from Bharti’s results statement shows, data use per customer rose 21% and the number of customers using fast 3G wireless data networks rose 29%.

Nokia Siemens Networks said in a report last August that 3G data traffic in India had grown 78% between December 2011 and June 2012.

In its report, based on data from 290 million Indian mobile data users, Nokia Siemens pointed out that mobile phones were the preferred medium for internet access in India, with 81% of data users saying they used their phones primarily for web browsing. Another 17% used their phones mainly for watching videos or listening to music.

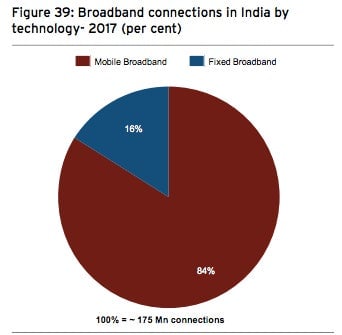

Many Indians also use phones, not PCs, to access the internet because broadband connectivity is incredibly slow and the nation lacks a decent fixed-line network. According to consultancy Akamai Technologies, India is one of only three countries in the Asia-Pacific region where average peak connection speeds are still under 10 megabytes per second. In this report (pdf p.65) AT Kearney, a consultancy, thinks Indians will go on preferring smartphones over fixed broadband connections for the next several years.

As is often the case in India, politics and bureaucracy are to blame for holding back the economic potential of mobile data. The number of 3G subscribers in India, at 39 million according to this Kleiner Perkins report (pdf p.7), is only 4% of the population.

Growth is being held back because the government sold 3G licenses by region, so no one operator has been able to offer a service that covers the entire country. Telecoms companies attempted to strike roaming agreements with each other so that customers traveling around the nation could keep their 3G connection. But the state wants to outlaw the roaming pacts, saying they breach the terms of the original licenses.

A round of 3G spectrum auctions by the government in 2010 was also derided by the industry and analysts as too expensive. The state raised almost twice as much money as it had expected after fierce bidding wars broke out between telecoms operators. That meant the 3G license holders were unable to sell the service cheaply enough for many Indians to afford it. Still, the phone companies started aggressively lowering prices last year, and are urging the government to make future spectrum auctions cheaper (pdf), which should spur 3G uptake.