Big bad currency wars actually end depressions

I don’t know how it compares to peeing in your bed, as one anonymous senior Fed official put it, but a currency war is one of the surest ways to end a global slump. Despite what you may have heard, it was a big part of what stopped the vicious circle of the Great Depression.

I don’t know how it compares to peeing in your bed, as one anonymous senior Fed official put it, but a currency war is one of the surest ways to end a global slump. Despite what you may have heard, it was a big part of what stopped the vicious circle of the Great Depression.

Currency wars are the best type of wars. Nobody dies, and everybody can recover, as long as everybody plays along. Here’s how it works. One country devalues its currency — in other words, prints money — which, in a time of weak global demand, puts pressure on other countries to do the same, lest they lose out on trade. Then another country devalues, and so on, in a cascade of looser money. It’s the invisible hand pushing for expansionary monetary policy when it’s needed most.

But there are a few caveats. For one, a currency war only makes sense during a global depression when short-term interest rates are mostly stuck at zero. It’s about boosting monetary stimulus when conventional methods are out of ammo. For another, devaluing forever (a là China) is not a sustainable growth strategy. It might make sense for developing nations to subsidize export industries early on, but, eventually, this will only cause imbalances to build up, while robbing the domestic population of purchasing power. And finally, there’s a risk that a currency war could turn into a trade war. In other words, countries will retaliate to expansionary monetary policy not with expansionary monetary policy of their own, but with tariffs. Presumably that’s what our silver-tongued senior Fed official was getting at with this head-scratcher of a quote:

Devaluing a currency is like peeing in bed. It feels good at first, but pretty soon it becomes a real mess.

This fear of a currency war begetting a trade war is certainly serious, but it’s made to sound more serious thanks to some bad history. Here’s the erroneous story you might have heard (especially now that Japan’s talk of more aggressive easing has revived fears of a currency war):

After the Great Crash of 1929, countries abandoned the gold standard and devalued their currencies in a beggar-thy-neighbor battle to the bottom. This currency war turned into a trade war, with countries eventually resorting to tariffs and counter-tariffs, as they tried to grab a hold on an ever-shrinking pie of demand. The consequent collapse in world trade is what made the Great Depression so great, and set the stage for the trade war to turn into an actual one.

Scary stuff. But not quite true. The reality is the trade war started before the currency war, and the latter jump-started recovery wherever it was tried. The infamous Smoot-Hawley tariff in the U.S., the first salvo in the trade war to come, was actually passed in June 1930, more than a full year before any country devalued its currency. It wasn’t until September 1931 that Britain abandoned the gold standard … and that’s when things get a bit complicated. It’s hard to accuse Britain of “competitive” devaluation here, because it had no choice but devaluation; it had simply run out of gold. Nonetheless, other countries responded to Britain’s increased competitiveness by increasing their trade barriers; in this case, the currency war, such as it was, did exacerbate the ongoing trade war, as Gavyn Davies of the Financial Times points out.

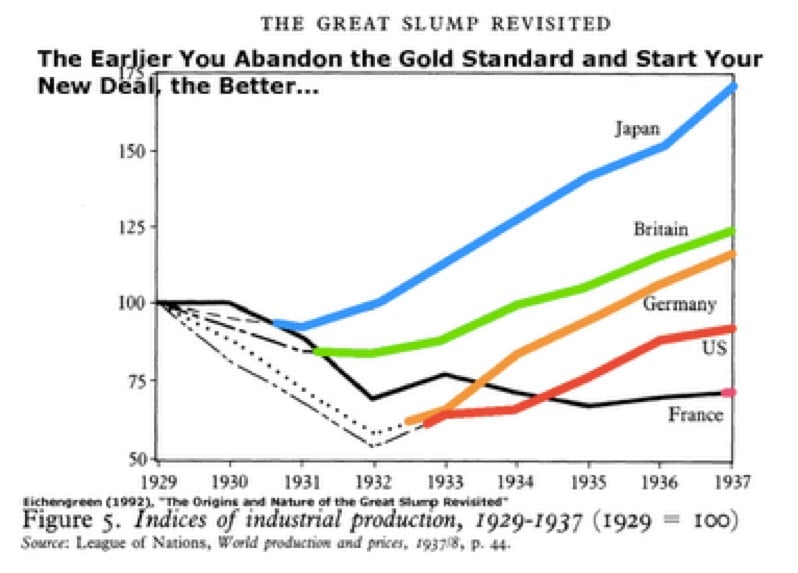

But then a funny thing happened. The punishment for Britain’s economic weakness was a recovery. Ditching gold gave Britain (and everybody else who did so) the freedom to pursue more aggressive monetary and fiscal policies than the “rules of the game” of the gold standard had allowed.* As you can see in the chart below (via Brad DeLong) from Barry Eichengreen’s magisterial work on the depression, Golden Fetters, recovery followed devaluation everywhere. There was no reward for financial orthodoxy in the 1930s. The countries that stayed with the gold standard the longest, the so-called Gold Bloc of France, Belgium, and Poland, were the last to begin growing again. In other words, the currency war didn’t deepen the depression; it ended it.

And that brings us to one last, stupid question. How did beggar-thy-neighbor policies kickstart growth even after world trade had already collapsed? In other words, how did stealing a trade advantage help so much when there wasn’t much trade to steal? Well, it’s not entirely, or even mostly, about stealing trade. Indeed, as Scott Sumner points out, the U.S. trade balance actually worsened in 1933 after FDR took us off gold, even as the economy quickly reversed its death-spiral and began a virtuous cycle. It’s easiest to frame devaluation as grabbing demand from abroad, but it’s really about increasing demand at home. Devaluation means printing money, and more money during a liquidity trap means more demand, period. It also allows more stimulus spending than a fixed-exchange rate system (like the gold standard) would. The next time you hear someone lamenting the “destructive devaluations that followed the Great Depression,” remember to ask them — what was so destructive about ending the most destructive depression in modern history?

The only thing we have to fear is fear of currency wars itself. Depressions are the only casualties in these kind of conflicts.

————————

* There were two exceptions. The gold standard did not constrain looser monetary policy in the U.S. and France in the early years of the depression, as both had more than enough gold to back more credit growth, but chose instead to sterilize their gold inflows out of fear of nonexistent inflation in the face of actual deflation. This stockpiling drained everybody else of gold, and consequently made staying on the gold standard impossible. Even the U.S. and France had to eventually abandon it to reverse years of deflation.