Why Spain and Italy look awful again

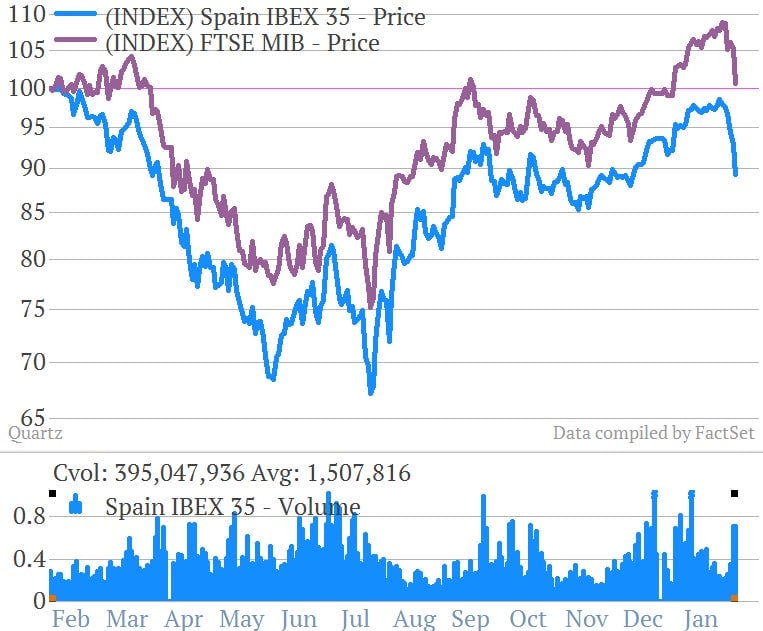

Staggering 4.5% and 3.8% falls in Spanish and Italian markets today (not to mention 3.0% and 2.5% drops in the French and German indices, respectively) suggest renewed scrutiny of Europe and the markets’ recognition that little has really changed since the euro-zone crisis flared up in late 2011.

Staggering 4.5% and 3.8% falls in Spanish and Italian markets today (not to mention 3.0% and 2.5% drops in the French and German indices, respectively) suggest renewed scrutiny of Europe and the markets’ recognition that little has really changed since the euro-zone crisis flared up in late 2011.

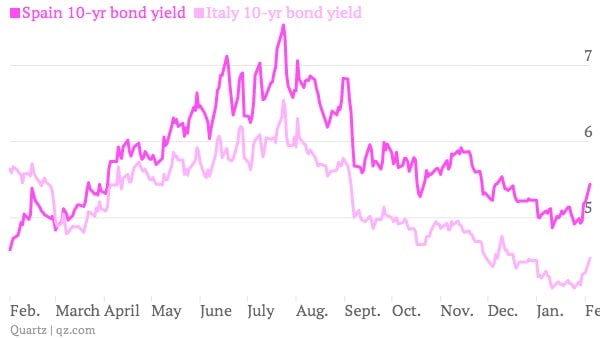

More worrisome, however, is the fact that yields on Spanish and Italian sovereign bonds jumped today. These securities, which trade on the open market, indicate the price the Italian and Spanish governments would pay to borrow if they issued debt today. Rising bond yields suggest that traders are more fearful that those countries won’t be able to return money they borrow.

Investors are blaming the renewed angst on a number of factors:

- Former Italian prime minister Silvio Berlusconi and his party are gaining in the polls ahead of elections to be held on Feb. 24 and 25, particularly with a new plan to cut taxes. Berlusconi is bad for business; his party was notorious for making little progress on reforming the country’s highly indebted economy.

- Spanish prime minister Mariano Rajoy and his center-right Popular Party are engulfed in a corruption scandal. Rajoy was cast into the spotlight in a press conference after a meeting with German chancellor Angela Merkel in Berlin, where he alleged that reports that accuse him of corruption are false.

- Concerns are mounting that Europe’s plan for banking union and a banking supervisor are simply a “sham,” (paywall) as think-tank director Sony Kapoor and London School of Economics professor Charles Goodhart explain.

- European Central Bank president Mario Draghi has been warning EU leaders that poor management of a Cypriot default or bailout could pose a systemic risk to the euro zone. If EU leaders renege on a promise not to force the private sector alone to bear losses in a default as they did in Greece, then they will spook the private creditors of other peripheral European countries.

- The euro has been soaring in value, hitting $1.37 last week. That’s bad for business investment and tightens credit conditions.