Who’s going to buy all those houses and drive the American economy?

Immigrants, that’s who.

Immigrants, that’s who.

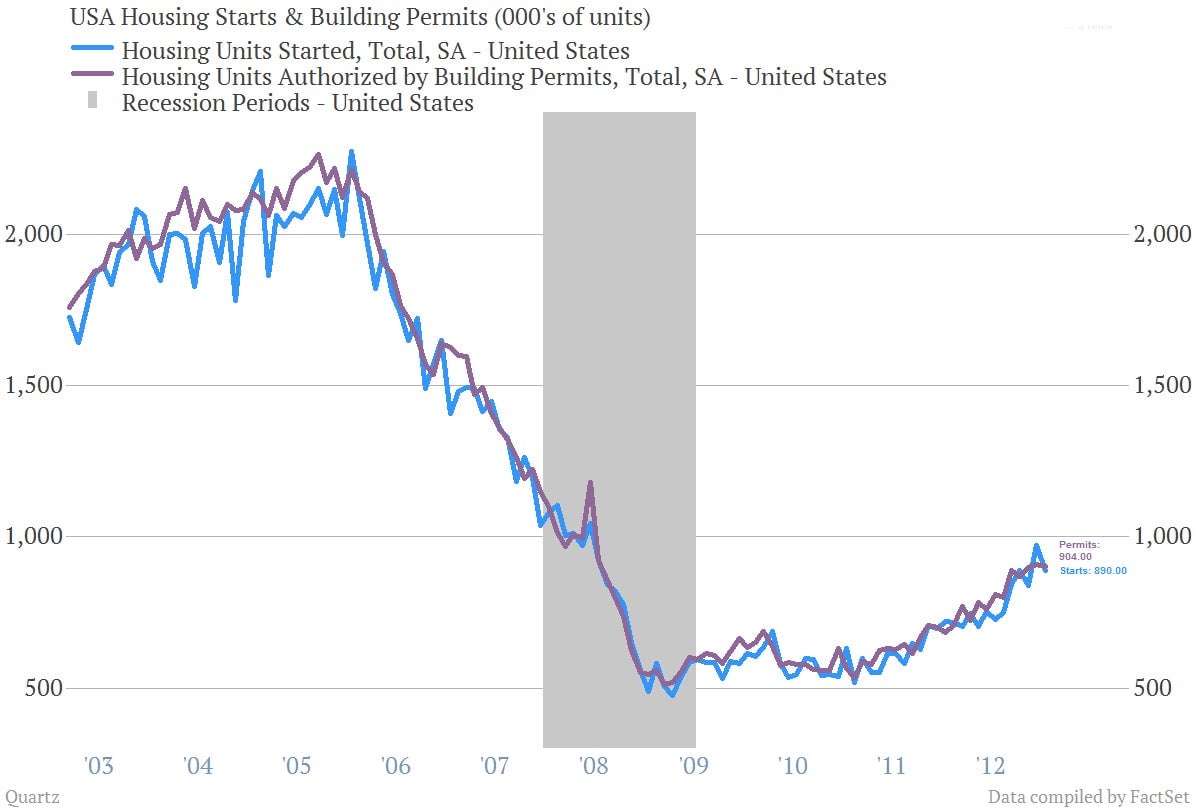

One of the most important economic stories right now is the rebound in the US housing industry from its recession-era lows, which is keeping the economy growing and providing jobs as the government continues to pull back its fiscal support for growth and consumers trim their spending.

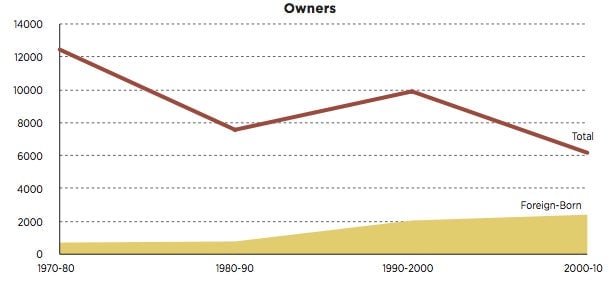

The story behind the story, according to new research from the University of Southern California (and funded by the Mortgage Bankers Association), is that the share of immigrants buying homes has increased significantly, and will continue to do so in the future:

The study reports that between 2010 and 2020, immigrants will represent 35.7% of the growth in homeowners, rising to 2.8 million from 2.4 million in the previous decade. That compares to 5.1 million native-born Americans who are expected to buy homes over the 2010-2020 period.

But the geographic effects are important, too: Foreign-born ownership will make up the majority of growth in California, New York, New Jersey, Massachusetts Connecticut and Michigan.

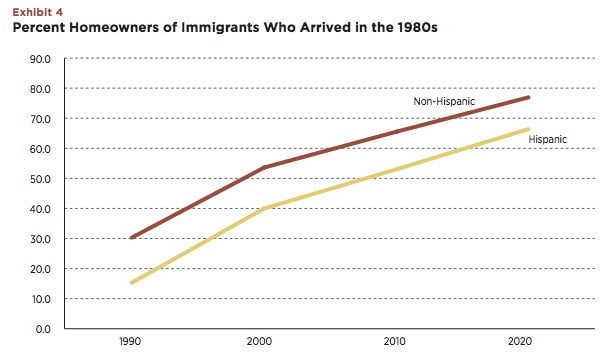

Much of the growth in home buying in recent years has come from the cohort of immigrants that entered the US in the 1980s and worked their way upward to homeownership:

This is an important argument for immigration reform, which would make it easier for undocumented aliens already in the US to buy houses—it’s hard to get a mortgage without legal status, after all—and would allow more highly-skilled workers and entrepreneurs to enter the country. Consider it an un-tapped source of demand for the economy. But the same argument applies to a lot of other demographic problems underlying the economic challenges facing a wealthy country with an aging population like the United States: Bringing in new people to expand the workforce has knock-on effects that would bolster a variety of sectors, not just housing, and help improve the fiscal picture, too.