Here’s how WeChat and Weibo users are explaining China’s stock market circuit breaker

Trading on the Chinese stock market was halted twice this week, thanks to a new mechanism that went into effect on Jan. 4, known as a “circuit breaker.” But what exactly is a circuit breaker and how does it work?

Trading on the Chinese stock market was halted twice this week, thanks to a new mechanism that went into effect on Jan. 4, known as a “circuit breaker.” But what exactly is a circuit breaker and how does it work?

A simple and humorous explanation has been circulating on WeChat and Weibo—two messaging services popular in China—as well as across the web (hat tip to the Financial Times for spotting it):

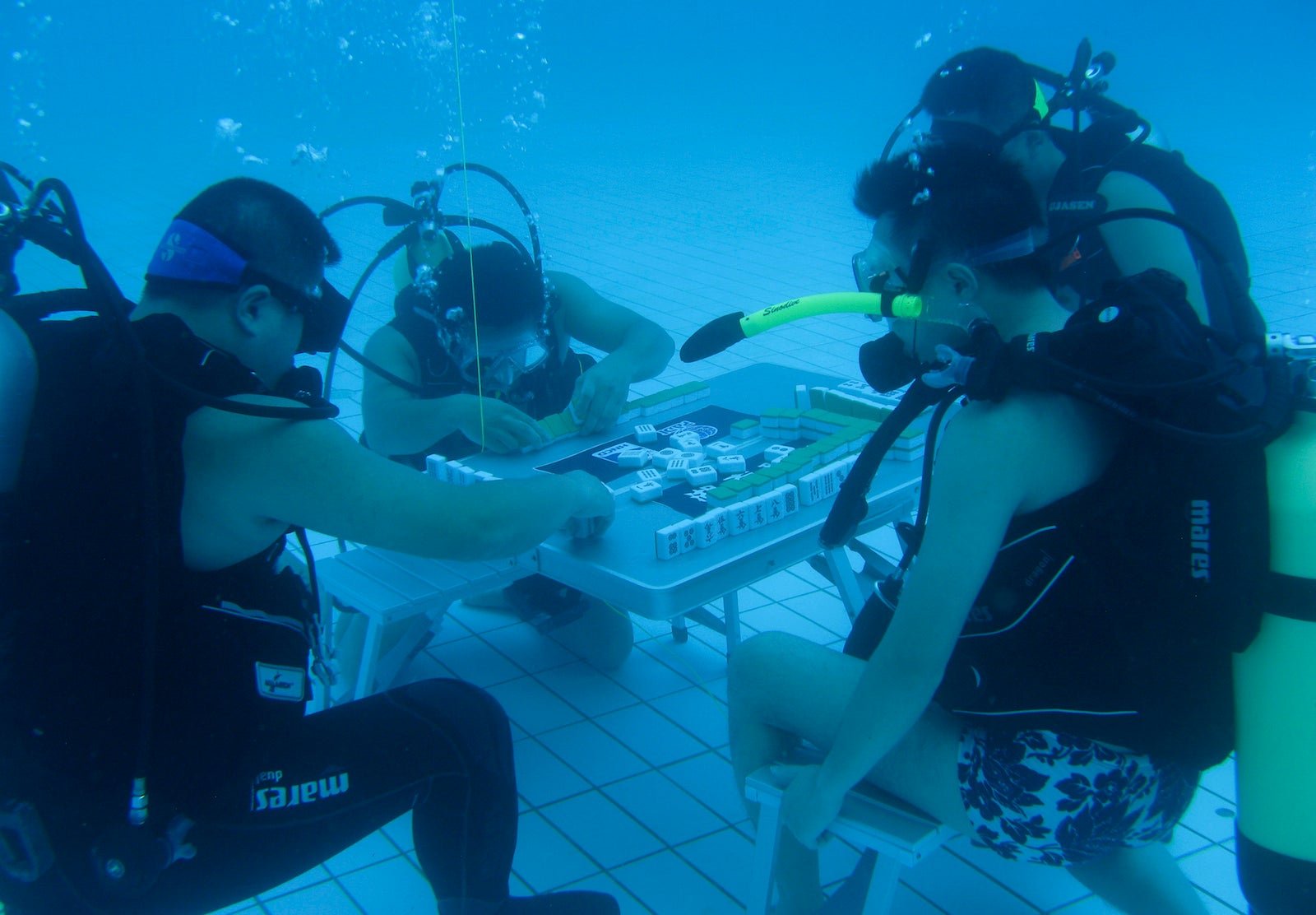

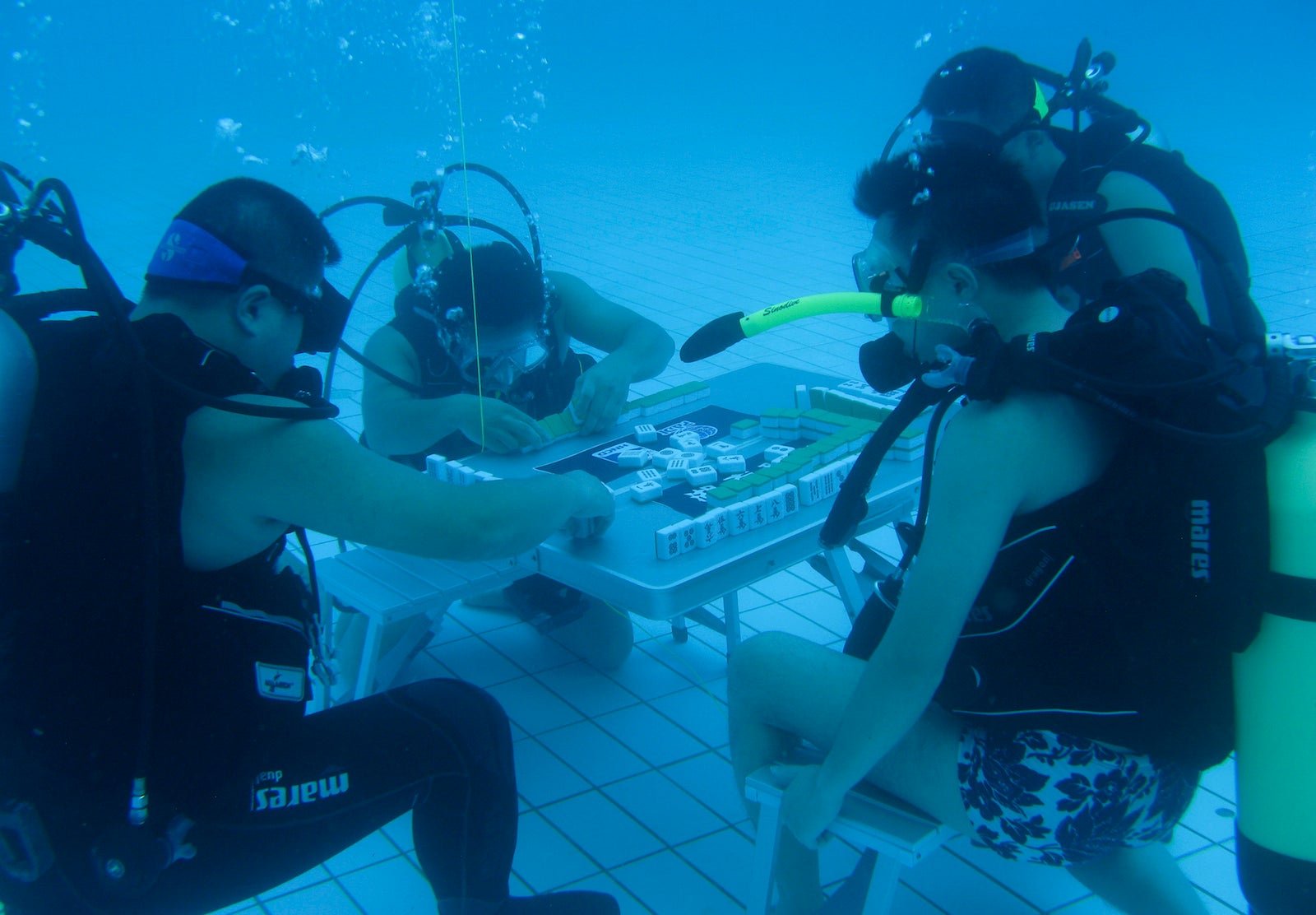

People are asking, “what is the ‘circuit breaker mechanism’?” It’s like this: You bring 3,000 yuan to a mahjong game and lose it all in just a half an hour. You pause the game for 15 minutes and run to the ATM to take out another 5,000 yuan, then you go back for more, and get wiped out again. Finally somebody says, “Your luck is terrible today, let’s call it a day.”

A circuit breaker is used to halt trading when a market falls dramatically—first temporarily, then for the day. At the New York Stock Exchange, trading stops if the market falls 5%, and again if it drops 13%, but ends for the day at 20%. In China, it only takes a 5% drop for a temporary stop, and a 7% fall to halt trading for the day.

Christopher Balding, an economics professor at Peking University HSBC Business School, told Quartz that the Chinese market is very volatile and a 5% drop can occur on an average trading day. Balding says the circuit breaker hasn’t accomplished much besides spooking Chinese investors into taking their money out of the market.

Chinese regulators agree—earlier today (Jan. 7), the China Securities Regulatory Commission announced it will ditch the precautionary measure.