You may be more exposed to the tech bubble than you think

For years there have been worries that an asset bubble is forming among the startups of Silicon Valley, where billions upon billions of dollars have flowed into companies that have yet to sniff a profit. Now, a series of markdowns of some of the hottest companies, and tales of founders burning through cash at an unprecedented rate have raised concerns that things are ready to pop.

For years there have been worries that an asset bubble is forming among the startups of Silicon Valley, where billions upon billions of dollars have flowed into companies that have yet to sniff a profit. Now, a series of markdowns of some of the hottest companies, and tales of founders burning through cash at an unprecedented rate have raised concerns that things are ready to pop.

But you might notice that many of these reports don’t foretell widespread doom (some have a tone that could be described as gleeful). That’s because conventional wisdom suggests we common investors needn’t worry because this time is different.

Unlike the dot-bust of 2001, when the public explicitly owned shares of failed tech firms after gobbling them up in boisterous IPOs, many of today’s best known and highest valued startups remain private. Venture capital firms backing these companies may end up losing money, but mom-and-pop investors are safe beyond any knock-on effects to the broader economy. But you may be more exposed than you realize. And, in terms of transparency and accountability, the situation is arguably worse than 2001.

There are two ways in which you may be exposed to the tech “bubble.” First, you might have a stake in these companies if you own any actively managed mutual funds, perhaps through your retirement plan. According to Todd Rosenbluth, director of mutual fund research at Standard &Poor’s, large mutual funds have been investing in non-public companies for years. “Most people have no idea.” he says. The payoffs can be big if some of these firms successfully go public, but the risks are significant because it’s impossible to assign a consistent, accurate value to these investments, and they are hard to sell if the fund faces redemptions. However, regulation keeps mutual funds from holding large amounts of private shares, which would mitigate the impact. “It’s a tiny part of their portfolios,” Rosenbluth says. For example, only about 2% of the Fidelity Blue Chip Growth fund is made up of tech startup investments.

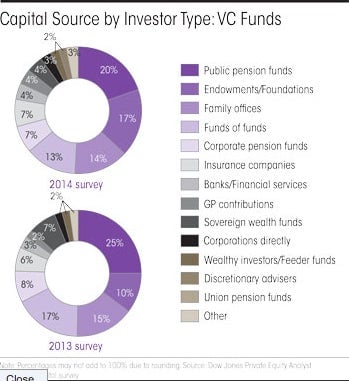

The second way you’re exposed is through public pensions, whether you’re a direct beneficiary or not. Prequin, a private equity tracking firm, estimates about 18% of all private equity assets come from US public pensions. Some estimates say at least 20% of venture capital is financed by public pensions—making them the biggest single source of VC capital.

While that’s an obvious worry to public pensioners, taxpayers should take note because pension benefits are guaranteed in most states’ constitutions. That means the taxpayer is on the hook to make up the difference if public pension investments don’t pay off.

To be sure, if a tech blowup destroys your finances, it won’t be because of your exposure through mutual funds or public pensions. Most state and municipal pensions don’t own very much private equity, normally making up less than 10% of their total portfolios. And, as mentioned before, mutual fund exposure is also pretty small. Nonetheless, billions of dollars of investor money is being invested without total accountability to all stake holders. And that’s concerning on it’s own, because that’s what feeds over-valuations to begin with.