These charts show the end of global banking is upon us

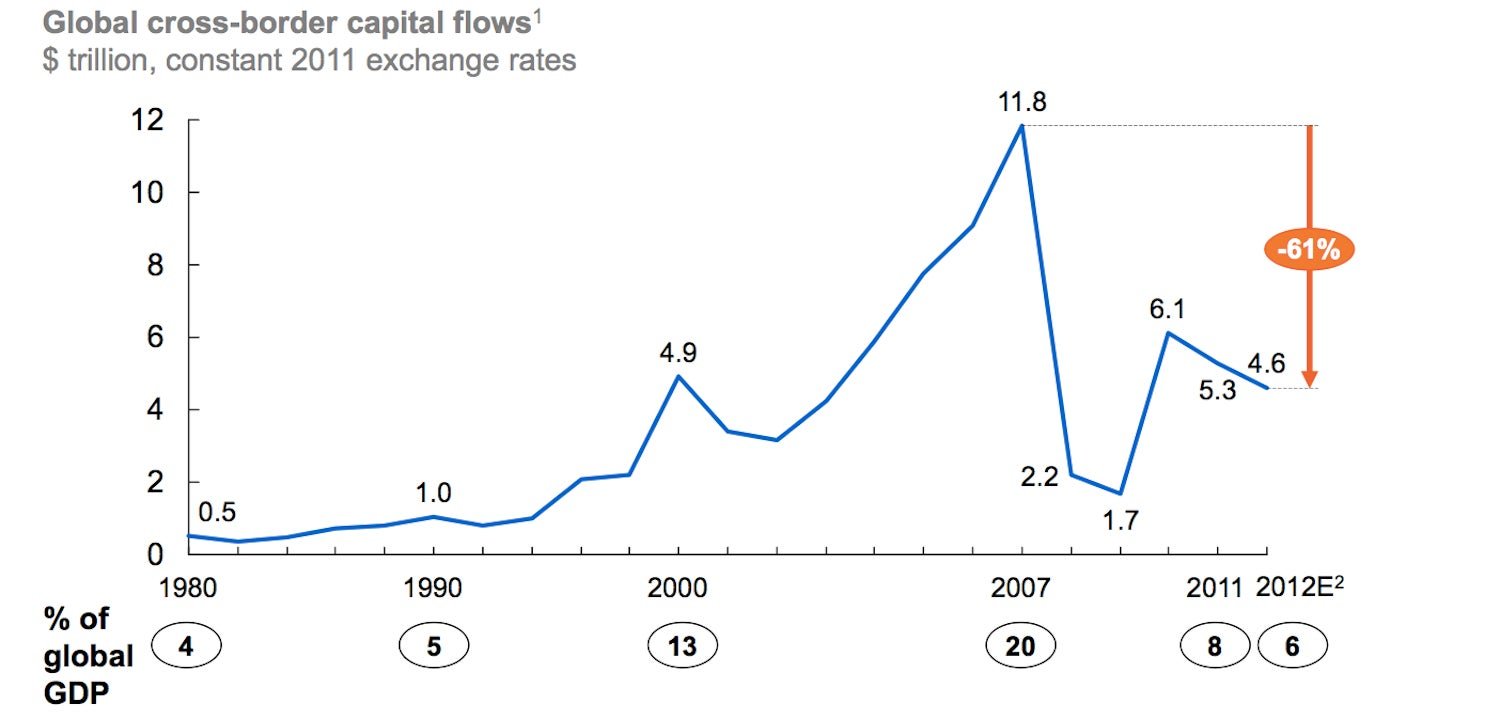

Cross-border capital flows—meaning, banks lending to customers outside their own countries—are now 60% less than what they were in 2007, according to a report by consulting firm McKinsey & Co.

Cross-border capital flows—meaning, banks lending to customers outside their own countries—are now 60% less than what they were in 2007, according to a report by consulting firm McKinsey & Co.

