Why the British pound won’t collapse this time, like it did in the early 1990s

During the last few weeks, a wave of news and the partial loss of the UK’s triple A rating gave the impression that a major correction was coming for the British currency. (Update: Today Fitch Ratings warned that it might downgrade Britain too.) Certainly, George Soros, a master of foreign-exchange speculation and a veteran shark, took a good bite of it—but this was nothing compared to 1992. Thanks to emerging markets and the technology revolution, the world and the business of London are something extremely different from those days.

During the last few weeks, a wave of news and the partial loss of the UK’s triple A rating gave the impression that a major correction was coming for the British currency. (Update: Today Fitch Ratings warned that it might downgrade Britain too.) Certainly, George Soros, a master of foreign-exchange speculation and a veteran shark, took a good bite of it—but this was nothing compared to 1992. Thanks to emerging markets and the technology revolution, the world and the business of London are something extremely different from those days.

Dimensioning the Soros Event

In 1992, the pound was under what was called the European currency snake, a forex mechanism to prepare economies for the monetary union that gave birth to the euro. That meant that every country was compromised to keep the value of its currency between a band of fluctuation. In other words, politicians were valuing currencies indicating when governments should buy and sell their own currencies. It all depended of how much ammunition they had to stay in the band. With this in mind, was there a better place for a forex speculator?

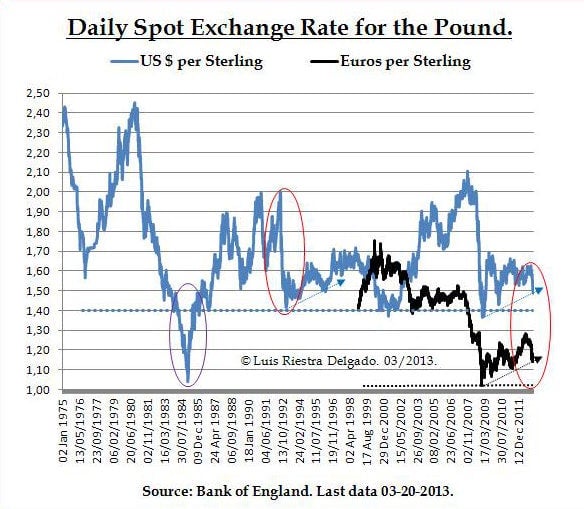

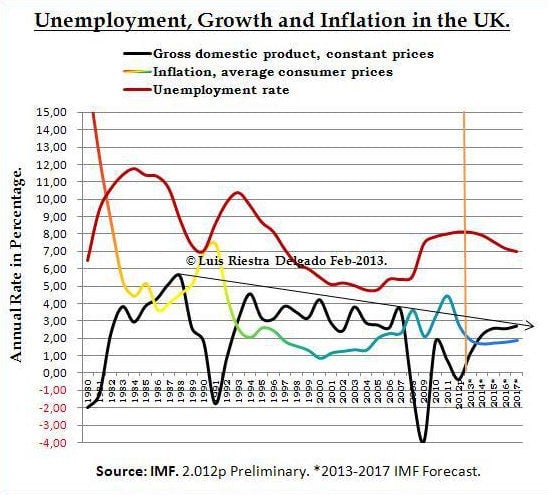

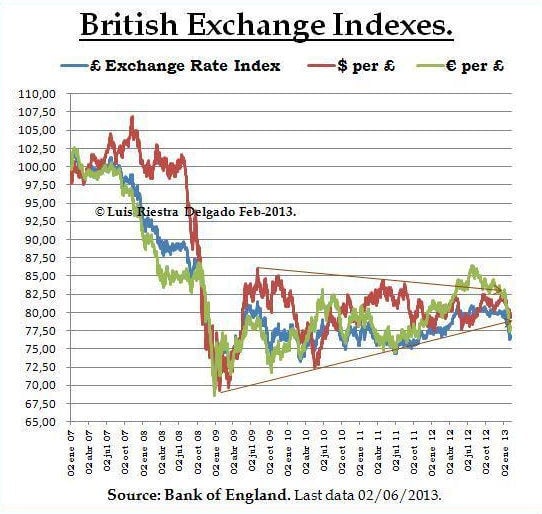

To again see a Soros Event, we would have to live under a series of adverse circumstances as strong as those in 1992 resulting in a strong devaluation of the pound. The pound was overvalued in 2007 when the financial crisis started and that correction has already occurred. What we are seeing now is a weak bounce back to a more “sound” value (see dotted arrows on above chart). But what is a sound value?

