Tech’s big valuation correction means the system is working the way it’s supposed to

Don’t call it a crash, but many of this tech boom’s most well-known, highest-flying startups have recently seen their valuations sharply reduced.

Don’t call it a crash, but many of this tech boom’s most well-known, highest-flying startups have recently seen their valuations sharply reduced.

For example:

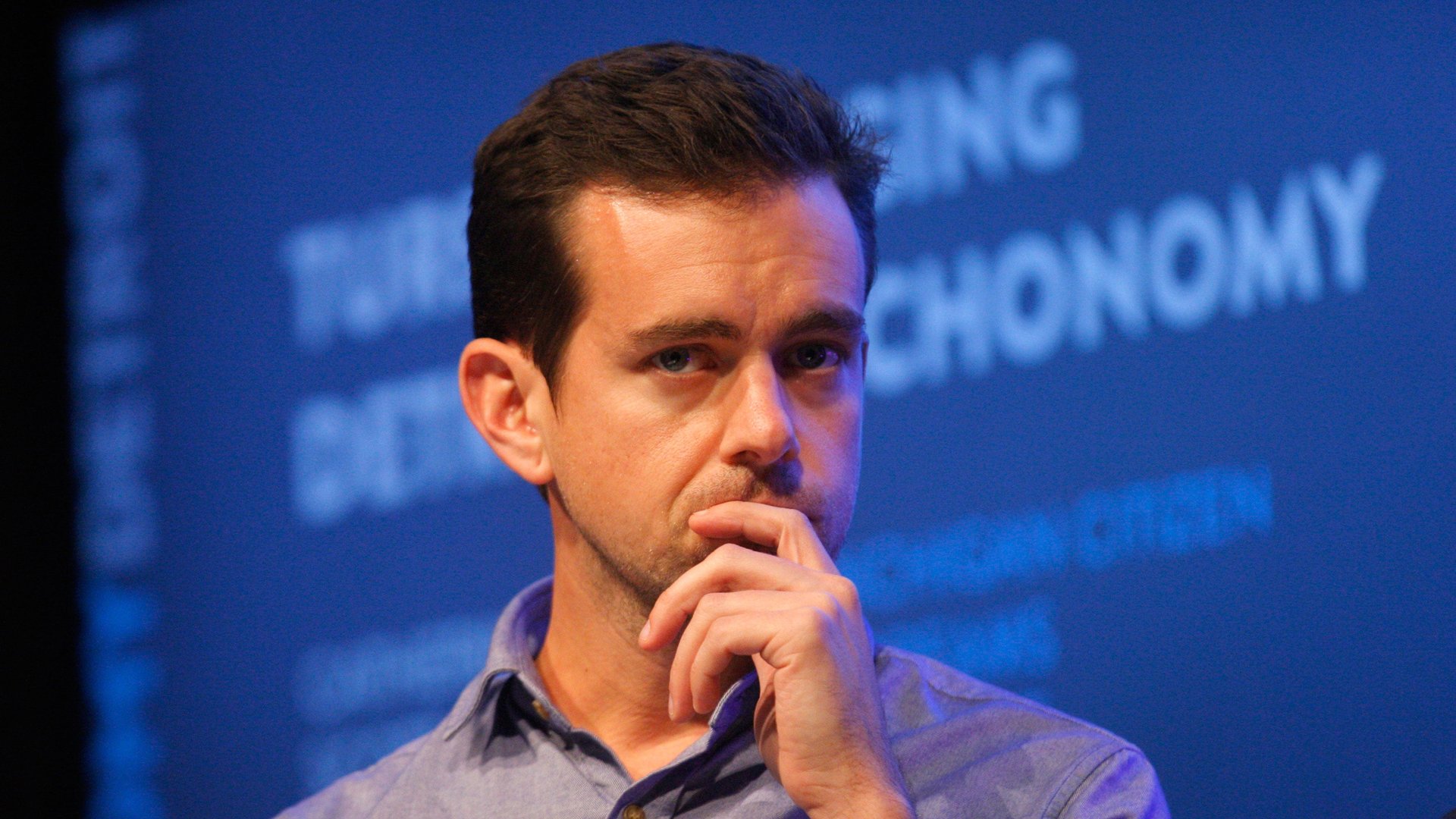

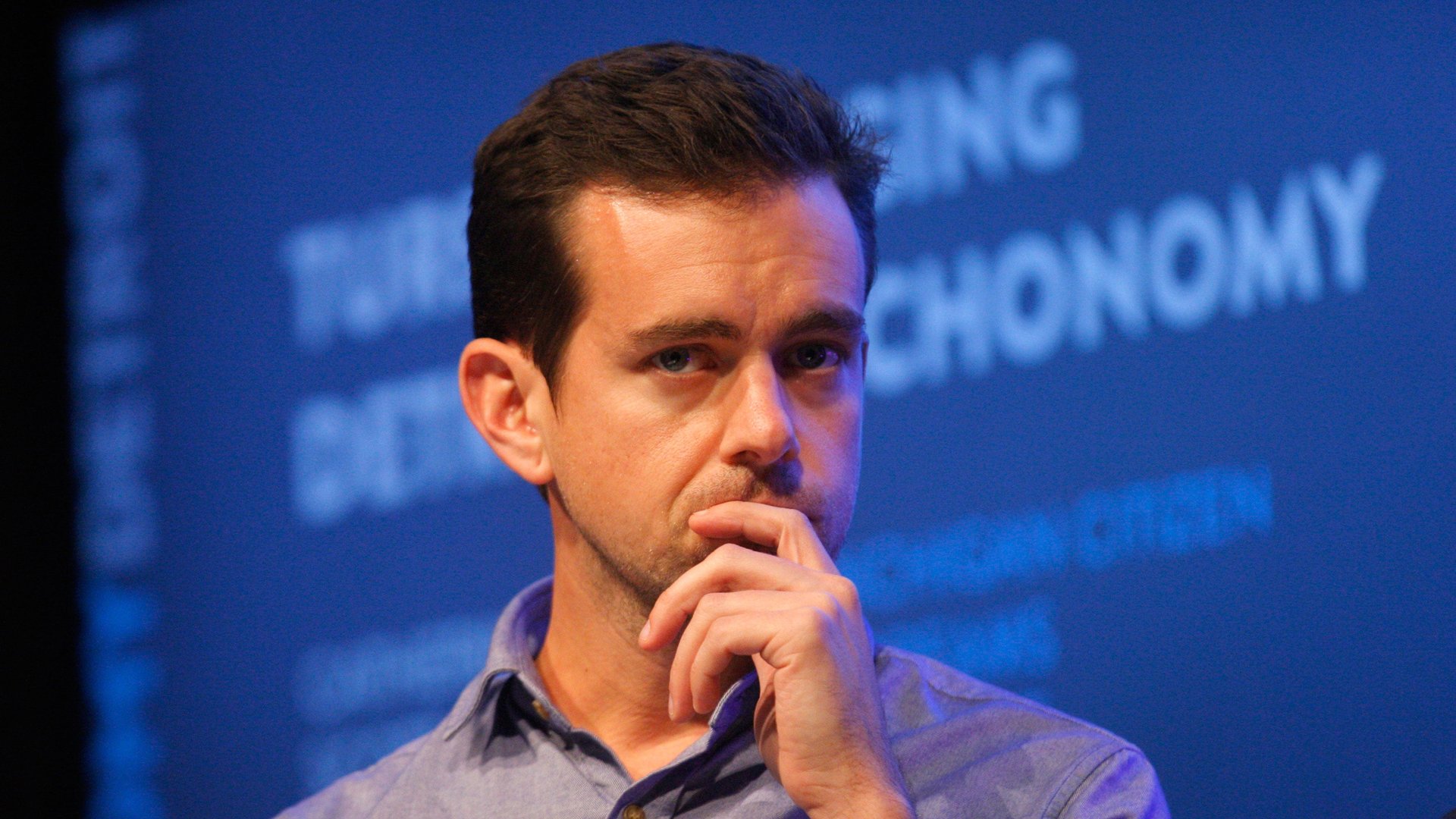

- Square, the small-business payments and finance company run by Twitter founder Jack Dorsey, started trading as a public company today (Nov. 19) at a price level significantly below its most recent private-market valuation. (Yes, shares popped out of the gate, but still trade below that last private valuation.)