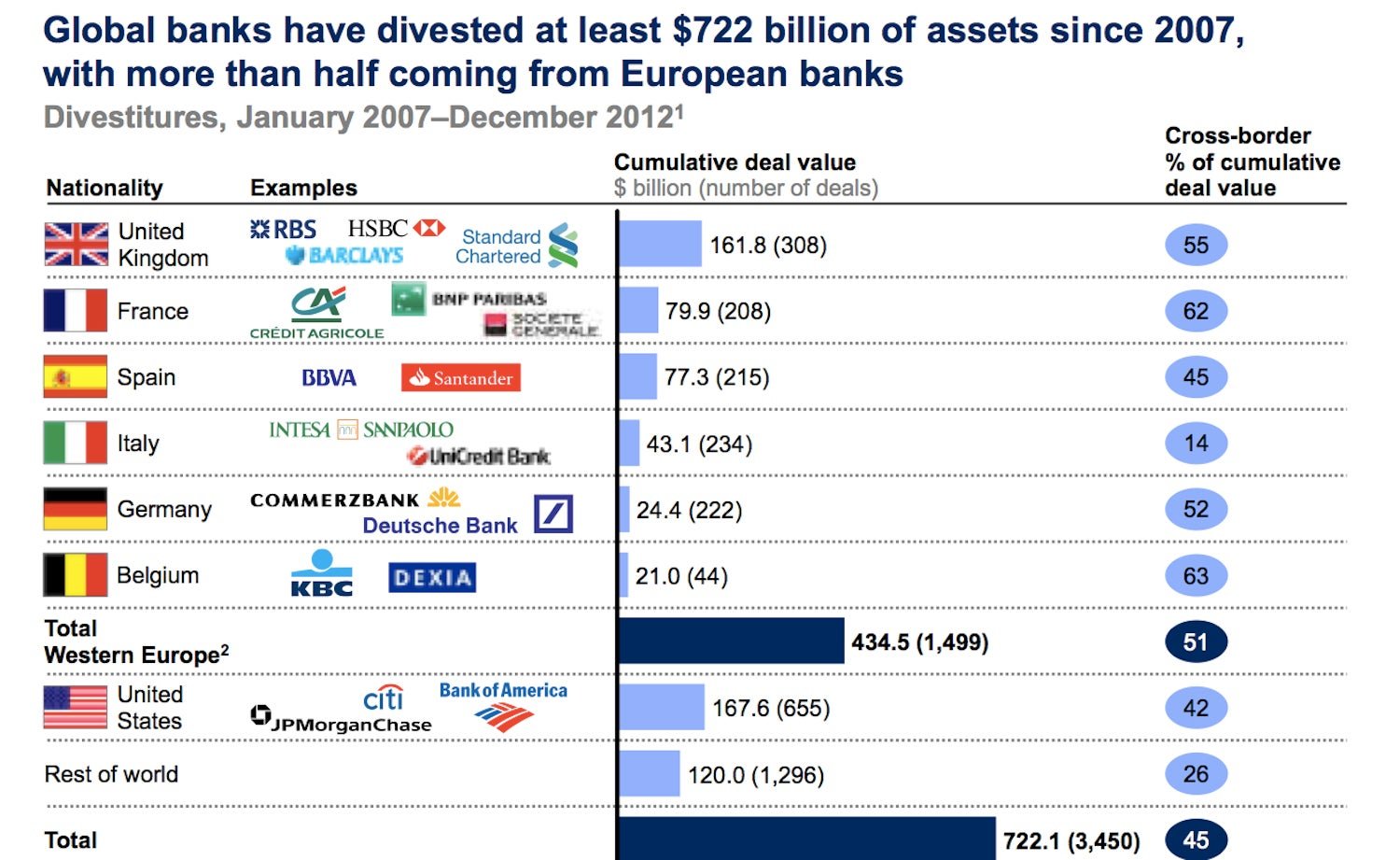

Euro zone banks are the biggest contributors to this trend, say McKinsey—particularly where it concerns lending to other countries in the currency bloc. This suggests that the great goal of European financial integration has stumbled.

Quartz has highlighted before how European banks’ balance sheets are bloated by risky loans. It would make sense that, under pressure to reduce bad loan risk and to support their home economies, their lending has become more domestic than ever.

But McKinsey also finds that while US, Canadian and Australian banks have increased cross-border lending since 2007, “their expansion is not substantial enough to fill the gap left by retreating European banks.”

In particular, US banks have done more painful deleveraging (meaning, reducing lending) than their European counterparts. They also remain under orders from regulators to keep large buffers of capital as security (paywall) instead of lending out the maximum amount of funds in pursuit of maximum profit. And like their European counterparts, they are expected to keep the US economy motoring while simultaneously shrinking their balance sheets. That all adds up to fewer long haul flights for the world’s senior lending bankers.

