More than $110 billion left China last month—and that was an improvement

As much as $113 billion left China in January (paywall), according to the US-based Institute for International Finance, an industry group that represents financial institutions globally.

As much as $113 billion left China in January (paywall), according to the US-based Institute for International Finance, an industry group that represents financial institutions globally.

If that figure is correct—China’s statistical data is notoriously difficult to pin down—it would mean a welcome decline from December’s $157.8 billion outflow. But it still represents more money exiting the country in January than in 10 of the 12 months last year.

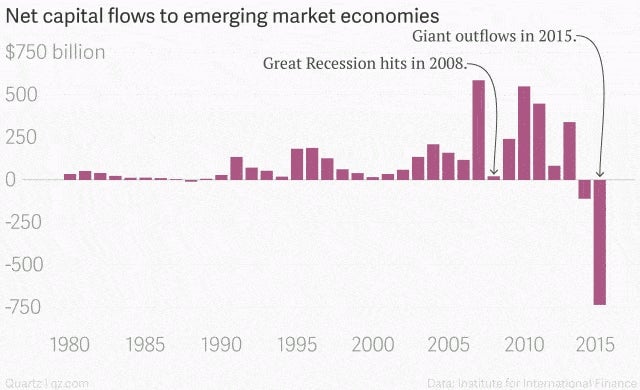

Some of that outflow is part of a wider trend of investors taking money out of emerging markets. Last year, a record exodus of $735 billion flowed out of emerging economies; China’s own outflows accounted for $637 billion of that figure (paywall).

While that sounds terrible, not all of it necessarily points to an emergency just yet. Some of the outflow is from Chinese companies anticipating further yuan weakening and rushing to pay down dollar-denominated loans—before the dollar becomes even more expensive against the currency.

Right now, the majority of the outflow seems to be the central bank spending its record foreign currency reserves (now at about $3.2 trillion) to prop up the yuan’s value. That’s currently costing it around $100 billion per month, according to official figures, and that can’t continue forever. The real emergency comes when the central bank can no longer spend such sums on its currency, and it has to let the yuan fall.