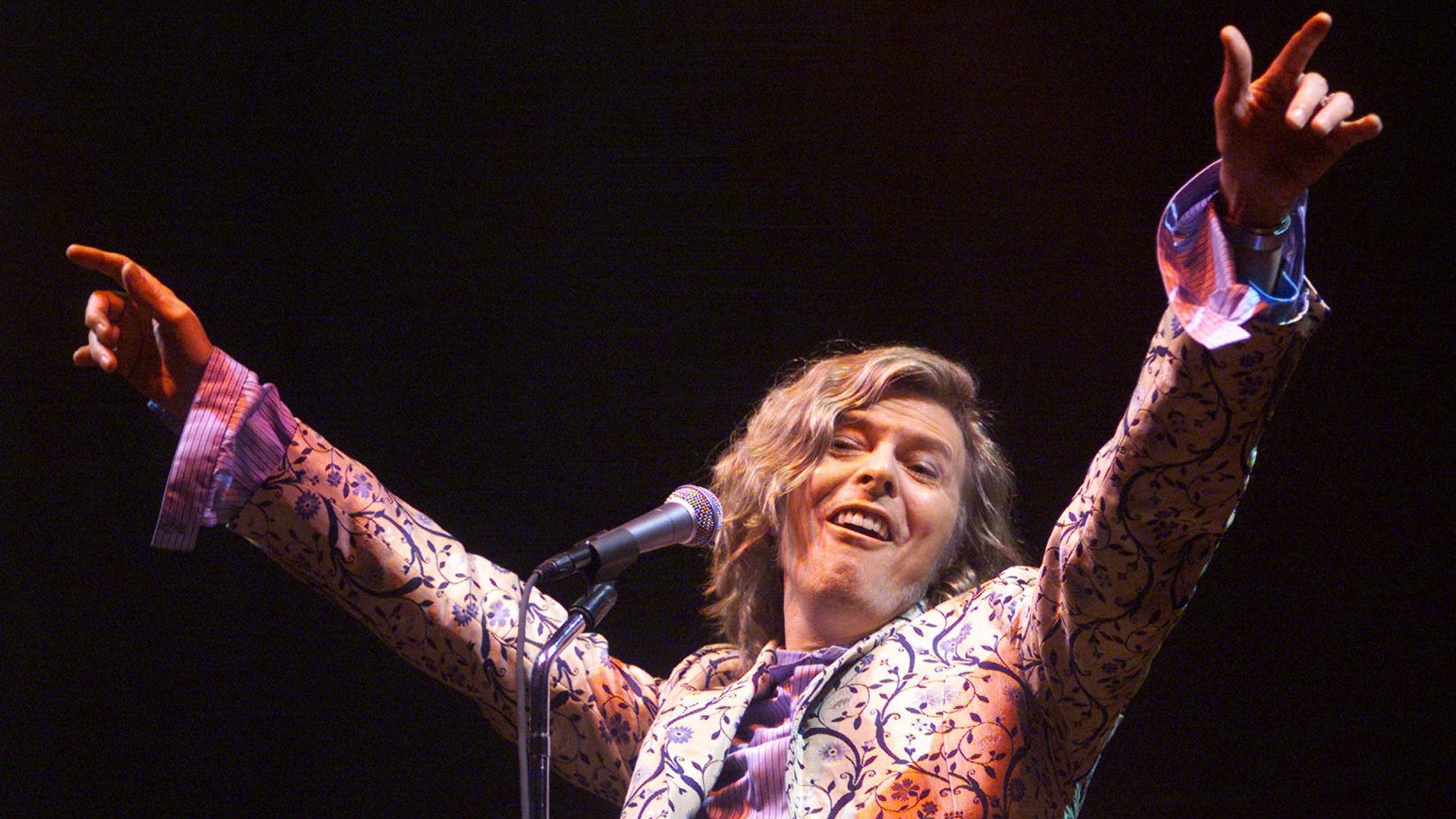

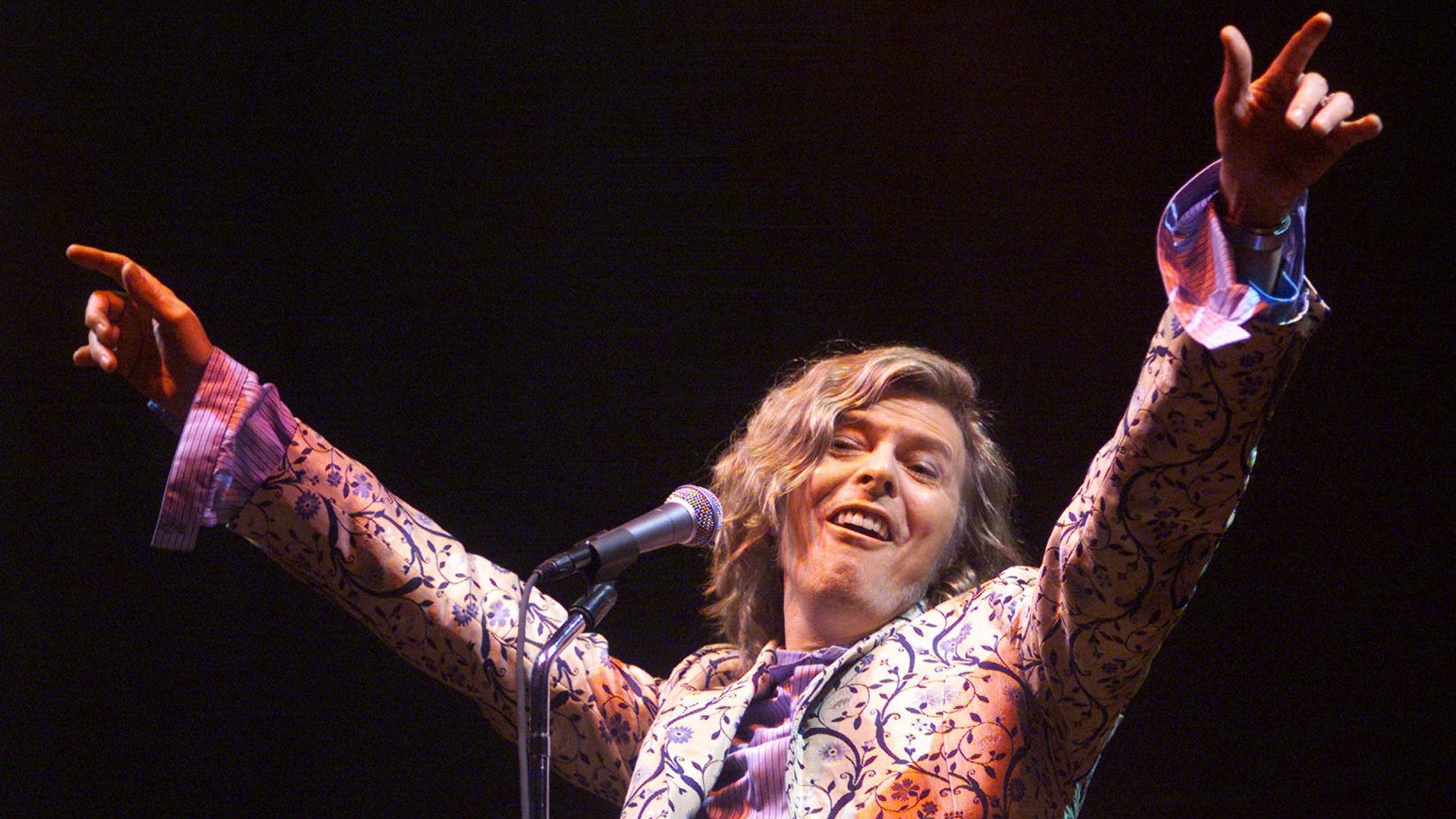

David Bowie was as innovative a financier as he was a musician

Tributes from across the world have poured in for singer David Bowie, who died after an 18-month battle with cancer. While there’s little doubt of Bowie’s impact on music, fashion, and the entertainment industry in general, the artistic chameleon led a quieter, yet just as important, revolution in—of all things—financial markets.

Tributes from across the world have poured in for singer David Bowie, who died after an 18-month battle with cancer. While there’s little doubt of Bowie’s impact on music, fashion, and the entertainment industry in general, the artistic chameleon led a quieter, yet just as important, revolution in—of all things—financial markets.

Bowie made history when he issued the first so-called celebrity bond in 1997. The master of reinvention raised $55 million of “Bowie bonds” backed by future royalties from his back catalog. Prudential Insurance bought the entire issue, which paid an interest rate of 7.9% for a term of 10 years. (The equivalent US treasury bond yielded 6.4% at the time.) The benefit to Bowie was a large, upfront payment instead of a trickle of royalties over time.

Bowie’s bonds boasted a fairly high investment-grade rating when first issued. But as internet piracy eroded recorded music revenues, the bonds’ rating fell to just above “junk” status as they approached maturity. In a 2002 New York Times interview (paywall), Bowie said that he believed copyright would cease to exist in 10 years, and as a result “authorship and intellectual property is in for such a bashing.” This, in part, explained his desire to cash in on his catalog via the bonds:

So it’s like, just take advantage of these last few years because none of this is ever going to happen again. You’d better be prepared for doing a lot of touring because that’s really the only unique situation that’s going to be left. It’s terribly exciting. But on the other hand it doesn’t matter if you think it’s exciting or not; it’s what’s going to happen.

Other artists soon followed suit, with James Brown, Marvin Gaye’s estate, and others issuing royalty-backed bonds with the help of Bowie’s advisor, David Pullman. Asset-backed securities weren’t new when Bowie issued his bond, but they had never been used for that sort of purpose before. These days, there are few things that clever bankers can’t package into securities—which we learned to our cost during the global financial crisis. In the Bowie vein, professional athletes have recently got in on the act, offering a share of their future earnings in exchange for upfront payments.

Bowie would go on to dabble in other innovative ventures in the early stages of their development, from setting up his own internet service provider (Bowienet) in 1998 to opening an online bank (BowieBanc) in 2000. As with so many other things, he did it before it was cool.