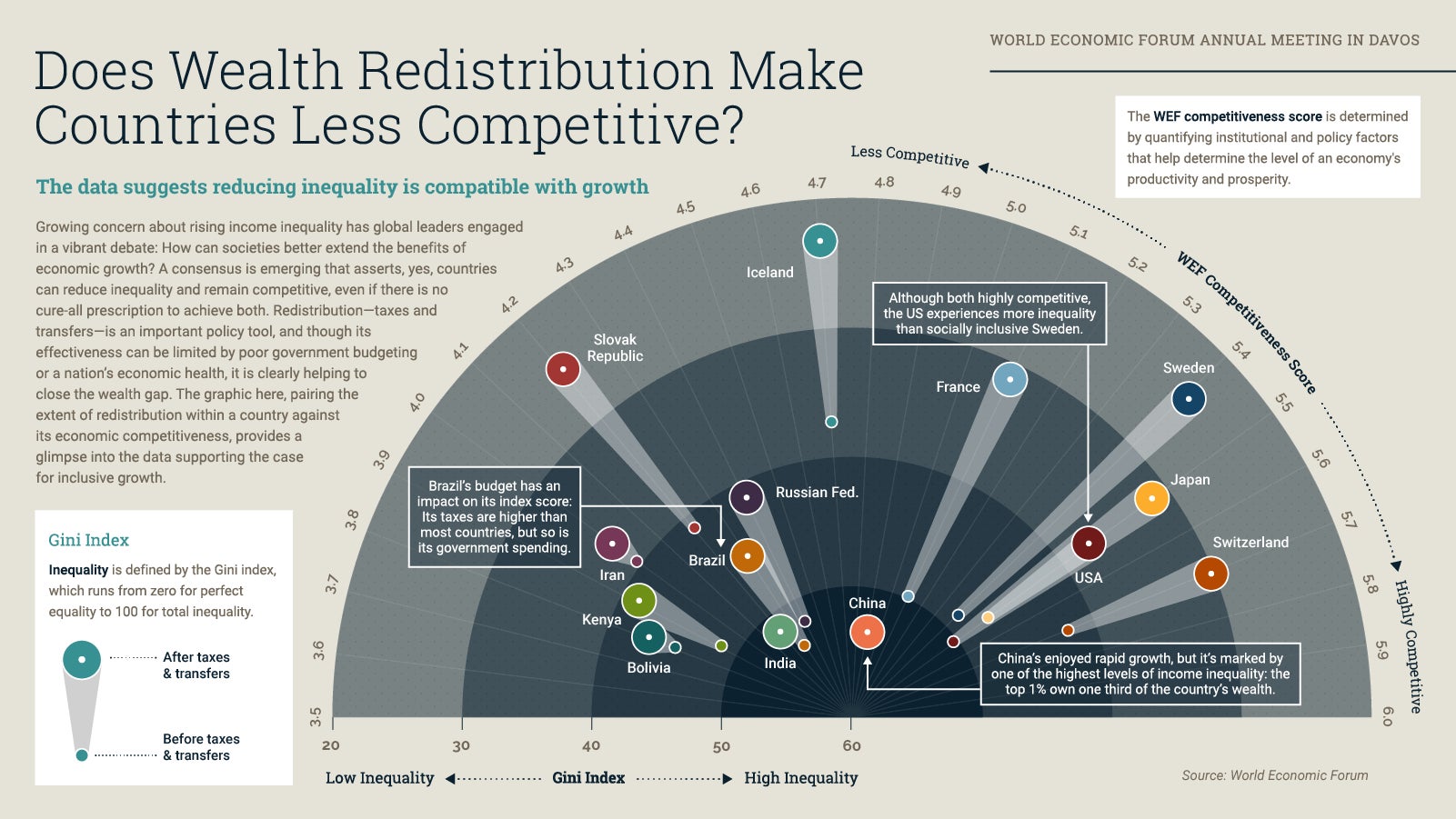

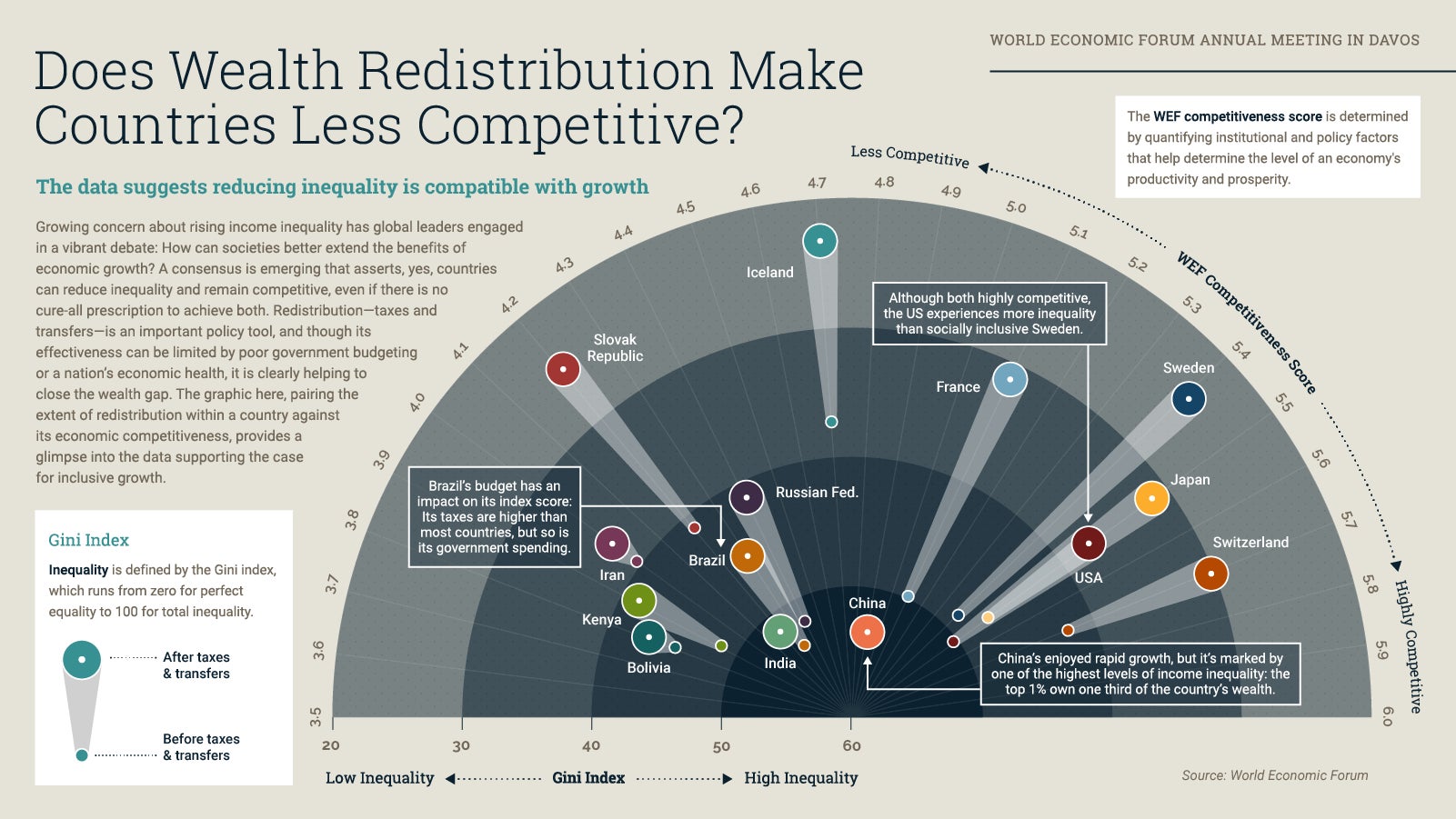

Infographic: Mapping growth vs. wealth distribution

(See the infographic enlarged.)

(See the infographic enlarged.)

It’s another snowy January in Davos, where this year the World Economic Forum welcomes its usual coterie of world leaders—and the Fourth Industrial Revolution as well. This year’s theme hits the sweeping Davos sweet spot. Far from just a business concern, the #4IR aims to frame a global digital shift ranging from politics to the arts (though, like everything at the WEF, that framing is up for voluble debate).

As Bloomberg illustrates, this is the first WEF in years where surveyed attendees did not cite an economic risk among their top five global threats. Despite this, the day saw significant unrest in global markets, supporting John Cassidy’s worries about traditional Davos optimism. But of course, the panels must go on, and here’s our rundown.

