Jack Dorsey can rescue Twitter only by defying two basic tenets of how companies are run

One of the most audacious gambles in Silicon Valley today has nothing to do with technology.

One of the most audacious gambles in Silicon Valley today has nothing to do with technology.

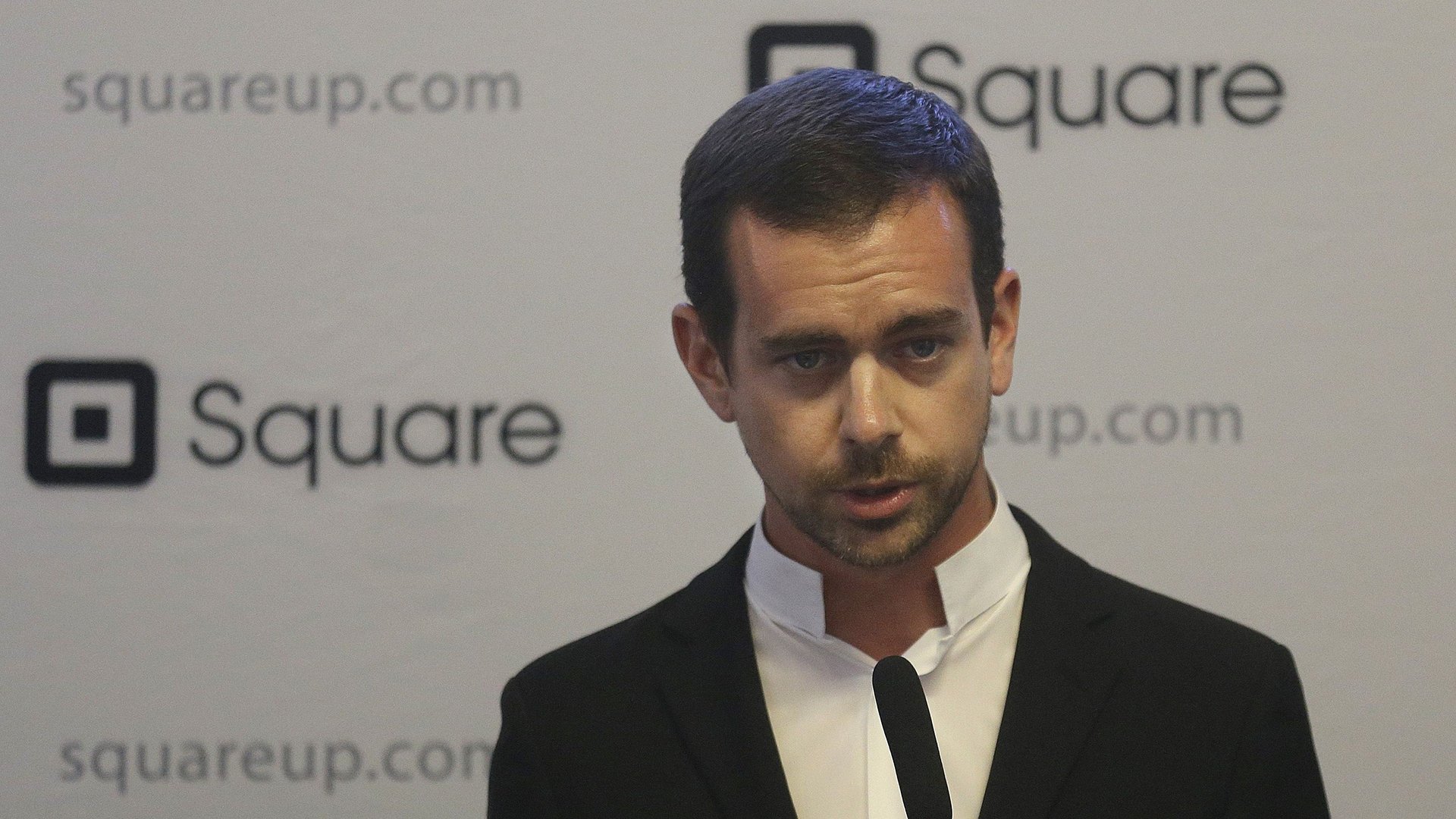

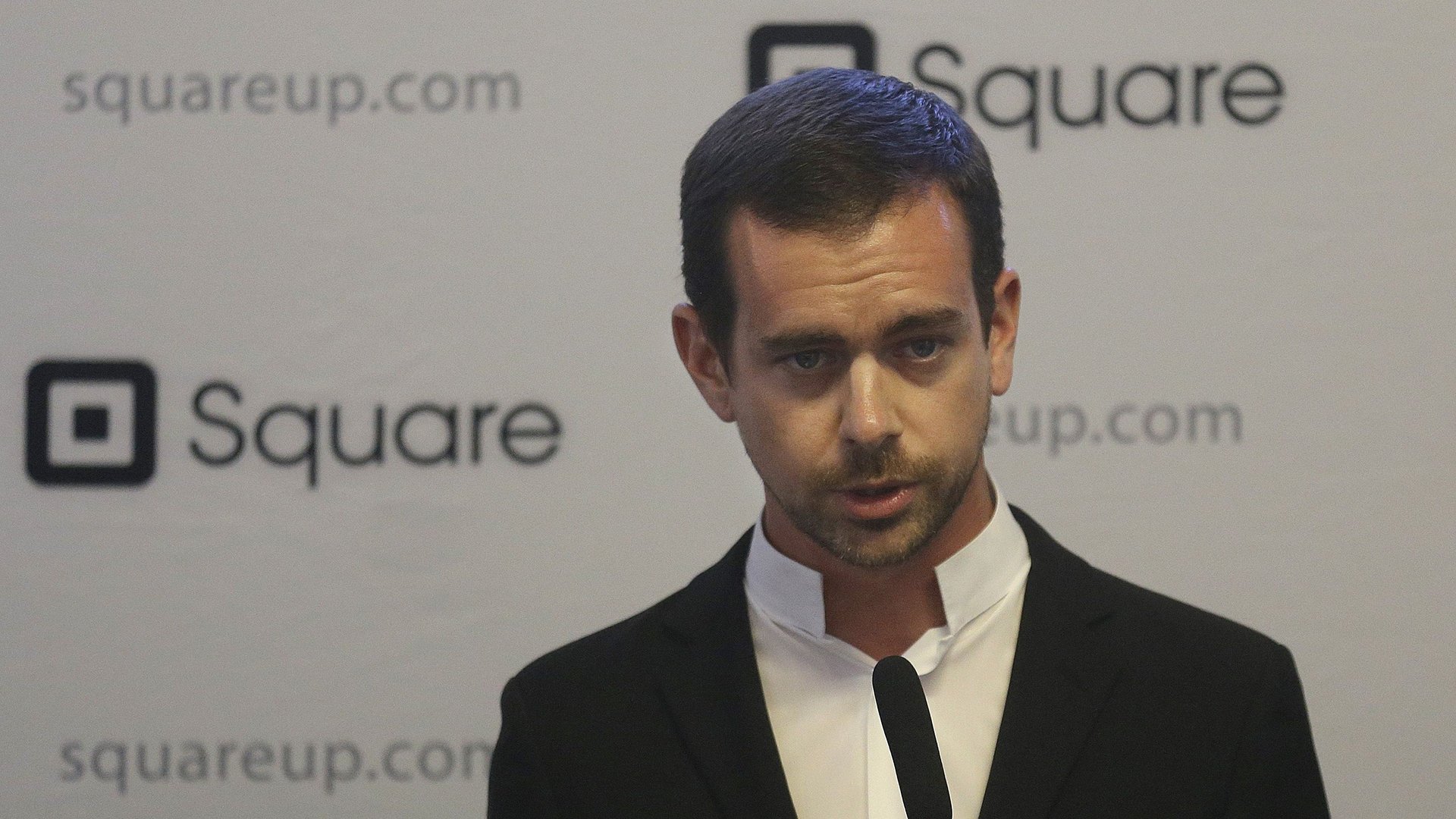

Twitter’s appointment of co-founder Jack Dorsey as CEO challenges some fundamental tenets of corporate governance. The troubled business is turning to Dorsey to reverse its fortunes, via deep cost cuts and a shift in strategy. Like his hero, Steve Jobs, Dorsey has the chance to rescue the company he helped create. Also like Jobs, he plans to do it while remaining CEO of the other company he created in the meantime: movie studio Pixar in Jobs’ case, payments firm Square in Dorsey’s.

Never one to give less than 200%, Dorsey will not only remain CEO of Square while trying to rescue Twitter; he will do it while Square launches its IPO—a grueling process in which investors clamor for as much time with executives as possible.

It’s a measure of Silicon Valley’s reality-distortion field that many people believe in Dorsey’s ability to pull off this improbable double-act. Everybody is eager to anoint the next Steve Jobs. And maybe that will be Dorsey. But outside the Valley, not many corporations would take such a gamble with management.

Moreover: Unlike Jobs, who was banished from Apple for more than a decade, Dorsey served as Twitter’s chairman in between stints as CEO. His success now would expose the ineffectiveness of corporate boards. What good is a board if a man can do nothing as its chairman but saves the company as CEO—part-time, to boot?

If Dorsey succeeds, then, it might prompt people to ask: What do all those other bosses, in the Valley and beyond, do all day? And why are directors and CEOs paid so much again? That really would be a world-changing breakthrough.

This was published as part of the Quartz Weekend Brief. Sign up for our newsletters here, tailored for morning delivery in Asia, Europe & Africa, and the Americas.