Finally, a textbook that treats finance as an art form

Here it is, finance wonks: The textbook of your dreams.

Here it is, finance wonks: The textbook of your dreams.

High Yield, Future Tense: Cracking the Code of Speculative Debt is “the most beautiful finance book ever conceived,” according to Karen Sterling, the book’s publisher and former president and CEO of the New York Society of Security Analysts (NYSSA). The lavish book was a commemorative project for NYSSA’s 25th Annual High Yield Bond conference last September, but has a design worthy of coffee-table prominence for years to come.

The book’s finishing touches include mirrored silver edges, full bleed “pin-up” spreads, decorative end papers, ribbon markers, and embossed letters on the hardbound cover. Co-edited by Sterling and junk bonds guru Martin Fridson, it packs insights from an international roster of distinguished analysts, who all contributed to the book on a pro-bono basis.

“I’ve spent two-thirds of my life in schools and research institutions and I’ve read many textbooks. No matter how beautiful the ideas, aesthetic beauty was never part of the equation and I couldn’t see why that had to be,” says Sterling, a former oncology researcher who turned her skills to finance.

Pink, purple and orange: The color story

The book’s designer is Pentagram partner Eddie Opara. He tells Quartz that High Yield, Future Tense’s unusual art direction was a deliberate departure from “very bland” graphic clichés often associated with finance. “We didn’t want the design language [to follow] the underpinnings of Wall Street,” he says. True enough, there are none of the usual Greek columns, faux marble textures, classic lettering.

Green—the color regularly used to symbolize money—does not appear in the book. Opara himself has penned a book about the strategic use of color and collaborated on several occasions with the mythic color standards company Pantone, and chose instead to pull in eye-popping cyans, purples, oranges and pinks to organize sections in the 464-page volume.

“Some people may argue that [a finance book] is not the place for these types of colors, but actually it is the place,” he says. “You can either go black and white or go to the other side and skip the in-between [muted colors].”

A finance bootcamp for designers

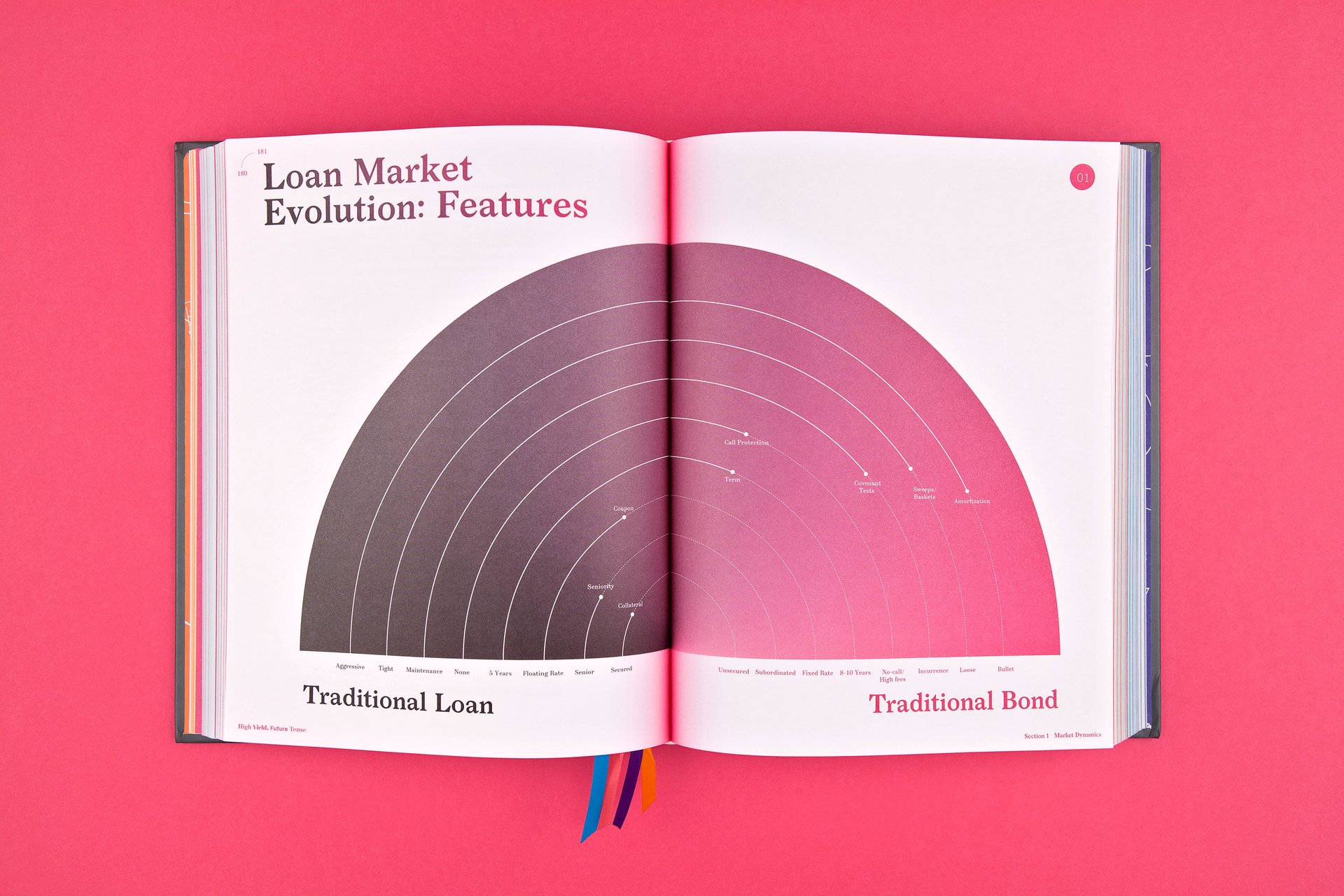

“The pink initially gave me pause,” laughs Sterling. While the hot pink eventually stayed, she was very particular about the clarity and accuracy of the book’s explanatory graphics. Through a yearlong design process, Opara’s team got a crash course in highly technical financial concepts, in order to accurately transform Excel charts into striking, full-page visualizations.

Their sketches and notations along the way have been immortalized in the pattern of the book’s end pages.

From the beginning, the designers knew that they were working with some important technical text about the multi-trillion-dollar-per-day sector. ”[The creative brief] was about understanding that there were multiple authors who don’t normally give up their content lightly,” says Opara.

Though the terms used in this volume may be abstract for lay readers, the ideas inside are important to all our futures.”In case anyone thinks this might not be critical to the man in the street: Anyone, everyone with a 401k plan is depending upon these researchers, analysts, practitioners and traders to help them reach retirement in solvency,” explains producer (and Karen’s husband) Adam Sterling.

But do serious securities analysts care for such bold design?

So far, the feedback has been universally positive, says Sterling. For Forbes, trading coach Brett Steenbarger called it “eye-opening.” It’s currently available on Amazon, though at time of writing, no reviewers on that platform had weighed in on the hefty volume. Sterling hopes that High Yield, Future Tense will be the first of many beautiful finance books for the 78-year old organization.

NYSSA was co-founded by Benjamin Graham, co-author of the seminal 1934 financial analysis text Security Analysis. Published during the Great Depression, Graham’s book brought scientific precision to the field for the first time and changed the craft of security analysis. Says Sterling, “I am dedicated to this intellectual legacy. My thought was, let’s do that again.”