What car sales around the world can tell you about the global economy

Car sales are a useful economic weathervane in that they reflect both consumer sentiment and industrial output. And despite the Great Game-like dynamics among national auto industries, when car sales suffer in one country, it’s usually not good news for their competitors. That’s why today’s car data out of Europe and Japan signal worrying things about the broader global economy, though the US data makes things a little sunnier.

Car sales are a useful economic weathervane in that they reflect both consumer sentiment and industrial output. And despite the Great Game-like dynamics among national auto industries, when car sales suffer in one country, it’s usually not good news for their competitors. That’s why today’s car data out of Europe and Japan signal worrying things about the broader global economy, though the US data makes things a little sunnier.

EUROPE

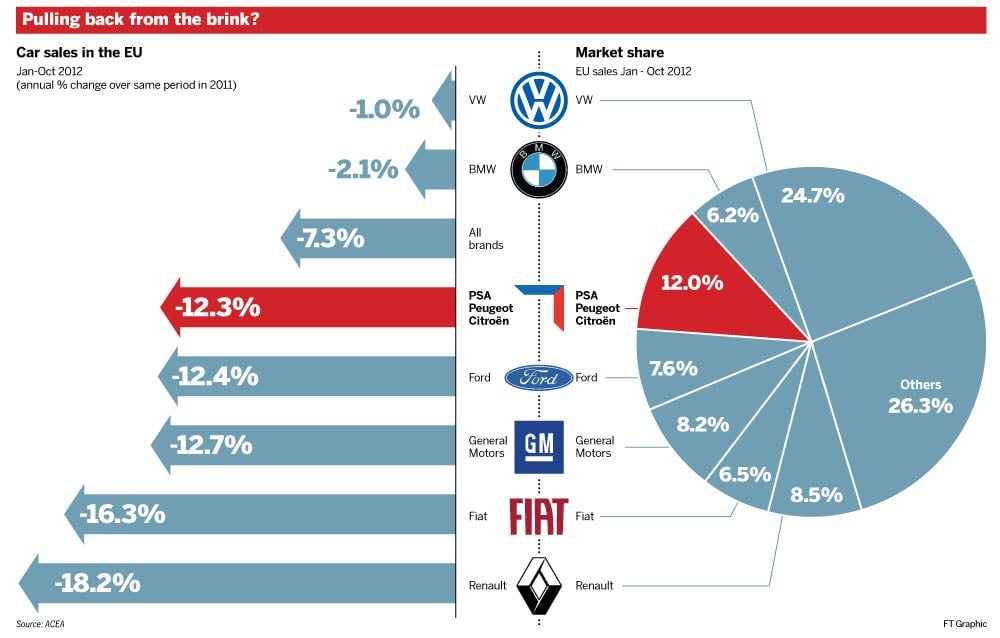

Europe, where car sales are at a 17-year low, is hurting more than most.

In France, where the economy continues to sag as consumers hold back on spending, car sales fell to their lowest level in 16 years this past January. The French bought only 124,952 vehicles, down 15% from the previous year.

Last month, local automakers Renault and Peugeot saw sales decline 7.4% and 16.7%, respectively, compared with January 2012. If Renault did slightly better than its competitor, it’s probably because its array of no-frills cars, such as the Clio or its compact Sandero, are more appealing, given consumer’s shrunken budgets. The knock-on effects are grim as well: Peugeot is cutting 8,000 jobs in France. Meanwhile, foreign carmakers didn’t fare much better: French sales for Volkswagen, the German automaker, fell 23.9%, while General Motors and Ford sold 21.2% and 35.3% fewer cars in France than they did last January, respectively.

Dampened somewhat by a government subsidy, car sales in Spain dropped 9.6% year-on-year in January—slightly less than the previous month’s decline of 13.4%. In 2012, car sales actually rose during the month of January, by 2.5%.

JAPAN

Japanese sales fell 7.8% from the same period a year ago, totaling 383,499 vehicles sold last month. Japan’s auto lobby expects sales to drop in 2013 by 11.7% year-on-year. Putting that somewhat in perspective, 2012 did happen to be the best year for auto sales since 2007, with a 27.5% increase from 2011. Still, it’s not great news. And Toyota, which is the biggest car-seller in both Japan and the world, may be taking a larger fall than others in Japan: It anticipates an 18% reduction in sales, in 2013.

US

In the US, car sales are expected to be up for carmakers both local and foreign—something we’ll keep an eye on throughout the day. Volkswagen’s prospects in America are less dim there than across the Atlantic. The German carmaker increased sales last month by 26.5%. Honda and Toyota both sold about 20% more American cars in January than they did in 2012.

And the American Big Three all anticipate double-digit growth for the first month of the year, with General Motors expecting a 13.5% increase in sales, and Ford and Chrysler both expecting growth of about 18%. American carmakers are also reducing the amounts they spend on incentives (promotional deals and rebates), indicating optimism about sales growth this year.