Priceline is the one big internet comeback attempt that actually worked

There’s a reason Yahoo’s attempted rebound under Marissa Mayer—looking shaky at the moment—is so improbable: Comebacks are hard and rarely work out. But they’re not impossible.

There’s a reason Yahoo’s attempted rebound under Marissa Mayer—looking shaky at the moment—is so improbable: Comebacks are hard and rarely work out. But they’re not impossible.

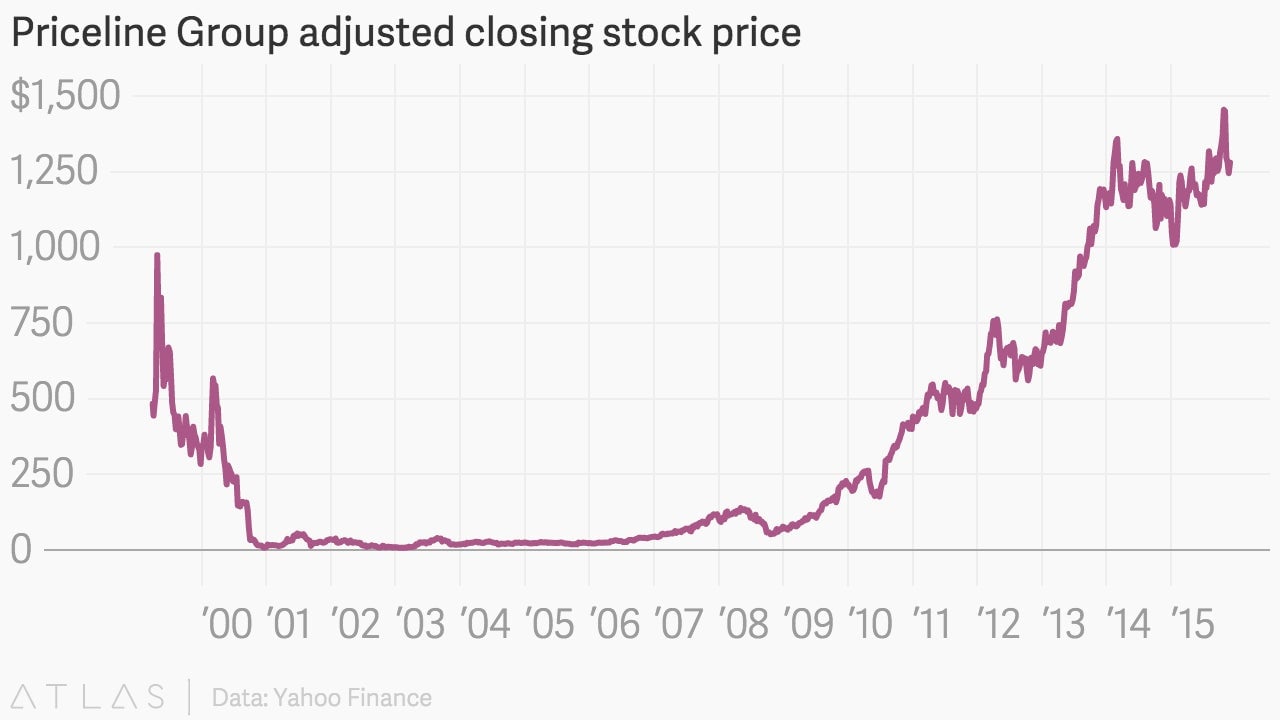

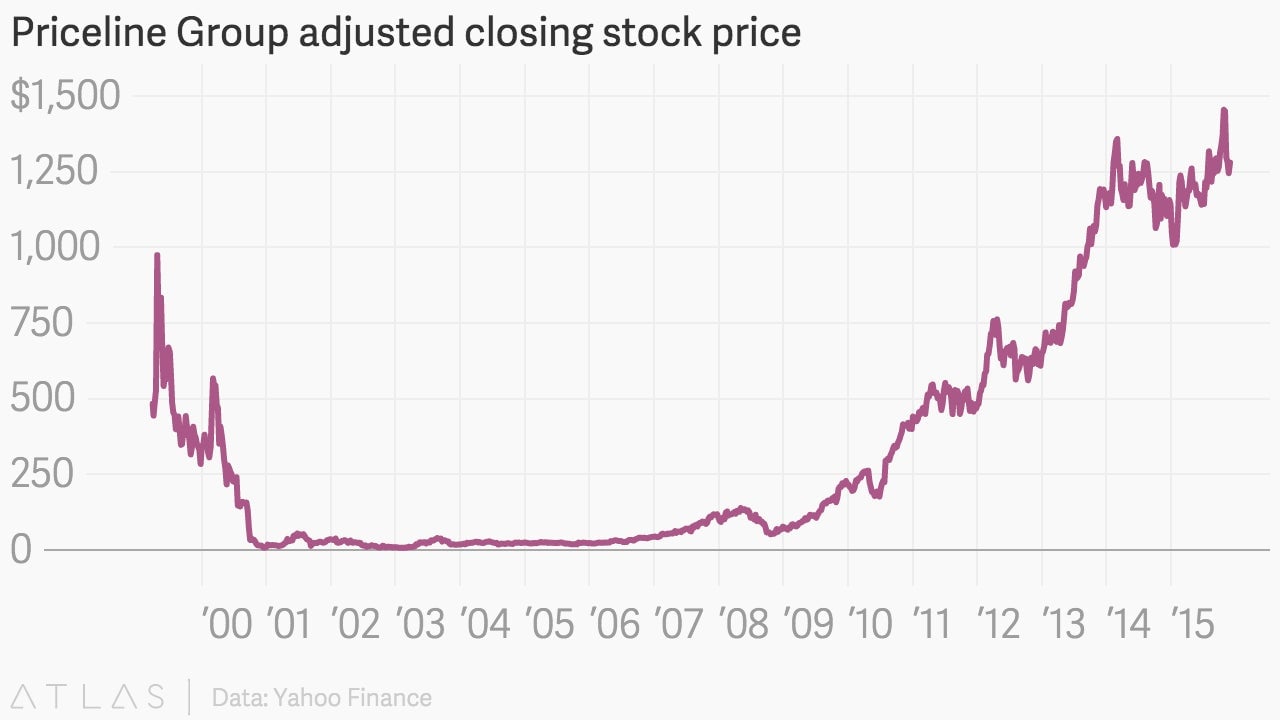

Perhaps the biggest internet comeback of all time rarely comes up in conversation. That’s the Priceline Group, the travel-booking site that went public in the heat of the dot-com bubble, crashed, went nowhere for a while, and then recovered to far surpass its bubble-era valuation.

How did Priceline do it? Slowly, quietly, and methodically.

Henry Blodget, the former dot-com-era internet stock analyst, summarized it well a couple years ago for Business Insider:

The company found a management team that was less interested in “buzz” and “ideas” and “stories” than it was in actual performance.

The company stabilized its business, and then went looking for a new growth engine.

And found it.

That management team was led by CEO Jeff Boyd, who dialed back Priceline’s “name your own price” concept and focused on hotel bookings, which are more profitable than airfares, and on international markets. In an especially key move, the company acquired Amsterdam-based Booking.com, which became a huge growth driver. (Priceline’s current CEO Darren Huston previously led Booking.com; Boyd is now chairman.)

Amid broader consolidation in the online-booking industry, Priceline has continued to acquire other firms, such as Kayak and OpenTable. Its market capitalization is about $65 billion, and its adjusted stock price of around $1,300 reflects an almost 20,000% increase from its lowest point in 2002.