Informal cash savings groups are driving female entrepreneurship in Nigeria

Recent years have seen the world make strides toward narrowing inequalities between men and women. We know the gender gap is not a developing world problem: women living in rich and poor nations alike face differences in education and job opportunities. But even as disparities remain, the idea that equality can enhance economic productivity, make growth inclusive, and shape more representative policy is gaining steam across the globe.

Recent years have seen the world make strides toward narrowing inequalities between men and women. We know the gender gap is not a developing world problem: women living in rich and poor nations alike face differences in education and job opportunities. But even as disparities remain, the idea that equality can enhance economic productivity, make growth inclusive, and shape more representative policy is gaining steam across the globe.

Still, there’s work to be done. Couple those long-standing disparities with the challenge of living in some of the world’s most fragile states, and you find a day-to-day reality that is far too common for young women and their families: limited infrastructure, no institutional support, and few opportunities for advancement. In Africa’s most populated state, Nigeria, women have particularly struggled to establish a foothold for themselves: the 2014 Social Institutions and Gender Index, which measure the root causes of gender inequality, ranked Nigeria 79 out of 86 countries.

Adolescence is a critical time to instill young Nigerian women with the means to counter that reality. For one, these girls are already engaged in economic activities out of necessity—it’s about survival for them. And providing the right tools can help adolescents learn and sustain the kinds of practices that will lead to fuller, more meaningful lives.

MasterCard has long recognized the need to help empower marginalized young women and has partnered with Mercy Corps, a global humanitarian organization, to help foment inclusive growth and expand adolescent’s access to economic opportunity. Though, historically, information about at-risk youth in the world’s poorest regions has been hard to come by, Mercy Corps recently completed a survey in four northern states in Nigeria, focusing on the key barriers and opportunities for entrepreneurship. The survey data can help organizations target practices that could be most beneficial for girls’ development.

These are the kind of teenage girls who could benefit from those efforts: Meet Jamima Joseph. Jamima is 18 years old and lives in Kano, Nigeria with her boyfriend. She lived with her uncle in Gombe State, but left because of persistent domestic abuse. Sadly, this is far too common: nearly half of unmarried women in parts of Nigeria have experienced physical violence. She’s dropped out of school and currently works with a food seller to meet day-to-day financial needs. Unfortunately, though Jamima would like to go back to school, she can’t afford the fees. For now, she needs to focus on working for the food seller, but she has bigger dreams: one day she’d like to build her own restaurant.

The results of the Mercy Corps survey make at least one thing clear: adolescent girls—girls like Jamima—want to either grow their business or start a new one. This is important. An investment in women’s financial progress is not only a moral imperative, but should stand as a requisite pillar of sustainable economic development for the region.

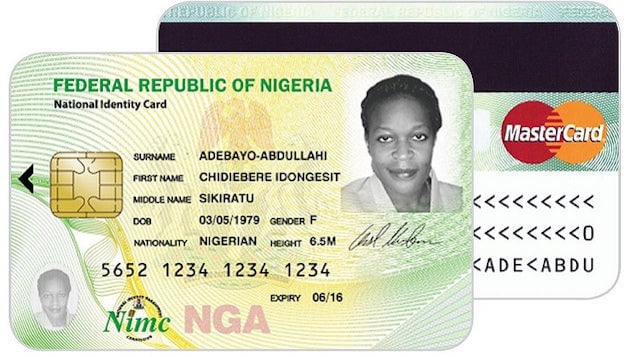

Still, there are two primary problems. First, adolescent girls have limited assets: 74% simply do not have resources to put towards economic advancement. Second, most girls lack formal identification: Nigerian law requires a birth certificate or passport to open a bank account or credit line, and only half of survey respondents had access to one.

To help with these challenges, Mercy Corps and the MasterCard Center for Inclusive Growth have initiated training sessions on business, financial literacy, and savings for girls in Lagos and the Federal Capital Territory. To date they have reached 3,800 adolescent girls.

At events, the participants come together in groups to collectively develop a savings culture. 84 savings groups made up of 15-20 girls have been established, and each girl owns shares in a pool relative to their weekly contribution. The girls can borrow from the pool to help them develop business ideas into local start-ups. The hope is that these kinds of informal financial tools help smooth a transition to a more inclusive financial market, and products that can help women better manage and grow their assets.

Which is the second problem: identification. Currently, MasterCard is working with Nigeria’s National Identification Management Commission to get all Nigerians age 16 and older their national ID. Truth be told, this kind of public-private development partnership is nothing short of groundbreaking, both in terms of scale and intention. It gets at the heart of the financial inclusion problem—analysts estimate that being dependent on using cash in a country like Nigeria can cost up to 1.5% of GDP—and it’s the biggest inclusion initiative of its kind on the entire continent. And as part of this program, 18,000 adolescent girls will have access to both electronic payments and savings accounts. This will be crucial in helping them reduce reliance on physical cash for day-to-day transactions and move into the global digital economy.

For girls like Jamima, help with these problems is only a step and the ladder of equitable economic progress is clearly tall to climb. But progress is being made. Thanks to the MasterCard and Mercy Corps training series, 400 girls are receiving specialized entrepreneurship skills training and another 875 girls have been matched to apprenticeship and internship opportunities. Bolstered with the power of identification and financial prowess, those girls are on the path toward growth, inclusion and prosperity. Clearly, those are invaluable steps.

This article was produced on behalf of MasterCard by the Quartz marketing team and not by the Quartz editorial staff.