Bankers may gripe about pay cuts, but their bonuses are probably going up

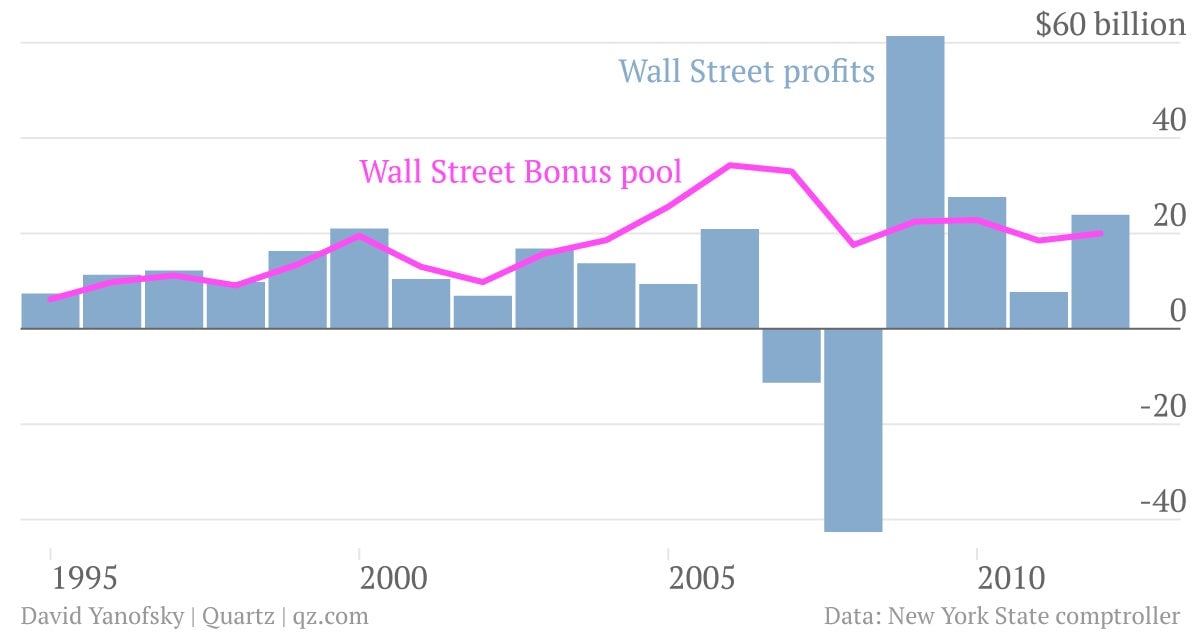

Despite bankers complaining about their pay, the New York state comptroller reported today that cash bonuses this year (for performance in 2012) for those in the securities industry are expected to rise by 8% to $20 billion.

Despite bankers complaining about their pay, the New York state comptroller reported today that cash bonuses this year (for performance in 2012) for those in the securities industry are expected to rise by 8% to $20 billion.

The report also said that the average cash bonus rose by about 9% to almost $121,900 last year, while the year before that, the average salary including bonuses was slightly up to $362,900. (Data for salaries weren’t yet available for 2012.) That salary figure is higher than the average from before the financial crisis.

The news may seem surprising given that many banks are cutting compensation amid hits from various scandals and investor outrage over bonuses. Deutsche Bank’s total bonuses will fall by 11% this year, while Credit Suisse made even deeper cuts. Other banks also increased deferments of cash bonuses, i.e., spreading them over several years. Morgan Stanley bankers will get their bonuses in installments through 2016, a plan similar to that at Barclays.

But the cuts in pay at the banks have focused more on senior-level bankers, who are also high earners, whereas the comptroller’s report focuses on all employees. At some firms, bankers who would normally get a $2-$3 million bonus are now getting $1 million, all of which is deferred at some banks. Today’s report suggest junior level bankers have fared better than their more senior counterparts, but the news gets worse as you move up the ladder.

Of course, $1 million still sounds like a lot of money to a lot of people. But given their lifestyles, the bonus cuts have forced many to rethink private schools for their kids and other expenses.