Illinois regulators threaten Square, the internet’s payment darling, with a huge fine

Disruptive technology is butting up against the tangled web of financial regulation once again, with the state of Illinois ordering Square to stop all of its business there and pay hundreds of thousands of dollars in fines.

Disruptive technology is butting up against the tangled web of financial regulation once again, with the state of Illinois ordering Square to stop all of its business there and pay hundreds of thousands of dollars in fines.

“We’ve been in close contact with the Illinois Division of Financial Institutions for several months and are addressing their concerns,” a spokesperson for Square, which is based in San Francisco, California, just told us by email.

Square, the online payments company founded by ex-Twitter CEO Jack Dorsey, has become a leader in the payments space thanks to its iconic white credit card swiping accessory and ease of use. Dorsey’s stake in the company is estimated to be worth $1 billion.

But as it quickly spread across the country, Square didn’t account for the varying forms of financial regulation imposed by US states. In a January regulatory filing, just released today, the state of Illinois caught up with Square.

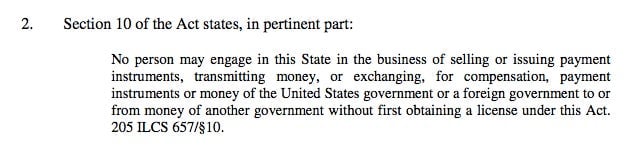

In Illinois, you need a licence to conduct transactions from the Department of Financial and Professional Regulation, and Square doesn’t have one:

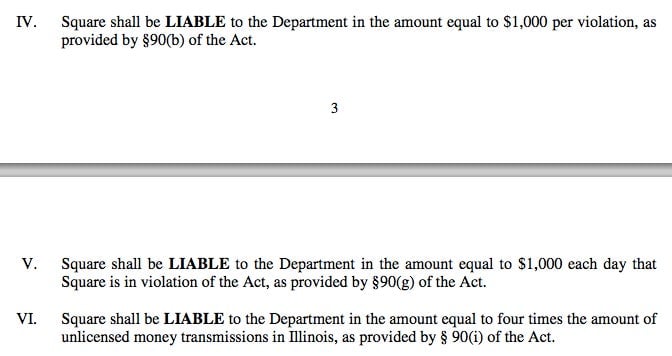

The punishment is calculated in terms of the number of transactions Square has performed in the state, which is probably quite a few:

The Department of Financial and Professional Regulation declined to comment on the filing.

This likely isn’t the last word on the issue; regulators use actions like these to bring companies to the table to talk compliance and settlement. But it could present a problem, like Amazon’s state sales tax issues, that will require a complex, multi-state resolution, and attract regulatory attention to other disruptive internet finance companies.

Thanks to Shamir Karkal of Simple for tipping us off to the filing.