Korean companies are missing expectations because everyone’s expecting too much

South Korean companies have had a rough start to the year. The Korean stock market has been see-sawing over worries of a resurgent euro zone crisis, a strengthening won, and scary talk from North Korea. In January, foreign investors sold 1.9 trillion won (paywall), or $1.7 billion, in Korean stocks while buying $7 billion in Japanese equities and another $6.5 billion in shares of other emerging Asian markets.

South Korean companies have had a rough start to the year. The Korean stock market has been see-sawing over worries of a resurgent euro zone crisis, a strengthening won, and scary talk from North Korea. In January, foreign investors sold 1.9 trillion won (paywall), or $1.7 billion, in Korean stocks while buying $7 billion in Japanese equities and another $6.5 billion in shares of other emerging Asian markets.

Moreover, 75% of companies who have now reported earnings for 2012 missed consensus earnings estimates by more than 5%, HSBC said in a note on March 15. That’s the most of any other East Asian country the bank surveyed–57% of Taiwan companies and 48% of Thai equities missed estimates. Korean steelmaker POSCO, for example, reported an operating profit 111 billion won lower than what analysts expected for its last quarter of 2012.

But that’s not so much because the companies are doing especially badly; it’s because the analysts are expecting them to do especially well. ”If you look at the historical trend of analyst recommendations across the region, it is evident that analysts covering Korean companies are usually more bullish,” says Devendra Joshi, an equity strategist at HSBC. Joshi says this pattern is known and is generally priced into the market.

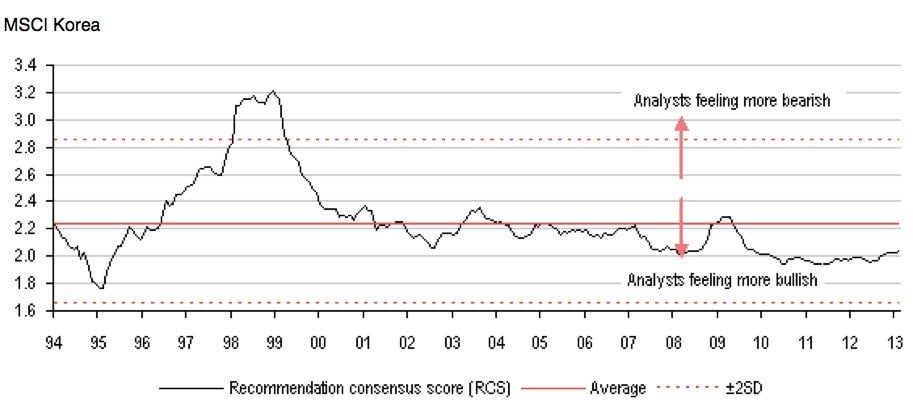

Still, it seems to be even stronger than usual right now. The two charts below of show how recommendations on Korean companies compare to those of other Asian companies (excluding Japan). The index, the recommendation consensus score, is the average score of all recommendations for all companies of a particular index where 1 represents the most bullish estimates, and 5 the most bearish. (Data is from Reuters, the MSCI, and HSBC.) As the second chart shows, Korea analysts are more bullish than average.

Why analysts tend to be bullish on Korean equities is hard to pinpoint, Joshi says. Investors may be expecting high growth of an economy that is Asia’s fourth largest but still considered an emerging “tiger.” Moreover, the Korean economy depends on exports to China, whose demand has grown over the past decade. Though Chinese demand tapered off in 2012, Joshi expects it to pick up again this year. On Goldman Sachs’ “growth environment score”, South Korea last year had one of the highest ranks in the world (pdf, slide 14-15).

For now, expectations for Korean equities have been reset lower, so that the consensus estimate for earnings growth has dipped to 15.5% for 2013 compared with 45% at one point in 2012—a more realistic figure, according to Joshi. “But the figure might still be on the higher side,” he says.