Yesterday the $639 trillion market that brought down the global economy got a little safer

Harken back to the days of the 2008 financial crisis, when insurance giant AIG found itself without the cash to pay up when the protection it sold for investments in the housing market was called in. The US government’s $85 billion bailout of the company marked a major escalation in the crisis and the messy financial regulation debate that followed.

Harken back to the days of the 2008 financial crisis, when insurance giant AIG found itself without the cash to pay up when the protection it sold for investments in the housing market was called in. The US government’s $85 billion bailout of the company marked a major escalation in the crisis and the messy financial regulation debate that followed.

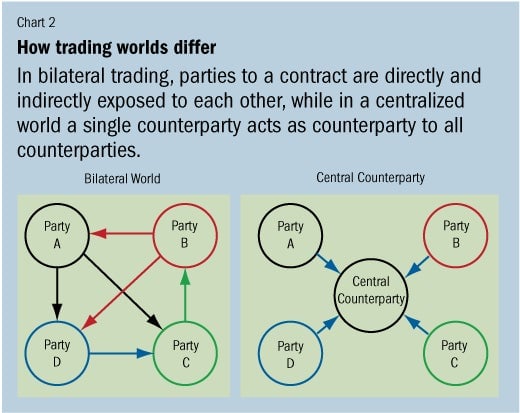

Yesterday, a new rule came into effect that require derivatives like AIG’s to be sold through independent clearinghouses. The rule, enacted by the 2010 Dodd-Frank financial reform bill, means that organizations like ICE and CME will hold collateral for investors who enter financial agreements based on the value of many kinds of assets, from bonds to currencies.

Functionally, it means that banks will need to put up more capital to backstop these swaps.

Swaps traders are expected to put up some money, a margin, based on changes in the risk of the underlying asset. Previously, when trading derivatives over-the-counter, things got loosey-goosey on the margin front: Derivatives are under-collateralized by perhaps $2 trillion (pdf). During the crisis, as mortgage bond prices dropped, the owners of already under-capitalized derivatives had increasing amounts of capital called in, leading to insolvency—and a film titled “Margin Call.” Perhaps the most important part of the central clearinghouse, which shares risk among its participants, is that it will create incentives for full capitalization and a better perspective for risk management.

Banks are already expecting to pay trillions of dollars in extra collateral into these clearinghouses, reducing profits for institutions that are dependent on the business.

But, you might ask, hasn’t the government just centralized risk in a new—dare we say, Too Big To Fail—institution?

The short answer is yes, but the clearing process could be better equipped to manage that risk (or at least make it more expensive for banks) while giving regulators a better view of the market. The long answer, according to economists, is that central clearing is only part of the picture. Further safety would require including more kinds of swaps in the clearing requirement, spinning off banks’ derivatives divisions into separately capitalized firms, or putting a tax on derivatives trading.