India will need new energy sources to keep up with its fast growth

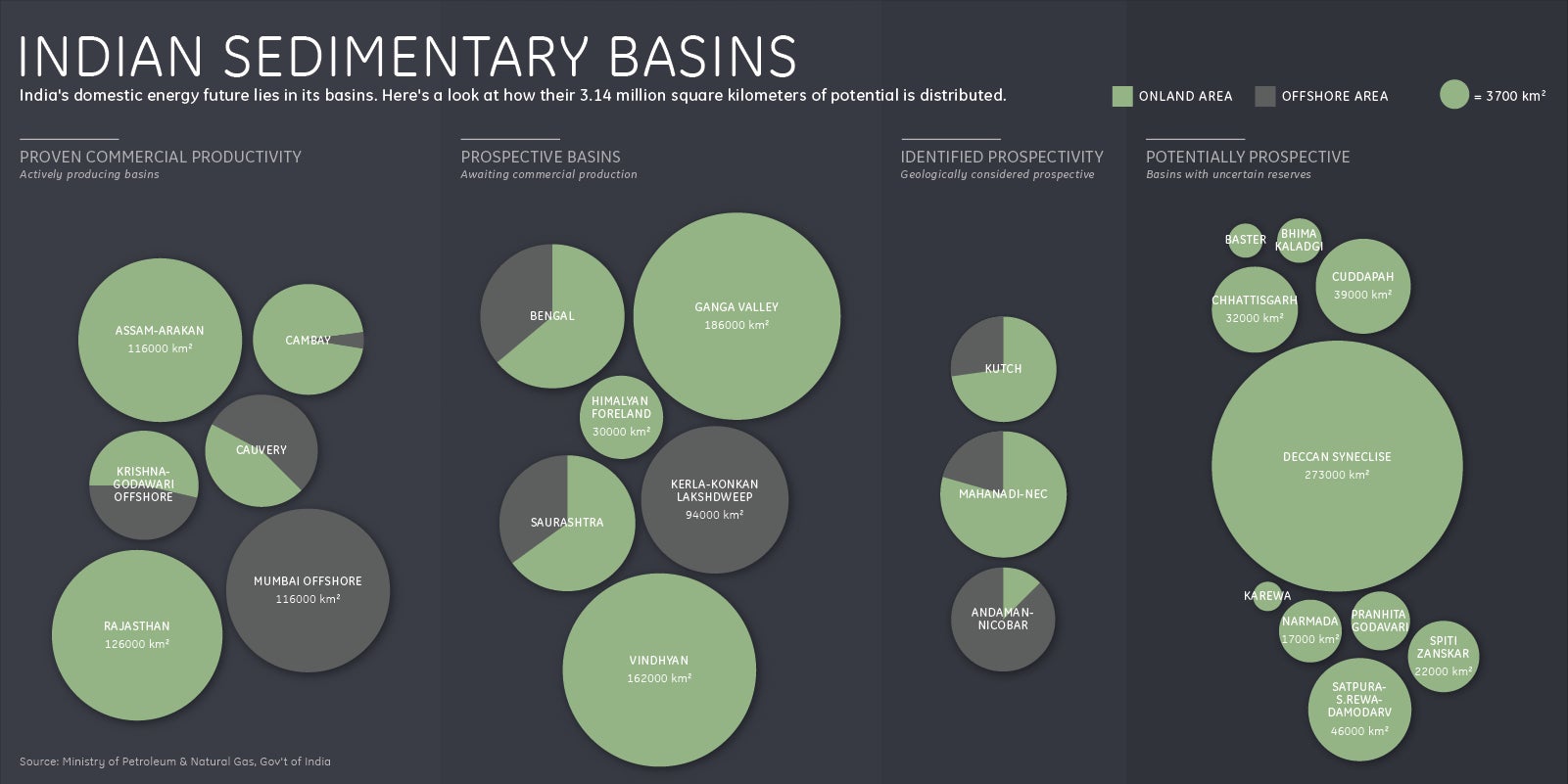

(See the infographic enlarged.)