- Match Group—largely the popular dating app Tinder—is also going public today at the low end of its targeted range.

- Dropbox, Snapchat, Zenefits, MongoDB, and Blue Bottle Coffee all recently had their private-market valuations marked down by Fidelity.

- Evernote, once valued at $1 billion, has experienced dramatic executive turnover this year, and seems to be unstable.

- Rdio, the music streaming service that had an implied $500 million valuation last year, is shutting down, and Pandora is buying many of its assets for $75 million.

The list goes on.

And while this isn’t great news for the people who set those peak valuations—though many have downside protection—it’s actually a good sign for the broader public. It means the market is working how it’s supposed to.

One of the most destructive parts of the 2000-era dotcom bust was its effect on individual investors. To oversimplify: Companies were going public way too early; there was no sense about what internet companies should be worth; everyone was chasing easy riches, and as a result, stocks shot up and collapsed with little reason behind the prices. Many shirts were lost.

It has been largely different this time. Companies have stayed private longer, fueled by an increasingly complex world of fundraising options that don’t require an IPO and the scrutiny that comes with being public.

This has also meant that valuations—even well into the billions of dollars for companies that have never even turned a quarterly profit—are often set by small committees of executives and professional investors, rather than a broader, public market. Hopefully, the numbers will be based on some sort of logic—not just a thirst to play in this hot market. And ideally, they will go up with each consecutive round. For many of today’s highly valued startups, they have.

But it’s also the case that these are immature, volatile companies, often run by inexperienced executives, operating in uncertain markets. In many cases, this is why they’re attractive. But over time, many firms—even the ones that were just looking great—will simply not be able to sustain their unprecedented growth, or turn their wildly popular products into wildly successful businesses. Valuations for unprofitable companies are inherently highly speculative. A deviation by a single key factor could throw off the whole calculus substantially. Thus, many of these corrections or down rounds.

Of course, stock prices go up and down on the public markets all the time. But because this billion-dollar startup concept still seems pretty new and a little crazy—and because the valuations were supposed to be assigned by professionals—it perhaps seems more surprising, or embarrassing, when it happens in private.

This tendency to stay private for longer has kept several soaring investment opportunities, such as six-year-old Uber—theoretically worth more than $50 billion—from the general public. But it has also limited the shirt-losing, in theory, to people and firms that can better afford it. So far, no large firm has imploded in a way that would affect a broad set of individual investors. And the recent corrections, while significant, are not overwhelming.

This is what we wanted, isn’t it?

Professional startup investors, meanwhile, have been placed into an interesting position. Many have substantial, unrealized gains in companies that they don’t want to see vaporize. (The IPO market, which has been particularly unfavorable for some time, has also taken away some control.) Some are using this as an opportunity to warn companies against unsustainable expenses, operating unprofitably, and the hidden costs of over-valuation. (And, of course, all would love to be able to buy into companies more cheaply.)

“I don’t think we will see less of these public markdowns,” writes Fred Wilson, the successful venture capitalist whose firm placed early bets on Twitter, Etsy, and Tumblr. “I think we will see more of them. And we VCs are now facing the choice of whether to markdown our portfolios in reaction to Fidelity’s markdowns or explain to our investors and auditors why we did not do that.”

Meanwhile, things are, of course, changing. Individuals are starting to gain access to crowdfunding for private companies, and new stock markets are emerging. “We are slowly witnessing the blurring of the lines between the public and private markets,” Wilson writes.

This will open new opportunities for startups and their investors, but it will also create new risks.