2016 macroeconomic outlook

Goldman Sachs economists and strategists from around the globe have been publishing their research and sharing their expectations for 2016. Below is a series of short videos and a chart highlighting the factors that will influence economic growth around the world in the months and years to come.

Goldman Sachs economists and strategists from around the globe have been publishing their research and sharing their expectations for 2016. Below is a series of short videos and a chart highlighting the factors that will influence economic growth around the world in the months and years to come.

Global economy: A stealthy path to full employment

In this video, Jan Hatzius, chief economist at Goldman Sachs, shares his expectations for a small uptick in global growth in 2016 and further improvements in developed labor markets.

“Our expectation for 2016 is ongoing cyclical recovery with unspectacular headline GDP growth rates, but further improvement in the labor markets.” – Jan Hatzius

US: Return to full employment as normalization begins

Jan Hatzius projects improvement in the US labor and housing markets, additional rate hikes and a small decline in overall growth due to the appreciation of the dollar.

“We’ll likely complete the labor market recovery, get back to full employment and get the normalization process for monetary policy underway.” – Jan Hatzius

Emerging markets: Finding a footing amid headwinds

Kamakshya Trivedi, chief Emerging Markets macro strategist in Goldman Sachs Research, sees a modest pickup in emerging markets growth in 2016 after five straight years of sequential declines, as expansion in countries such as India helps offset headwinds from “lower for longer” commodities, US monetary tightening and Chinese deceleration.

“I think 2016 is probably going to be the year where some emerging markets that have made their adjustments start to find their feet.” – Kamakshya Trivedi

Europe: Resilient growth, easy policy

Goldman Sachs Research’s chief European economist Huw Pill expects Euro-area growth to remain around 1.5 percent in 2016, supported by low oil prices, weaker exchange rates, better domestic financial conditions and fiscal expansion.

“We are seeing fiscal expansion in Europe, with a combination of government spending rising and taxes falling.” – Huw Pill

Asia: Deceleration in China, growth opportunities in India

Andrew Tilton, chief Asia Pacific economist in Goldman Sachs Research, sees two dominant challenges for Asia in 2016: China’s deceleration and US monetary policy normalization. Still, Asia will remain home to some of the world’s most promising growth markets, including India, Indonesia and the Philippines.

“We think India has the highest potential growth in the region and can ultimately reach growth close to 8 percent a couple of years out.” – Andrew Tilton

Global growth in 2016

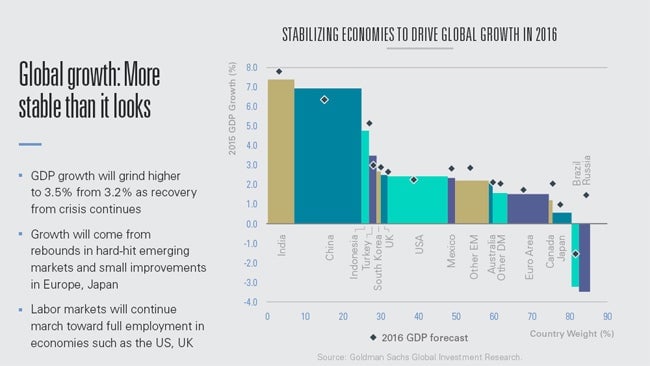

The expectation for 2016 is steady global growth, divergent monetary policy in developed markets and higher-than-expected inflation. The chart below highlights some of the key market themes our economists say will define global growth in the year ahead.

Learn more

about the macroeconomic issues and trends that are shaping markets around the world.

This article was written by Goldman Sachs and not by the Quartz editorial staff.