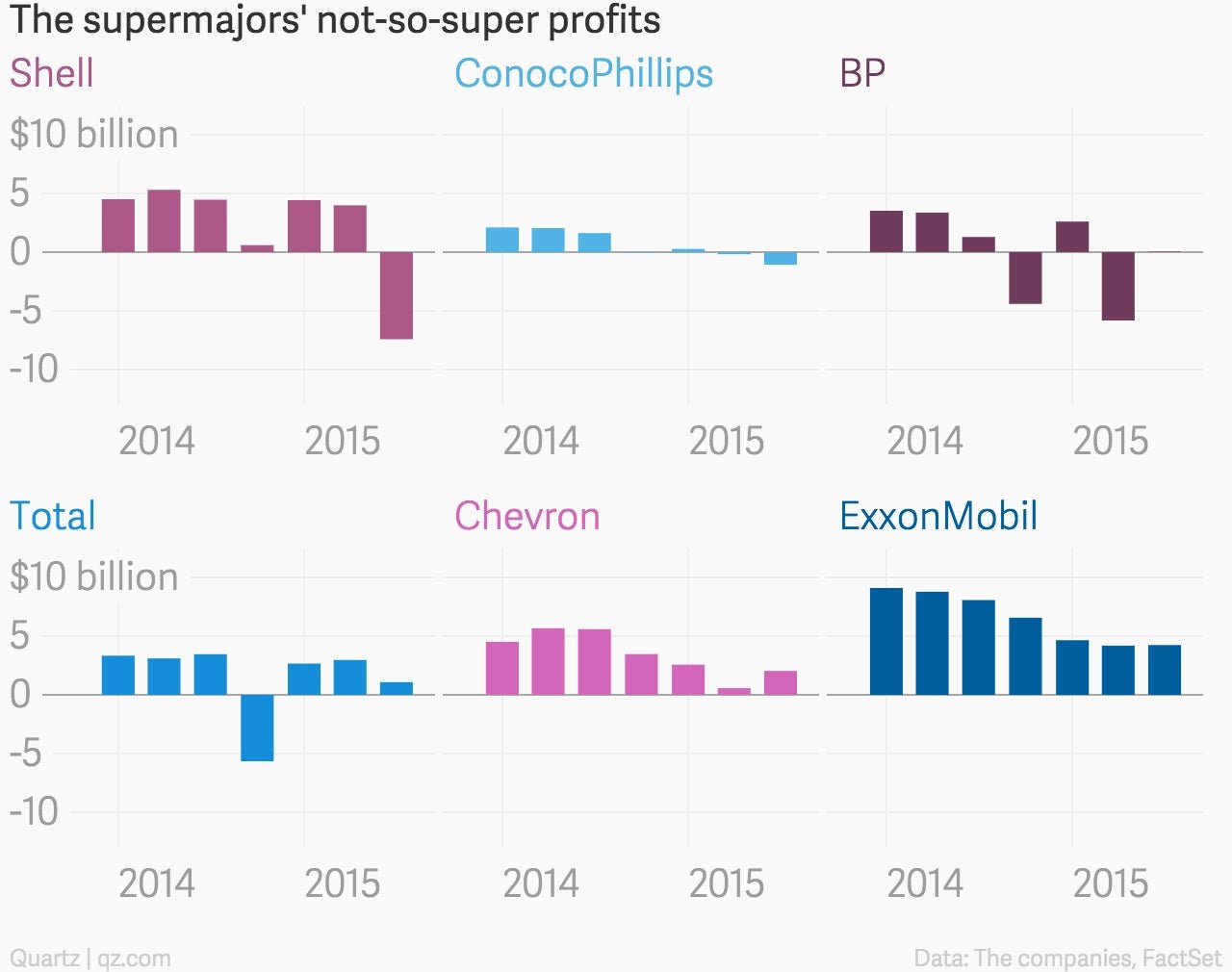

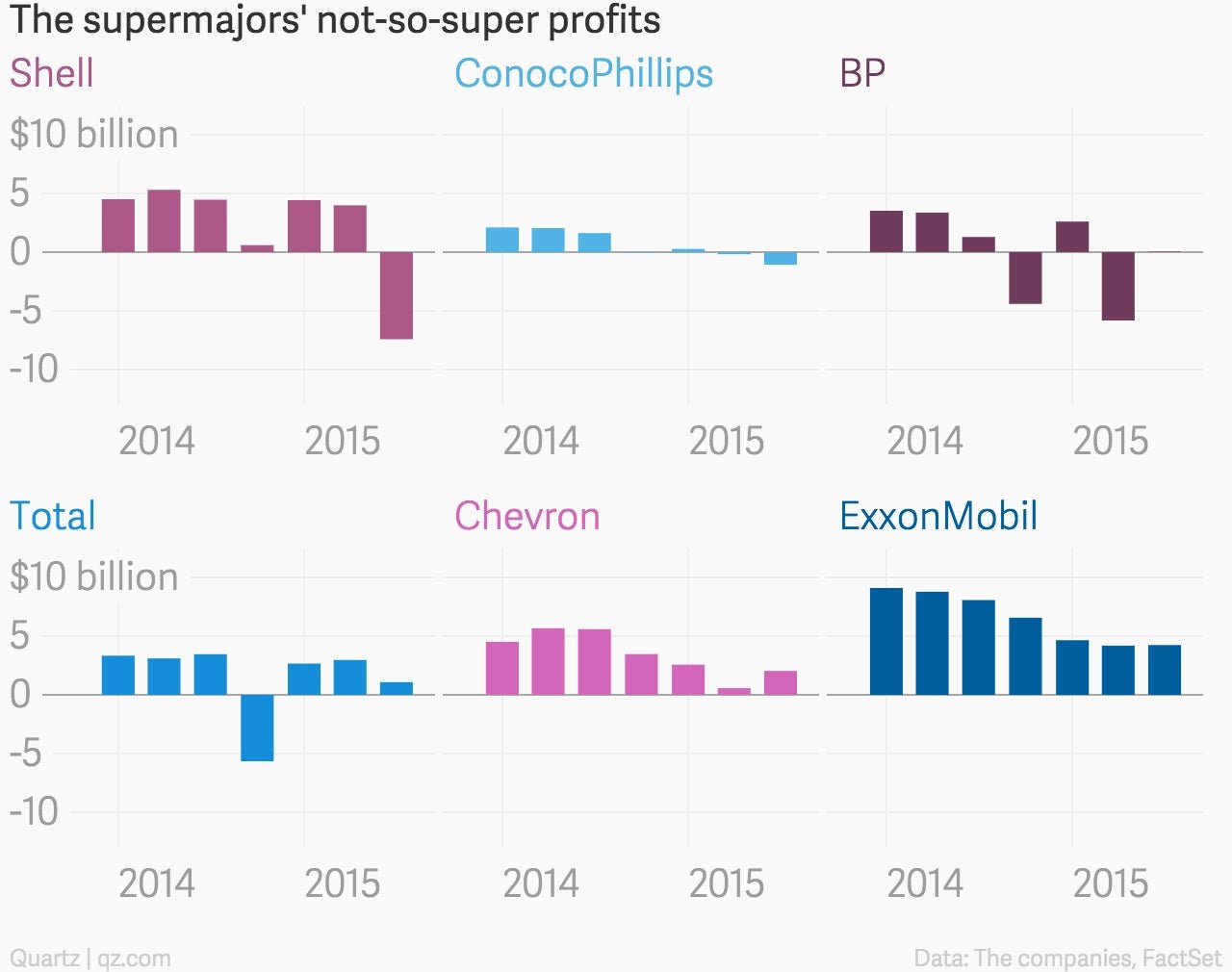

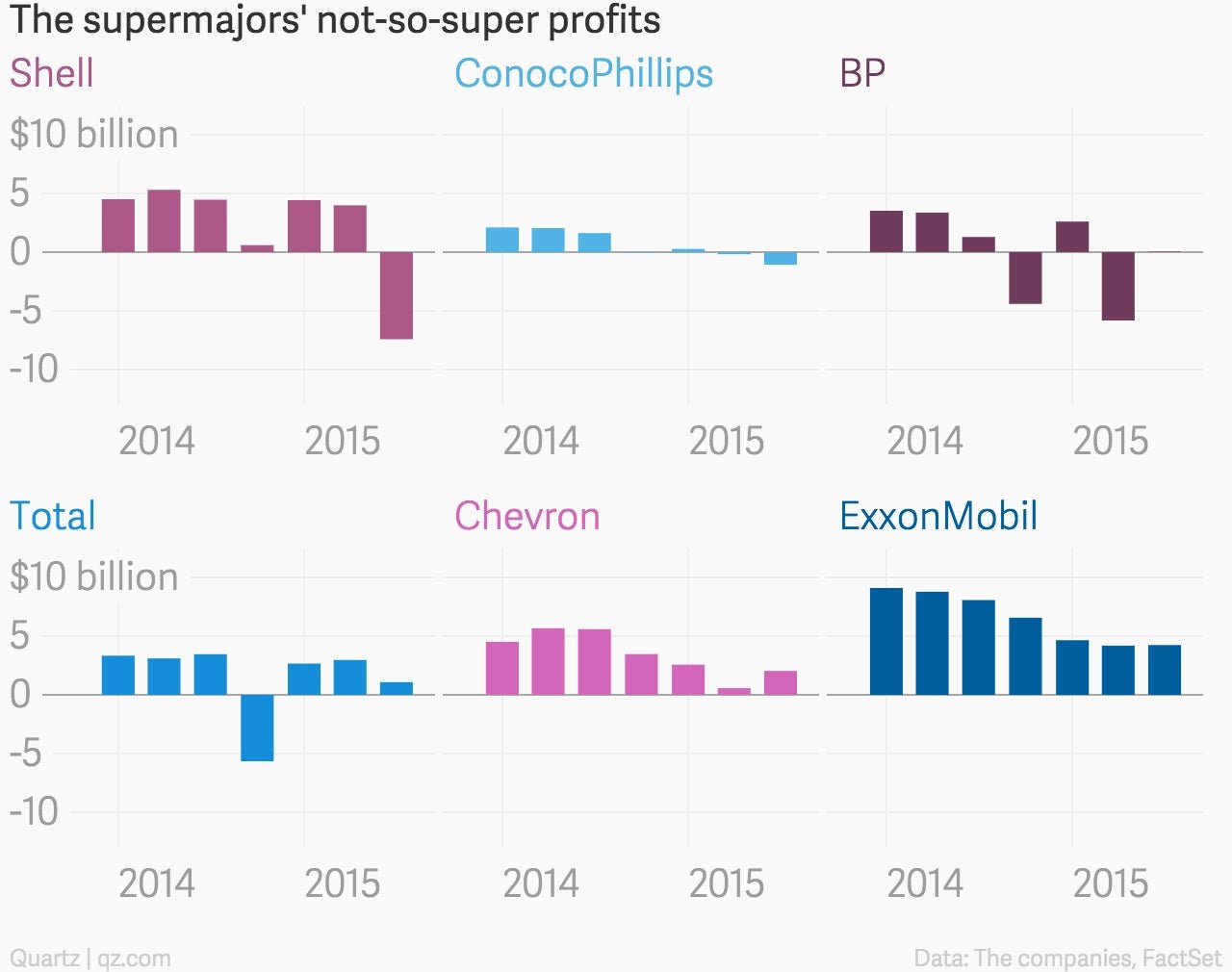

Big Oil’s supremely awful quarter, in one chart

The supermajors aren’t feeling so super these days. This week, the six largest private oil companies reported third-quarter earnings, and the news wasn’t pretty.

The supermajors aren’t feeling so super these days. This week, the six largest private oil companies reported third-quarter earnings, and the news wasn’t pretty.

The wrenching drop in oil prices since mid-2014 has made things uncomfortable for oil companies for some time, but the latest quarter has a distinct feel of capitulation to it. With production and stockpiles as strong as ever, there are few signs that prices will rise any time soon.

As a result, companies are slashing investments and shelving projects. Across the industry, oil companies have written down the value of once-promising projects by some $20 billion this week alone, according to Bloomberg.

Royal Dutch Shell led the way with a $7.4-billion quarterly loss—its worst result in 16 years—thanks to a huge write-off related to its ill-fated effort to drill in the Arctic. ConocoPhillips recorded a $1.1-billion loss for the quarter, and said it would quit all deepwater exploration by 2017. BP barely eked out a profit thanks to aggressive cost cuts.

The other three supermajors fared better, but only in relation to their peers. ExxonMobil’s $4.2-billion profit was half of what it made last year, while Chevron and Total saw quarterly profits fall by two-thirds. Chevron said it will cut up to 7,000 jobs and slash capital spending by 25% next year, while Total pledged to shed $10 billion in underperforming assets by 2017.