Why you should take Italy’s and Spain’s horrifying public debt figures with a grain of salt

This post has been corrected.

This post has been corrected.

The debt situation in Spain and Italy looks to be getting grimmer and grimmer. The Bank of Italy announced that Italy’s public debt now stands at €2.02 trillion ($2.65 trillion) (pdf). That’s 127% of its GDP, up from 120.8% in 2011. And as Bloomberg points out, it’s the highest since Mussolini took power. With its debt now sitting at a mind-blowing €884.4 billion ($1.14 trillion), Spain’s debt to GDP ratio was 84.1% of its GDP at the end of 2012, a 14.8% gain on 2011. The government had expected the number to come in at 79.8%.

Still, the year-over-year increase in public debt is falling in both countries, as austerity measures kick in. Then again, austerity measures have triggered recessions in both countries, which means less tax revenue from companies and businesses, since they are earning less money. That means that, although economic reforms are needed to make Spain and Italy more competitive, those same policies are actually putting governments on shakier financial footing in the short term.

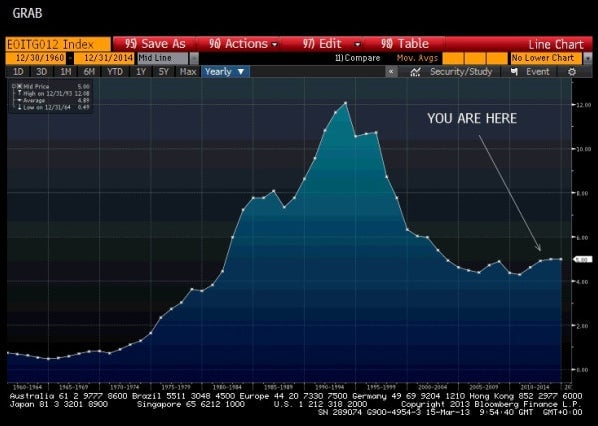

Even so, in Italy’s case, it might be wise to calm your daily freakout about the size of its public debt. (And while, data on Spain is not available, its situation is similar.) Crucial to assessing Italy’s financial footing is the amount of Italian GDP that’s devoted to servicing interest on the country’s debt. As this chart from @Pawelmorski shows, Italy’s not paying an outrageous sum to do that by historical standards—payments on its massive debt burden comprise about 5% of GDP. Should yields on Italian bonds rise again, one would expect that these payments would reach a size that could cripple the Italian government. But as you can see, that’s not currently the case:

Correction at 11:07 EST: An earlier version of this post said that Italy’s public debt was €2.02 billion, rather than €2.02 trillion.