Are we witnessing the end of globalization?

Globalization is the predominant economic, strategic and political force of our age. Its implications and side effects—from wealth creation to climate change—are pervasive. It’s no secret that the direction globalization takes has far-reaching implications.

Globalization is the predominant economic, strategic and political force of our age. Its implications and side effects—from wealth creation to climate change—are pervasive. It’s no secret that the direction globalization takes has far-reaching implications.

Though it’s not complete, the world is currently in a benign transition from full globalization to one defined by competing regional economic powers. In the course of the last year alone, some events—the establishment of the Asia Infrastructure Investment Bank, international political engagements surrounding the Ukraine crisis, Abenomics in Japan, the rise of Asian companies like Alibaba and the active role that the ECB is playing in the European economy—point towards the emergence of a more complex world and away from globalization as we have come to know it.

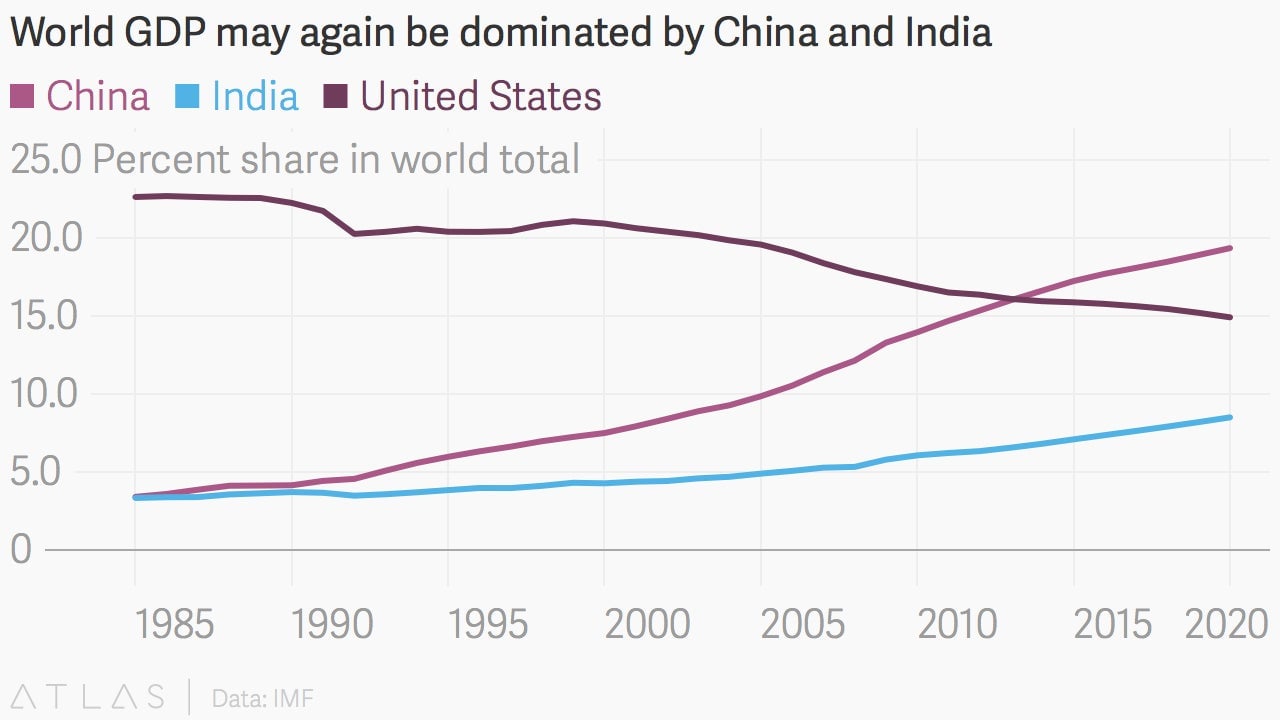

One defining factor is the economic power shift away from the West. China and India are on their way to building dominant economic powerhouses, and in the future, the top 50 urban agglomerations will be dominated by cities such as Delhi, Shanghai, Mumbai and Beijing that are all located in the east. For contrast, in 1950, 22% of the world’s top 50 urban agglomerations were located in the USA alone but by 2030 only 6% of the world’s urban commercial centers would be in the USA.

Clearly, if such a change is materializing, it will have enormous implications for companies, markets, economies and governments—not least because so many of them have come to rely upon globalization. A recent report from Credit Suisse aims to establish and track the direction that globalization will take, outlining three prospective scenarios for the future. The report incorporates specific trends in financial markets, trade, governance and corporate activity into the construction of two models—the ‘Multipolarity Index’ and a ‘Globalization Clock’—for its projected scenarios.

Scenario 1: Globalization continues

The first scenario sees globalization continuing in the form we know and have understood over the past thirty years. In substance, this means the dollar continues its role as first amongst equals in the world of foreign exchange. Western multinationals dominate the global business landscape and the fabric of international law and institutions is still western in nature.

In economics, macroeconomic volatility is low, trade grows with few interruptions from protectionism and the Internet economy grows across borders. Socio-politically, the significant development is that human development improves, characterized by more ‘open societies.’

Scenario 2: A multipolar world

The second scenario envisions Asia rising and a stabilized Eurozone driving a global economy which rests, broadly speaking, on three pillars—the Americas, Europe and Asia (led by China). Credit Suisse expects to see the development of new world institutions, as well as the rise of ‘managed democracy’ and a more regionalized version of the rule of law.

In this vision, migration becomes more regional, and rural to urban-led, rather than cross-border. Further, regional financial centers rise and banking and finance develop in new ways. At the corporate level, the significant change would be the rise of regional corporate champions, which in many cases would supplant global multinationals.

Credit Suisse also expects to see uneven improvements in human development leading to more stable, wealthier local economies on the back of a continuation of the emerging market consumer class growing. In Europe, the EU halts its outward expansion and thrives as the restructuring of banks and companies makes for a leaner economy.

Scenario 3: The end of globalization

The third scenario is a darker, more negative one that calls to mind the collapse of globalization in 1913 and the subsequent onset of the First World War. Over the last few years, though the world has been stressed by the global financial crisis and terrorist attacks, these developments have generally led to more, rather than less, cooperation between nations.

But there are risks to globalization, and Credit Suisse points to a few areas to watch—an economic slowdown impacting trade, or the possibility of a macro shock from indebtedness, inequality, or immigration. The world could see a rise in protectionism, a military clash between the great powers, currency wars, a climate event, a backlash against global corporations, or even a reversal in transitions to democracy.

Read more of Credit Suisse’s analysis on the end of globalization here.

The possible demise of globalization’s dominance is just one of a host of issues affecting the world of business today. Stay up to date with the world’s ever changing financial landscape by subscribing to Credit Suisse’s newsletters.

This article was produced on behalf of Credit Suisse by the Quartz marketing team and not by the Quartz editorial staff.