HP earnings beat estimates, finally giving investors reason to hope

Hewlett Packard announced an 11% drop in earnings at 82 cents per share, but beat Wall Street estimates, showing possible light at the end of the tunnel for the struggling PC maker. First quarter net revenues were down by 6% at $28.4 billion, which also beat expectations.

Hewlett Packard announced an 11% drop in earnings at 82 cents per share, but beat Wall Street estimates, showing possible light at the end of the tunnel for the struggling PC maker. First quarter net revenues were down by 6% at $28.4 billion, which also beat expectations.

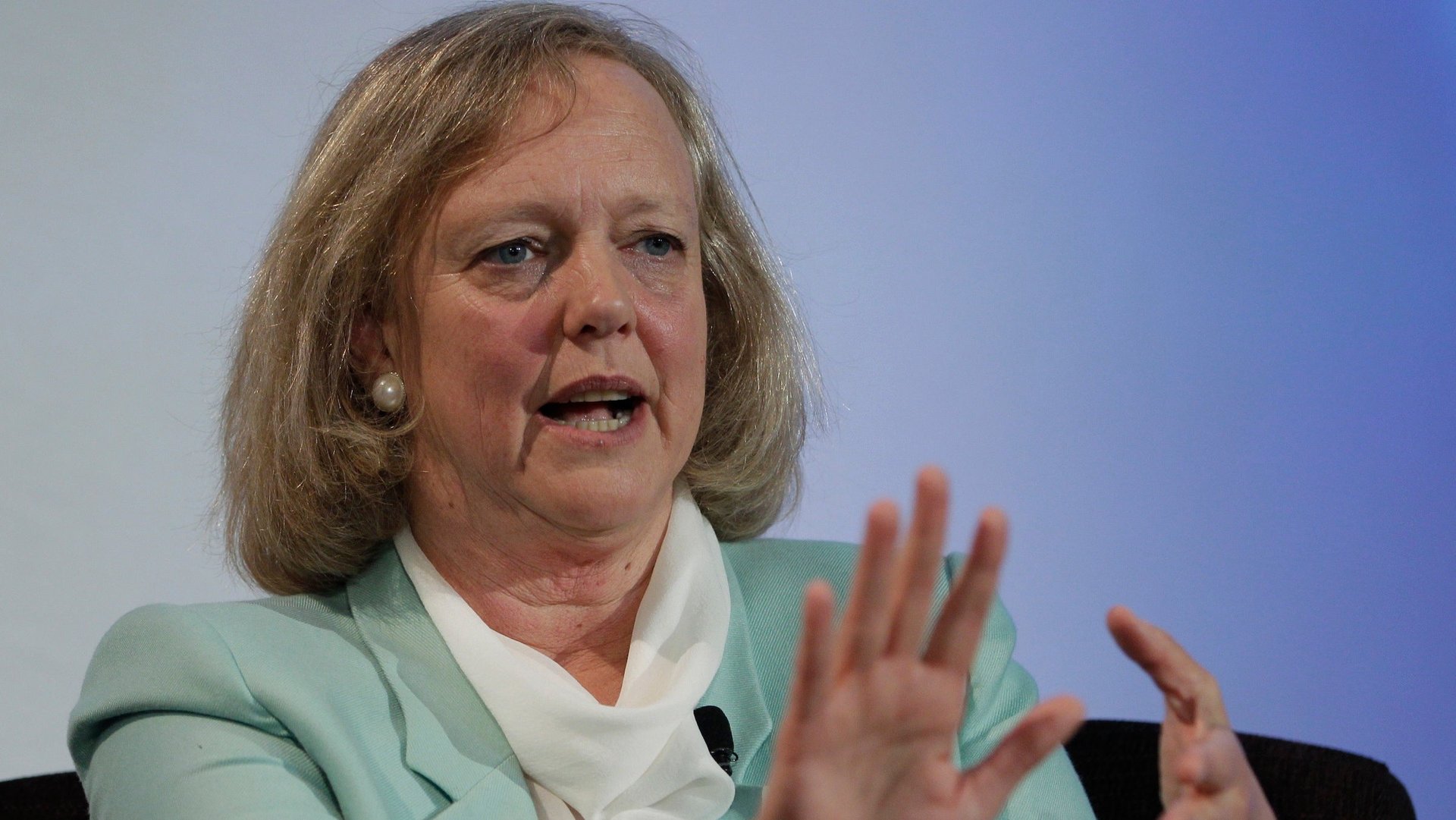

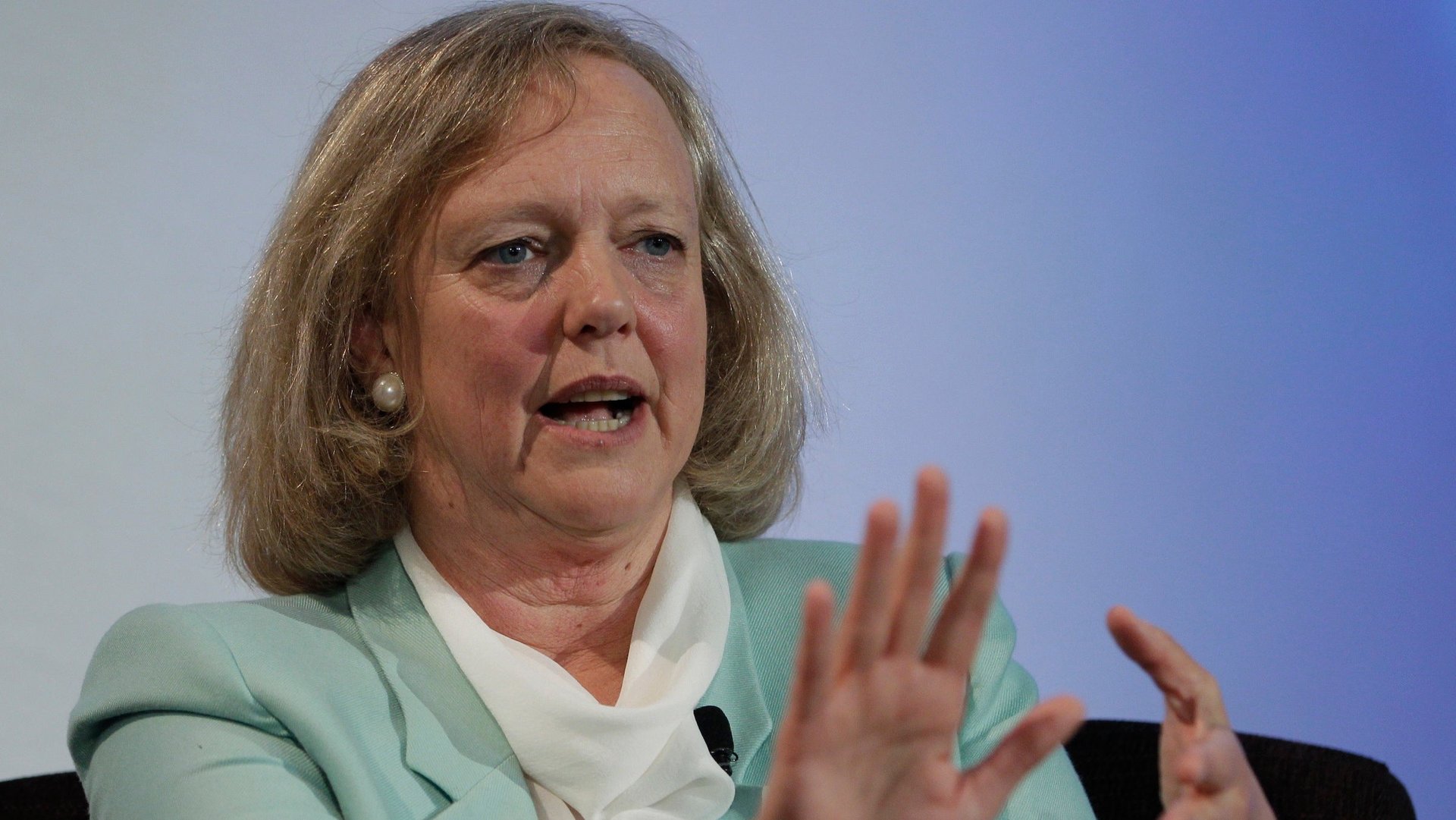

“While there’s still a lot of work to do to generate the kind of growth we want to see, our turnaround is starting to gain traction as a result of the actions we took in 2012 to lay the foundation for HP’s future,” HP CEO Meg Whitman said in a statement.

Investors rewarded HP by sending shares up by more than 6% in after-market trading to about $18.20.

Today’s earnings were closely watched to see if Whitman had stabilized the company after an accounting scandal at British software company Autonomy, a firm HP bought in 2011 for about $12 billion. Regulators in the US and the UK have been investigating Autonomy and HP said in November it would write down nearly $9 billion because of the Autonomy acquisition.

The decision to buy Autonomy was made under former CEO Leo Apotheker, who left the company after shareholders sharply criticized the Autonomy purchase as too expensive. Whitman, who was already an HP board member, took over the CEO role.

While HP is known for making computers and laptops, it is trying to focus more on its corporate customers since sales to consumers have been falling as they migrate to tablets and mobile phones. Revenues for its “personal systems” unit was down by 8%.

Whitman is in the midst of implementing a five-year restructuring plan that focuses on cutting costs, along with concentrating on growing businesses like network servers and data storage products.