IAG Airlines lost $1.2 billion last year, but its misery has plenty of company

IAG, Europe’s fourth-largest airline group by market value, reported a net loss of €943 million ($1.2 billion) for 2012. The company, which owns British Airways as well as the Spanish carrier Iberia, was hit by a rise in fuel prices of 20% from a year earlier and a €351-million operating loss at Iberia, where workers have promised 15 days of strikes for the airline’s plan to cut 15% in capacity, including 3,800 jobs.

IAG, Europe’s fourth-largest airline group by market value, reported a net loss of €943 million ($1.2 billion) for 2012. The company, which owns British Airways as well as the Spanish carrier Iberia, was hit by a rise in fuel prices of 20% from a year earlier and a €351-million operating loss at Iberia, where workers have promised 15 days of strikes for the airline’s plan to cut 15% in capacity, including 3,800 jobs.

IAG’s troubles are part of a larger unsteady future facing Europe’s legacy airlines—former state-controlled carriers like IAG, Air-France KLM, and Lufthansa—which are struggling to compete with low cost rivals like Ryan Air, Easy Jet, and Gulf carriers cutting into their short-haul traffic within the region. The airlines make most of their revenue from long-haul flights, but falling intra-Europe business is cutting into those profits. Thus Lufthansa and Air France-KLM are both restructuring to improve short haul-operations; Air France-KLM said last month it was creating a new low-cost operator to be named Hop.

Still, it’s not all bad news. Willie Walsh, IAG’s chief executive said today he hopes the company will turn a profit this year if restructuring goes as planned. Moreover, today’s poor results are still better than what was expected. According to Reuters data, IAG’s operating loss for 2012 was €68 million, if restructuring and impairment charges at Iberia aren’t taken into account, better than the consensus forecast of an €82 million loss. The company’s share price was up 8.3% by 3:30 GMT, leading the FTSE 100.

Also, IAG could benefit from the US-American Airlines merger, which will create the world’s largest airline that is expected to join the Oneworld Alliance of which IAG is a part. IAG and Oneworld airlines might be able to better compete against those of other groups like Star Alliance and Skyteam.

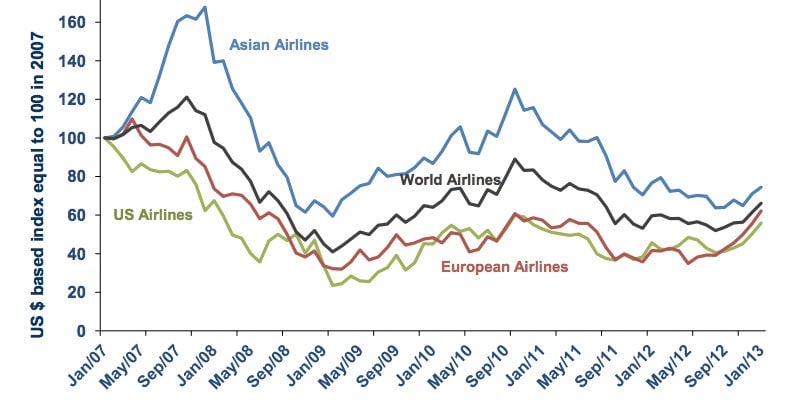

The International Air Transport Association predicts that the global airline sector will see a recovery this year, driven mostly by North American airlines, but European airlines will at best break even. That seems to be enough hope for some investors: Share prices of European airlines have risen since December and are higher than a year ago, according to the Bloomberg Airlines Index.