4 reasons to like consumer staples stocks

Many of the products we use every day, such as toothpaste, soft drinks, diapers, and many other household items are part of the consumer staples sector. Investors who are drawn to more “exciting” opportunities like smartphone technology, Internet start-ups, or the latest restaurant IPO may overlook them, but when it comes to investing, “boring” can often be better.

Many of the products we use every day, such as toothpaste, soft drinks, diapers, and many other household items are part of the consumer staples sector. Investors who are drawn to more “exciting” opportunities like smartphone technology, Internet start-ups, or the latest restaurant IPO may overlook them, but when it comes to investing, “boring” can often be better.

Here are four features of the consumer staples sector that investors may find surprising.

1) A sector leader in returns

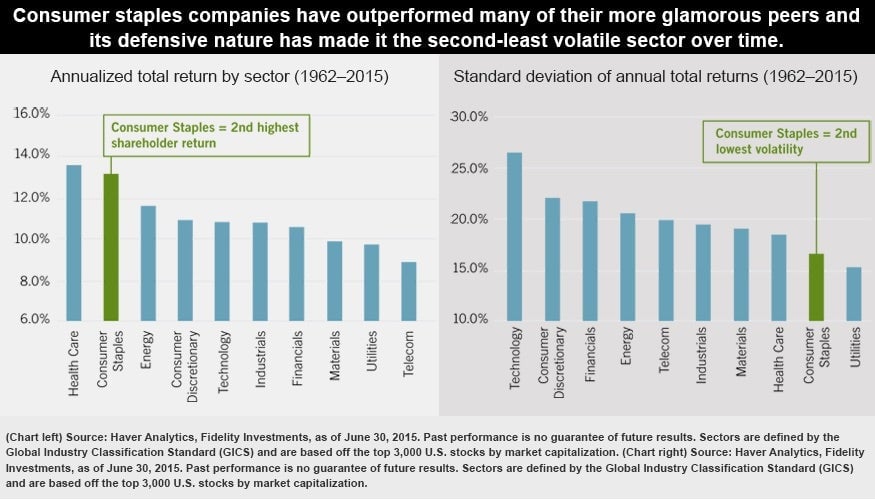

Although it is populated by companies that seem plain vanilla, consumer staples has had the second-highest return of the 10 economic sectors since 1962.¹ During the past 50-plus years, consumer staples has had an annualized return of 12.9% (see chart below, left). That’s almost 200 basis points (2.0%) per year better than the technology and consumer discretionary sectors, and it also beat the broad stock market (as measured by the Russell 3000 Index) by a similar margin.

One reason consumer staples have performed so well over the long term is the sustained “brand” of many of the companies throughout the sector. In other words, new competitors have had trouble knocking leading brands off their perch.

2) Downside protection in volatile markets

In addition to producing the second-highest return, consumer staples has had the second-lowest volatility of any market sector since 1962 (see chart above, right), meaning it has produced more consistent returns from one year to the next. This is likely driven by the more consistent nature of the demand for everyday staples items such as toothpaste and diapers, which people tend to buy in similar amounts regardless of the ups and downs of the economy.

Because of this, investments in consumer staples have tended not to lose as much during bear markets as investments in other sectors. And during the past 50 years, consumer staples has experienced fewer bear markets (a correction of more than 20%) than the broad stock market overall, and is tied with utilities for the fewest bear markets of any equity sector.²

3) May provide more income than other investments

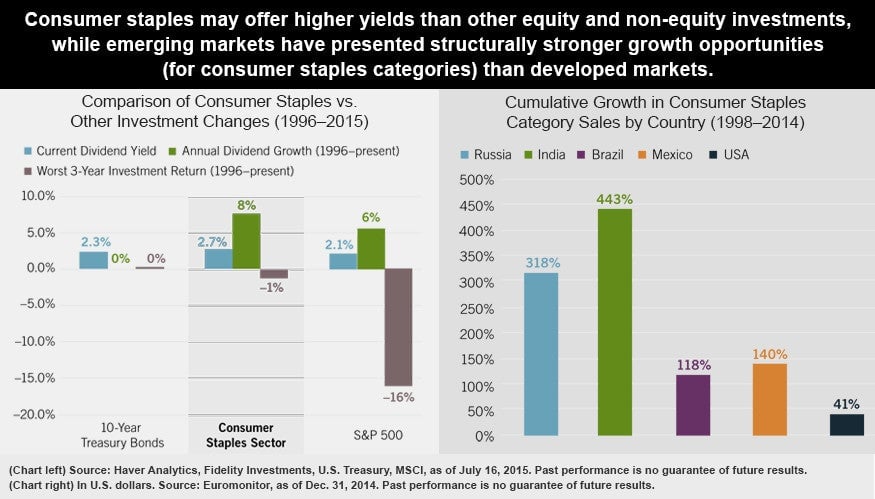

The consumer staples sector has characteristics that can make it an attractive building block for income-oriented investors. Consumer staples tend to have stronger dividend yields and dividend growth than other equity sectors, and their yields are often competitive with those of non-equity investments. Also, unlike most bonds where the interest payments are fixed, many staples stocks have successfully increased their dividends every year, including in difficult economic periods like 2008 and 2009. In fact, the average staples company has increased its dividend at an annual rate of 8% over the past 20 years (see chart below, left).

4) Multiyear international expansion opportunity

Americans tend to buy the same amount of toothpaste and laundry detergent every year, so volumes across the sector grow roughly in line with the annual population growth of about 1%. But international consumers have many of the same needs and wants that consumer staples products address. With incomes on the rise for consumers living in places like China, India, Indonesia, and Brazil, we have seen spending on consumer staples items growing much faster than the growth rates in their populations and the growth rates in the US (see chart above, right).

In addition to purchasing more and better-quality staples items, emerging-market consumers are also buying more discretionary items, such as washing machines. This in turn further boosts spending on consumer staples such as laundry detergent. As incomes continue to increase in the coming decades, the growth potential for many staples companies in emerging markets remains a massive opportunity.

Investment implications

Looking forward, I believe there are ample stock opportunities that may help the consumer staples sector continue to outperform the broader US equity market in the months and years ahead. In any event, consumer staples should continue to benefit from its reputation for steady growth, dividend income, and low volatility.

Learn more about Fidelity® Select Consumer Staples Portfolio.

This article was produced by Fidelity and not by the Quartz editorial staff.

Before investing in any mutual fund, please carefully consider the investment objectives, risks, charges, and expenses. For this and other information, contact Fidelity for a free prospectus or, if available, a summary prospectus. Please read it carefully.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

General Methodology

Fidelity Brokerage Services LLC, Member NYSE,

SIPC

, 900 Salem Street, Smithfield, RI 02917

730776.5.0