Here is how China is taking advantage of the European crisis to buy up technological know-how

Due to its perilously high pollution and shrinking labor force, China needs to stop being the world’s workshop and start producing higher-value exports that require fewer, smarter workers and fewer factories powered by air-choking coal. China’s problem is its relative lack of creative entrepreneurs because of its dictatorial government, conformist culture and an education system that values rote learning over individual thought.

Due to its perilously high pollution and shrinking labor force, China needs to stop being the world’s workshop and start producing higher-value exports that require fewer, smarter workers and fewer factories powered by air-choking coal. China’s problem is its relative lack of creative entrepreneurs because of its dictatorial government, conformist culture and an education system that values rote learning over individual thought.

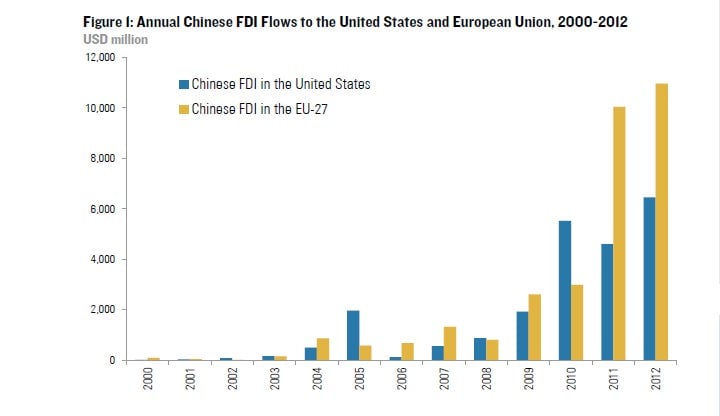

The nation’s solution has been to buy technological know-how via overseas acquisitions, and it has been on a spree in the depressed economies of Western Europe. This chart from US consultancy Rhodium Group shows how Chinese investment in Europe has soared since the euro zone crisis began raging in 2010.

In this brief report, Rhodium notes heavy recent Chinese investment in Europe’s “medium-sized industrials with experienced staff [and] advanced technology.”

The industrial machinery and automotive industries have been popular European targets for Chinese buyers, Rhodium adds. Examples of high-tech European companies that have welcomed a cash injection from the Chinese in the last two years include London black cab maker Manganese Bronze, German concrete pump maker Putzmeister Holding and Italian yacht maker Ferretti Group.

And while some Europeans view China’s rise negatively, European politicians have generally not yet followed their American and Canadian counterparts in fanning the flames of anti-Chinese sentiment to win votes. Instead, European governments have long welcomed Chinese investment as they put assets up for sale to strengthen their nations’ weak balance sheets.