How to make money from Brexit: get ahead of the freaked-out foreigners

The analysts at Liberum, a London-based investment bank, think that British voters are very unlikely to choose to leave the EU in the referendum to be held on June 23. They put the odds of a British exit—aka “Brexit”—at just 25%.

The analysts at Liberum, a London-based investment bank, think that British voters are very unlikely to choose to leave the EU in the referendum to be held on June 23. They put the odds of a British exit—aka “Brexit”—at just 25%.

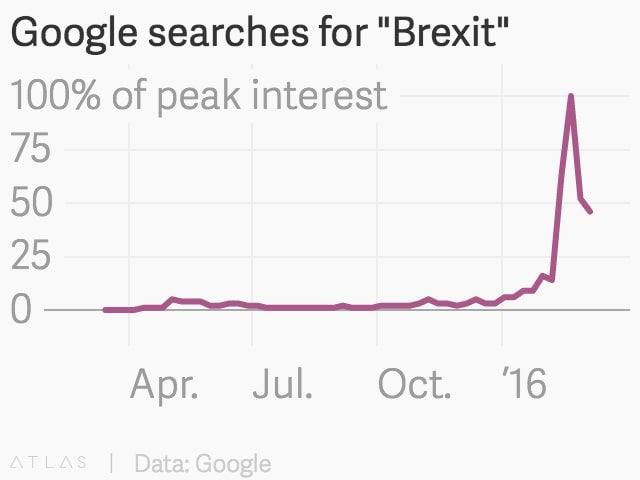

Bookies, meanwhile, have long been offering bets on Brexit with a probability of success of only around 30%. Even so, the referendum—a campaign pledge made by prime minister David Cameron before he was re-elected in May last year—has recently captured global attention.

In the markets, this has manifest itself primarily in the pound. Sterling dropped sharply against the dollar last month after Cameron set the date of the vote and prominent figures like justice minister Michael Gove and mayor of London Boris Johnson lined up in favor of Brexit, defying Cameron’s wishes.

At this point, any self-respecting stock picker would ask himself: how do I make money from this? Sebastian Jory of Liberum has an idea.

Based on his experience with clients, “non-UK investors seem more interested in the referendum than UK investors,” he tells Quartz. Americans, in particular, appear preoccupied with the possibility of Brexit—the recent drop in the pound presents problems for hedging their currency exposure if it falls further.

That’s where one of his Brexit trade ideas comes from. As he put it in a recent research note: “Get ahead of nervous US holders.”

British stocks don’t seem to reflect much of a Brexit discount yet—not as much as currency markets, anyway. But as the vote approaches, if there are polls that show the odds of Brexit rising it could trigger “indiscriminate” selling of UK stocks by anxious US investors looking to cut their exposure and “return when things seems a bit safer,” Jory says.

More than half of the shareholders in several large, London-listed stocks are based in the US, including luxury group Burberry, engine maker Rolls-Royce, and pharma firm Shire. These and other companies with lots of Americans on their share registers could come under pressure if Brexit seems a real possibility.

Given how tight recent polls have been, there will probably be many more twists and turns ahead. And since there is a “big consensus” among local fund managers that Brexit is unlikely, Jory notes, some of them will be looking to snap up stocks on the cheap from sellers spooked by the volatility.