Here is the story of the great retreat from global banking in charts from the McKinsey report. This first one shows how, beginning in the 1980s, banking became increasingly global but localized again during the global financial crisis:

Euro zone banks have been at the vanguard of this new parochialism, though British and American lenders have shrunk their balance sheets rapidly too:

And don’t assume that Asian banks have stepped into the gap created by the retreat of Western lenders. They have cut their cross border lending since the crisis as well:

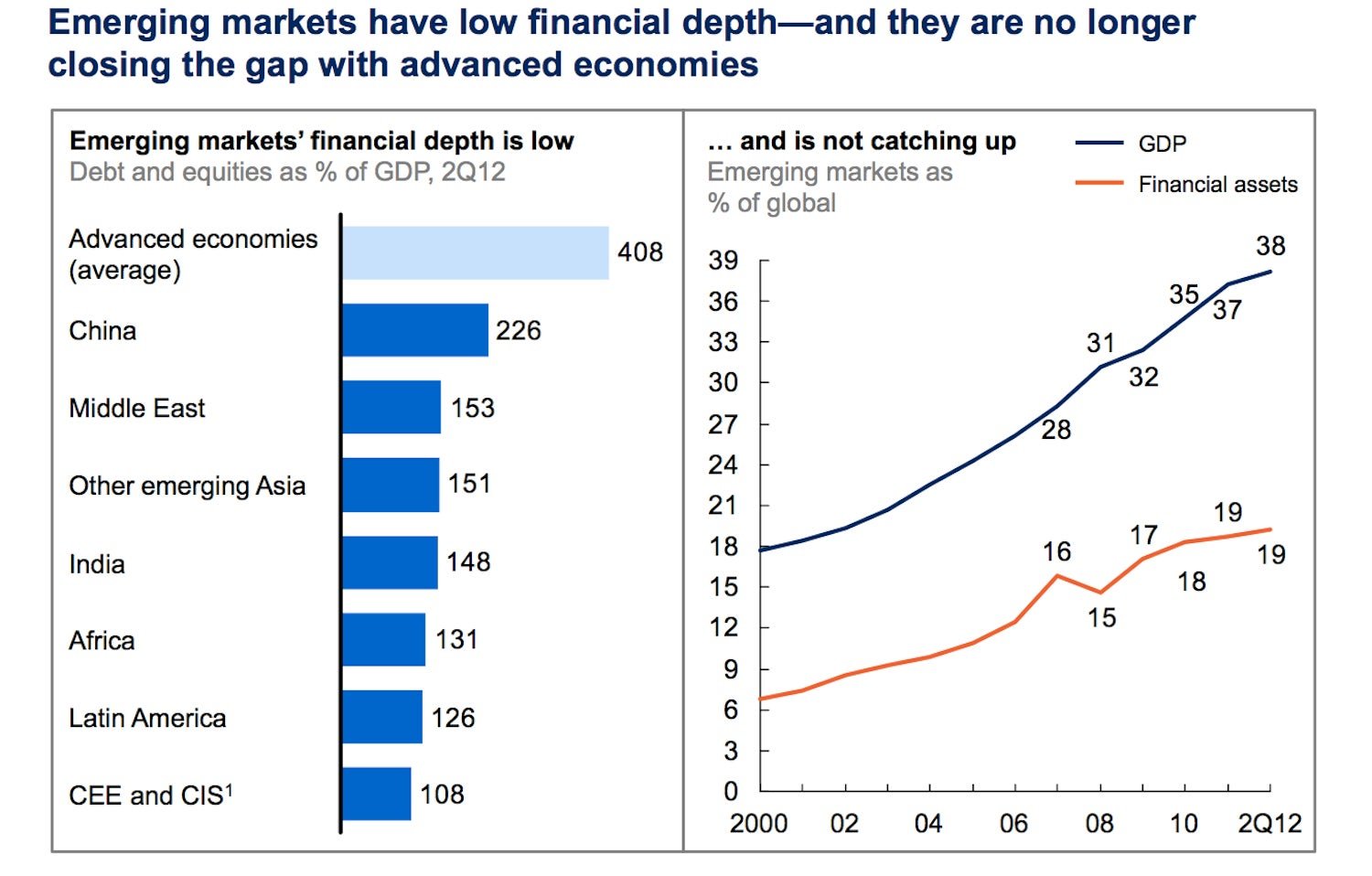

Meanwhile, emerging markets lack the financial depth necessary to build giant banks that can fling large amounts of cash across borders: