China’s new consumer class will transform the global economy

Across Asia, rising incomes are creating an enormous new class of consumers. Much of that growth is coming from China, whose working population is larger than those of the US and Europe combined. Right now, only 11% of China’s population is considered middle class. As more people gain purchasing power, their needs and preferences will have a powerful effect on the global economy.

Across Asia, rising incomes are creating an enormous new class of consumers. Much of that growth is coming from China, whose working population is larger than those of the US and Europe combined. Right now, only 11% of China’s population is considered middle class. As more people gain purchasing power, their needs and preferences will have a powerful effect on the global economy.

China’s consumers can be divided into four tiers and future growth will come from two key groups—the white-collar “Urban Middle” and the blue-collar “Urban Mass.” Learn about their impact on global spending:

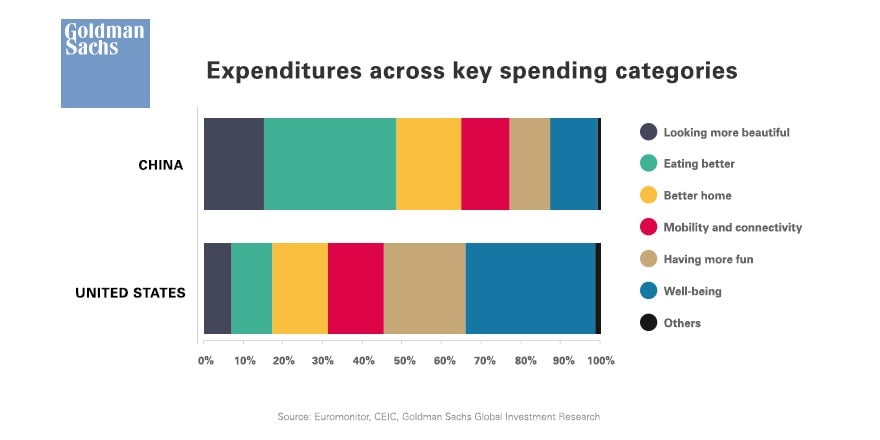

Now, nearly half of China’s consumer incomes go to “needs”—clothes and food. Comparing China’s consumption patterns with those of the US shows how as incomes rise, spending will shift from necessities to more discretionary items.

As the ranks of the China consumer market swell, so too will their effect on the global economy with huge opportunities for the entertainment, food service, technology, and other industries. But to take advantage of those opportunities, businesses will need to understand China’s urban middle class and align pricing, offerings, and other practices to the groups’ specific needs.

We asked Joshua Lu of Asia Consumer Research at Goldman Sachs to discuss how the growing middle class is poised to drive China’s consumption growth.

“In the coming years, we see that rising income will bring a couple hundred million people into the consumer class,” Lu said. “And that is what makes China extremely important in the coming decade.”

Learn more

about the implications of China’s new consumer class and other ideas and trends that are shaping markets around the world.

This article was written by Goldman Sachs and not by the Quartz editorial staff.