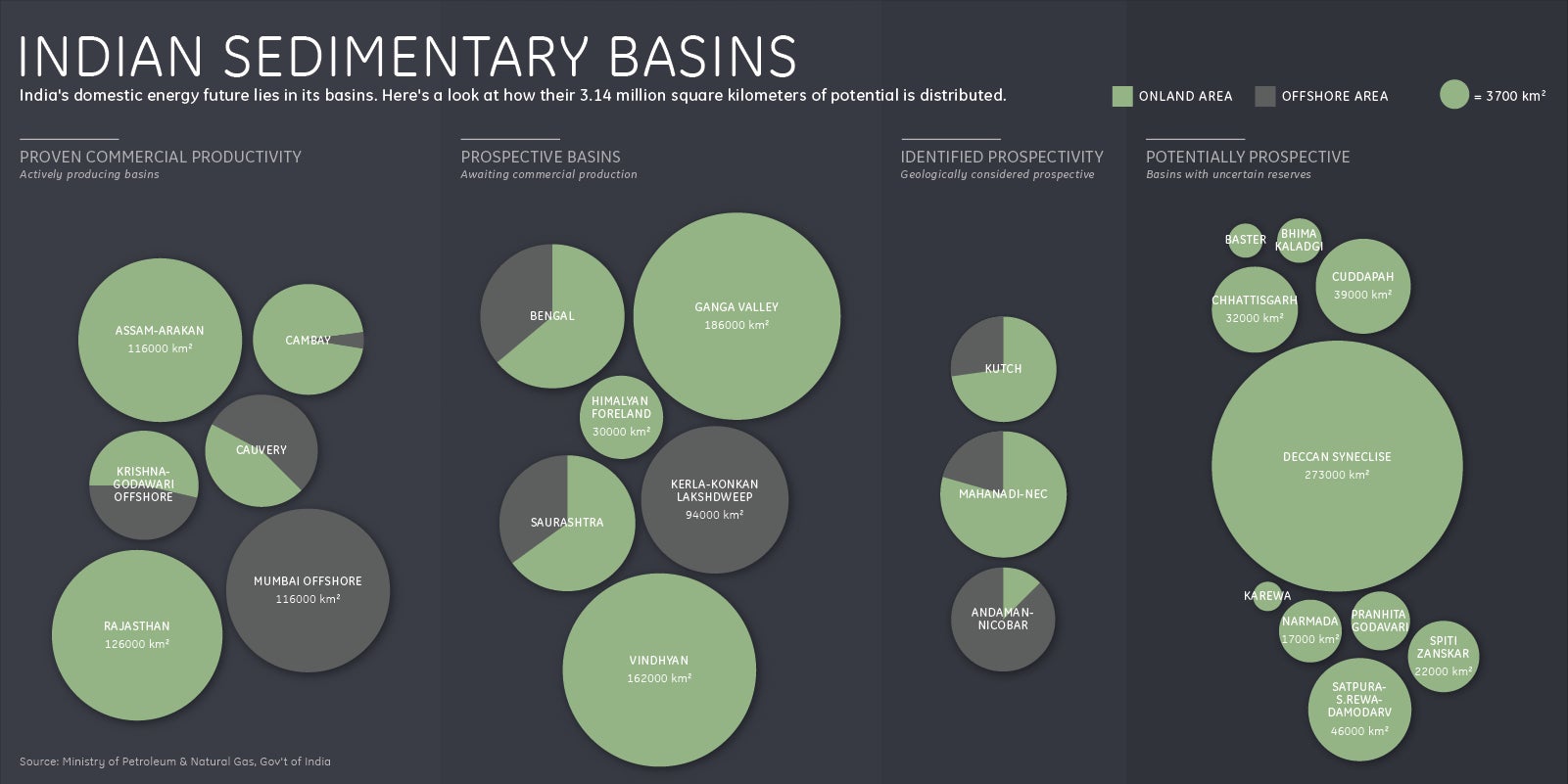

(See the infographic enlarged.)

India is the fastest growing economy in the world. Last year, India’s economy grew 7.3%, surpassing its neighbor China, then the undisputed Asian economic giant.

To sufficiently fuel its growing economy, India requires a huge amount of oil & gas. Currently, India is the world’s fourth-biggest oil consumer, and energy demand is growing at a 3% clip. And as it stands, India imports 80% of the oil it consumes, which won’t decline anytime soon. In fact, analysts project that development in India and China will account for about half of global energy demand growth through 2040.

By 2030, India’s hydrocarbon imports are expected to range from $300B to $500B annually. That sort of energy dependence is far from desirable. Even with the recent drop in the price of crude, tapping alternate sources of fuel will be critical for the future of India’s energy security and a key driver of economic growth. India’s upstream—its exploration and production segment—holds enormous potential.

Although the country has proven reserves of 206 billion barrels of oil, only 67 billion barrels are online. Further, less than 25% of India’s sedimentary basins are explored, with subsea areas particularly underexplored. In fact, only one of the country’s 83 deep-water blocks has been developed. To capture the kind of inclusive and expansive economic development in its sights, India needs to increase its refining capacity to meet rising domestic demands.

Recognizing this, the Indian government has adopted ambitious goals for domestic power and is encouraging investments and innovation in the sector. The Prime Minister himself has challenged India to reduce its import dependence by 10% by 2022.

Spurred by that charge, Indian companies are expanding into new areas and experimenting with technology to feed growing demand. For one, Super Wave Technology is developing an alternative extraction technology, using shock waves to initiate fractures in shale reservoirs located in the depth of 1000-1500 meters. The traditional hydraulic fracturing process produces large volumes of contaminated water that can flow back from the well. Replacing water with shock waves would help drillers avoid the water contamination and broader environmental problems.

Because oil is becoming harder to find and drill for, these kinds of production innovations may increase cost efficiencies. “In the near term… high-pressure, high-temperature drilling and multi-stage hydraulic fracturing will dominate. And from 2025 and beyond, subsea robotics is seen as most promising,” says John Wishart, director of Lloyd’s Register Energy.

Since some of the most attractive prospects in India are either in remote or environmentally sensitive areas, exploration, production, and transportation can require especially intensive efforts and a host of specialized resources—advanced turbines, enhanced sensors, communications, and data analysis capability—that need to be integrated into the equipment and tailored to specific sites.

Established industry players also have a role to play in securing India’s energy future, and can handle the trickier technological maneuvering. In Bangalore, GE’s established its largest integrated multidisciplinary Research and Development Center outside the US, the John F. Welch Technology Centre. Currently, GE has hundreds of engineers on the ground developing new technologies for the sector—the work done by inventors at the Centre alone has resulted in over 2250 patents filed.

It’s clear that multinational industrials can play a major role in growing the country’s current domestic production. But they’re making a real difference when it comes to optimizing software efficiency. For one, GE’s rollout of a massive data-analytics project—the “Industrial Internet”—pinpoints inefficiencies along the production line and extracts data that will streamline processes from production to transportation to consumption. GE estimates that just one percent efficiency gains achievable through these kinds of technologies would result in $90 billion in savings for the sector.

Those smarts will help India focus on continuing to grow its economy smoothly and sustainably.

This article was produced on behalf of GE by the Quartz marketing team and not by the Quartz editorial staff.