DIGITAL DIVVY The “Transformation of Tomorrow” panel grappled with key issues of digital change as introduced in the above WEF video. “We are in a period of rapid change in technology,” said Facebook COO Sheryl Sandberg, yet she emphasized that four billion people are still deprived of data connectivity worldwide—depriving humanity of their potential in turn. Microsoft CEO Satya Nadella concurred, urging leaders to consider distributing the digital dividend to decrease the digital divide. Rwandan President Paul Kagame acknowledged the high failure rate of startups and other 4IR ventures, especially in emerging markets, and said that states must ensure proper support in order to encourage growth. Sandberg pointed out that such leadership must incorporate women, who still face severe educational and management disadvantages. “Men still run the world,” she said. “I’m not sure it’s going that well.”

WORKING IT The “A World Without Work?” panel examined the threat of “narrow artificial intelligence” to assembly line automation and other jobs, while also commenting upon “general artificial intelligence,” which is still in development but much more human-like and potentially dominant. Artificial intelligence researcher Dileep George envisioned a possible leisure society, while economist Christopher Pissarides worried about the fate of the middle class and the need for a universal minimum income. MIT professor Erik Brynjolfsson and LIXIL Group CEO Yoshiaki Fujimori advocated for directing education and compensation toward what machines don’t yet do well—creativity and interpersonal skills.

Panelists from the “State of Artificial Intelligence” discussion were of the same mind. Carnegie Mellon Dean of Computer Science Andrew Moore celebrated the rising access to massive machine learning among researchers outside of big companies, the removal of “boring” white collar work by artificial intelligence, and the promise of computer-based negotiation and even deception (as in the first AI poker game). Computer scientist Stuart Russell built on Sheryl Sandberg’s earlier point about universal access to data, observing that advanced artificial intelligence personal assistants would have a greater impact among the masses than the elite. He also said that despite the accomplishments of companies like Deep Mind, the real value of artificial intelligence right now is in areas like augmented teaching, medical access, transport safety, and robotics (including artificial limbs, but not superhuman minds).

THE MATH FOR GREEN GROWTH It was all warmth for green investment in the “New Climate For Doing Business” panel. Chairman of DSM Feike Sijbesma, was emphatic: “You must really be blind if you don’t see that we are at a tipping point.” Walmart CEO Doug McMillon argued that going green isn’t just about reputation anymore; as the retail giant has figured out how to lower costs and become more efficient, it’s clearer than ever that the math for green investment works. Meanwhile, Christiana Figueres from the UN warned against complacency after the gains of the Paris climate talks. “Now the real work starts,” she said. A quick straw poll unanimously favored a reasonable carbon price for which managers must account. “If you’re assuming it’s zero, you’re misinvesting,” HSBC Group Chief Executive Stuart Gulliver said.

VEEP US Vice President Joe Biden made his presence felt with a moving call for a cancer cure “moon shot” in the wake of his son Beau’s death due to brain cancer last year. He also encouraged business leaders to put pressure on countries with repressive LGBT policies whenever possible. Other news amidst the Davos views (both exterior and expounded) came from a $5 million investment in a new Merck Ebola vaccine and a pledged joint appeal to reunite Cyprus that is set for Thursday’s schedule.

REMODELING The “Digital Transformation of Industries” began with a strong focus on business innovation before keying in on the importance of people to the Fourth Industrial Revolution. HPE CEO Meg Whitman said that the future belongs to the fast, admitting that HP could have made even quicker moves when she started there. “You can always go faster than you think you can,” she advised, while observing that many problems stem from rigid IT environments built up over the last decade that now need to adapt with evolving strategy. Salesforce founder Marc Benioff echoed the need for speed and agility. “The most dangerous place to make a decision is in the office,” he said, though the panel agreed that such changes are worthless if organizational culture and customer trust lag behind. On the latter, the divide between elite and mass populations on confidence in institutions came up, with the new Edelman Trust Barometer outlining a clear challenge.

And as the future arrives, we depart after a busy first day. We’ll see you back out in the snow tomorrow.

This article was produced on behalf of Bank of America by the Quartz marketing team and not by the Quartz editorial staff.