These are clues that can help investors spot fraudulent pitches

Investors can overlook signs that an offer is potentially fraudulent. Emotions often override an individual’s ability to make a rational choice during an investment pitch. Review these statements illustrating potentially fraudulent pitches to improve your investing approach. A few minutes of your time can possibly save years of regret over losses.

Investors can overlook signs that an offer is potentially fraudulent. Emotions often override an individual’s ability to make a rational choice during an investment pitch. Review these statements illustrating potentially fraudulent pitches to improve your investing approach. A few minutes of your time can possibly save years of regret over losses.

“Time is running out!”

Investors should be cautious any time they are pressured or rushed into making a decision about an investment opportunity. Is the offer described as being good for only a limited time or in a limited quantity? Are you being led to believe you are part of a special group being notified? Take time to evaluate the offer and don’t allow yourself to be rushed into making any financial decision. Most legitimate offers will be there later on.

“I took you out to lunch, now give me access to your portfolio.”

When the person on the other end of the trade offers to do a “small favor” for you in return for a big favor, it may be a ploy to distract you from the business at hand. It’s best to stay focused on the opportunity, not to just look for bargains.

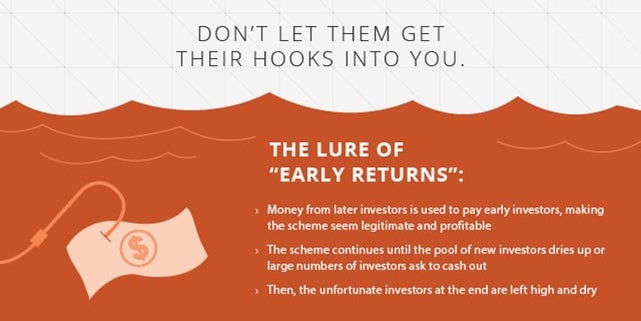

“Your returns will beat the market by 10%!”

This is when a con artist dangles the prospect of unrealistic wealth, enticing you with something you want but can’t have. Consumers should consider whether the salesperson is dangling incredible returns or guarantees. It’s important to remember that all investments carry some risk.

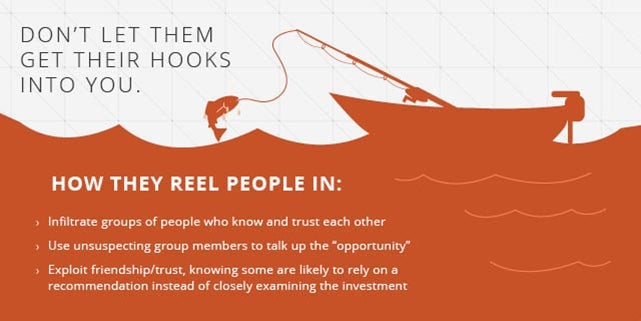

“You can trust me. I’m an active member of our Neighborhood Watch.”

This is when the con artist tries to build credibility by appearing successful, claiming affiliation with a reputable organization or touting a special credential or experience. A seller may have a corner office, framed diplomas or certificates and wear an expensive suit, but appearances really can be deceiving. Learn how to check out the seller’s actual qualifications by visiting SmartCheck.gov.

“Everyone you and I know is investing in this opportunity.”

When someone talks about a lot of people you know investing in the opportunity and that you shouldn’t be left out, it’s probably a good idea to keep your hand on your wallet and your wallet in your pocket until you learn more.

Whether it is one of these potentially fraudulent pitches, or a normal sales call, check out the financial professional you’re considering by using SmartCheck.gov, and make sure you review them on an annual basis. Checking can help save you money and make you a smarter investor.

This article was produced by the Commodity Futures Trading Commission and not by the Quartz editorial staff.