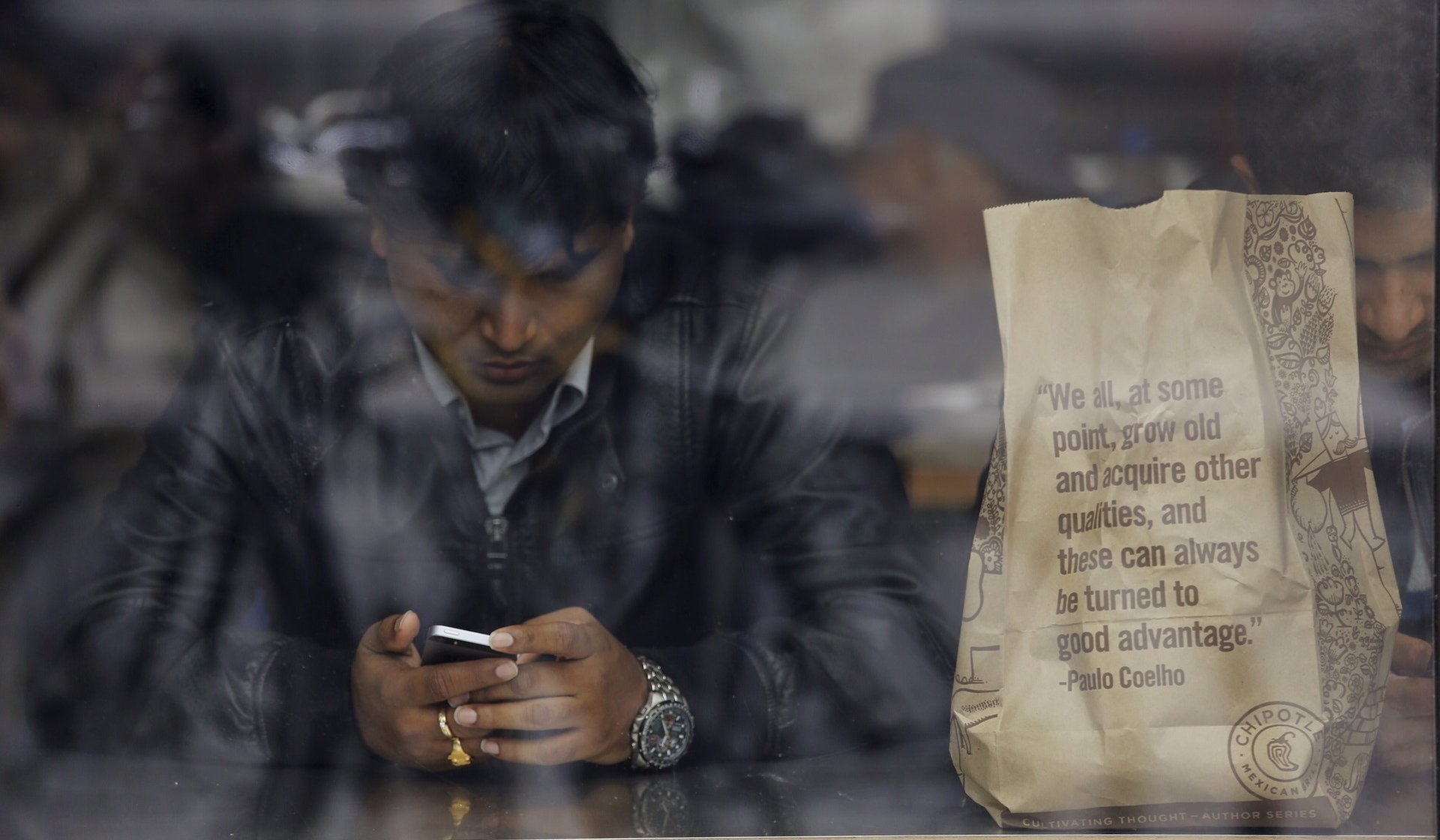

Chipotle is looking at mobile orders and more efficient utensils to boost growth

Growth at Chipotle is slowing down and the company plans to change that by speeding things up behind the counter and in its customer lines.

Growth at Chipotle is slowing down and the company plans to change that by speeding things up behind the counter and in its customer lines.

The fast casual restaurant chain continues to post enviable margins, and revenue was in line with analyst expectations for the third quarter. However, sales at stores open at least a year grew just 2.6%. On its earnings call yesterday (Oct. 20), customer traffic for October was described as “choppy,” and the company said it expects same-store sales growth to hover in the low single digits into 2016. The company’s shares fell more than 7% after it reported earnings.

The challenge for Chipotle is to reassure investors that there’s still plenty of growth potential. One possible source that kept popping up during the call was the opportunity to boost ordering online, on phones, and via fax. From CFO John Hartung:

About two-thirds of our business is eaten outside of a restaurant, but only 7% of our business is ordered outside of a restaurant. And so, there’s a big gap between our customers who choose to or end up eating somewhere else other than a restaurant. So it kind of makes sense for us to provide the convenience to order outside of a restaurant. And we do have–we have iPhone, we do have Android, but we can make that whole process more efficient. We can make it more reliable. … I think we can enhance their overall experience so that 7% can continue to grow over time.

To make that happen, the company has some work to do. It deliberately hasn’t put any marketing or promotional muscle behind its out-of-store ordering apps, according to Chipotle founder and co-CEO Steve Ells, because it’s not sure it can handle the traffic on the tech or restaurant side.

“We just have not quite optimized the experience in the restaurants to the point where we feel comfortable driving a large number of people in there,” Ells said on the earnings call.

Co-CEO Monty Moran said the company now has a “second make line” at many restaurants, a separate back-of-the-house assembly line for out of store orders, and a dedicated take-out specialist. This produces an average of $500 in extra sales per day per restaurant. For some locations, it’s much more than that, serving as “almost a second restaurant within the restaurant.”

Now, the company is figuring out how to optimize that second line.

“The way we scoop can be improved using different kinds of utensils that are more efficient that might not be appropriate for the main line, but are very efficient in the back of a house,” Ells said.

The company did not respond to a request for comment on how these utensils are more efficient, and why they aren’t appropriate on the main line.

Once the process is streamlined, Chipotle is likely to start pushing online ordering more. Newly hired Curt Garner, the company’s first chief information officer, should be a big asset on that front. Chipotle announced last week that it had poached him from Starbucks, a pioneer in mobile ordering and payments, where he had the same role.

Another reason for the emphasis? Throughput. Burrito velocity at the company declined in the essential peak lunch hour, after what seemed like endless quarters of faster and faster service.

“I think we took our eye off the ball a little bit,” Moran said.

More orders on a second line should speed things up. It’s unlikely to be a silver bullet, though: The company acknowledges many people like the in-store experience because it’s so friendly to customization.