Why it’s a good thing when investors think more banks will fail

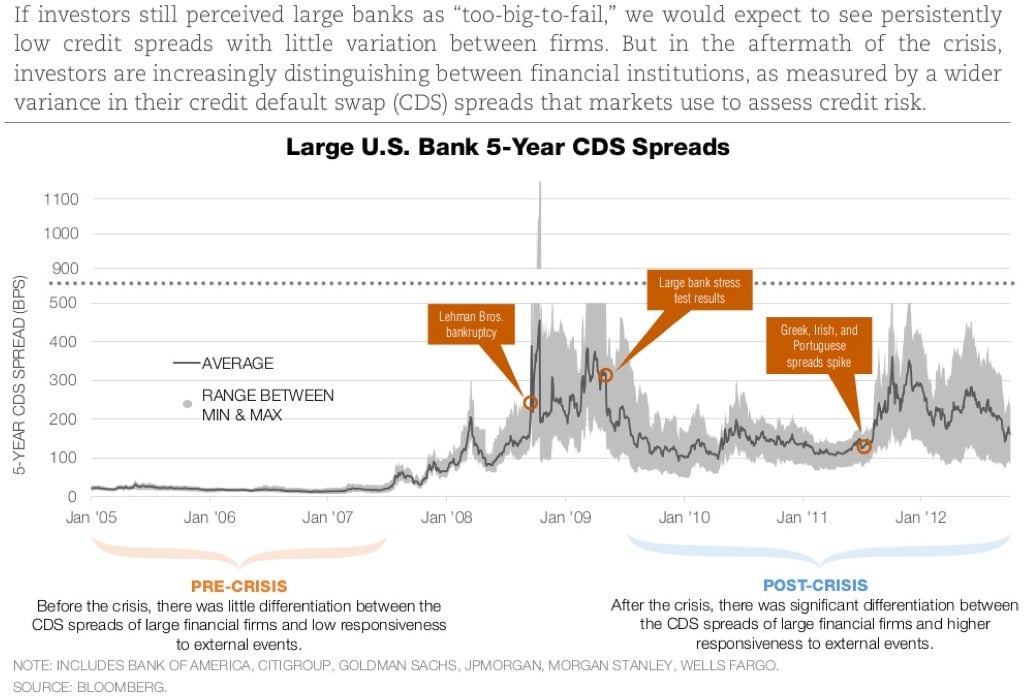

Legislators in Washington have renewed their interest in limiting the size of banks they deem “Too Big To Fail”–so economically important they receive special protection from the government—so it’s worth looking at this December chart created by the US Treasury Department.

Legislators in Washington have renewed their interest in limiting the size of banks they deem “Too Big To Fail”–so economically important they receive special protection from the government—so it’s worth looking at this December chart created by the US Treasury Department.

It makes the case that “Too Big To Fail” isn’t such a problem anymore—markets now believe that some banks are more likely to fail than others and are betting accordingly by purchasing credit default swaps (CDS) that pay out in the event a bank can no longer pay its debts. For instance, if it becomes insolvent and the government shuts it down.

Fed Chairman Ben Bernanke mentioned this change in his testimony before Congress last week as evidence that “Too Big to Fail” is over, and critics of plans to further restrict bank operations, especially firms on Wall Street, are making it a talking point.

But it’s a funny one at that. It’s true more variance in CDS prices among financial firms is market evidence that some firms’ debt is more risky than others—i.e., that banks can fail—but it is also means that the market thinks banks are more likely to fail, which isn’t exactly great news, even if it suggests a healthier market overall. The reasons for that phenomenon are fairly clear, however: A baseline of pessimism about the sector by some investors after the crisis, continuing challenges of valuing banks with opaque balance sheets, and the challenges of the European crisis.

That’s the paradox of proving “Too Big To Fail” wrong—for government officials, or anyone else, to do it convincingly, a bank would have to fail.