Determinants of currency values

There is a certain consensus among economists that, in the short term, the value of currencies is determined by financial flows but, in the long term, the key is the foundations of its foreign transactions. With London as one of the major, if not the major, center of global financial transactions, the pound is probably the most complex currency in forex terms.

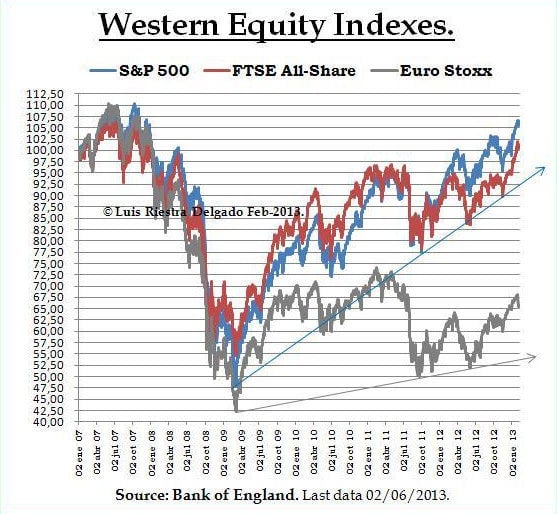

A good example of this is the FTSE index and its global companies (see below) “replicating” the American S&P 500, located in a country that is having a fair recovery, especially compared to the European Union or UK. Somehow, the UK financial sector helps the pound to be decoupled from its domestic economy.

The foundations of the UK economy

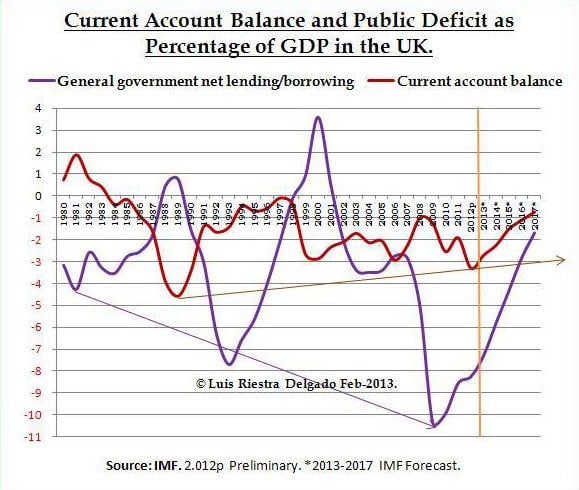

One of the foundations of the UK economy is London, of course, but what about the rest? Foreign transactions, its current account balance (trades of goods, services) and revenues (including dividends of the FTSE), which has a deficit that should be improving given the pound correction and it isn’t.

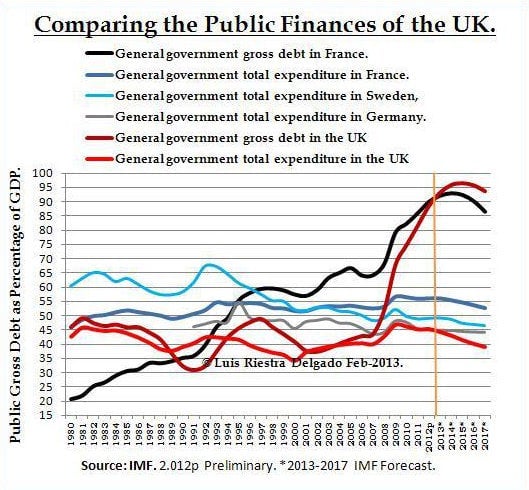

What is certainly another matter of concern is the public budget deficit (violet line, above chart). Its size and behavior is making British finances unsustainable given the huge debt generated (see chart below) by the recapitalization of the banking system, wrongly supervised by the FSA (instead of the Bank of England) and now under reform. Such a mess is the field of rough and vigorous discussions in the Houses of Parliament where the underlying debate is how to reduce such a gigantic debt.

The other determinant of the value of the pound is growth—as it produces new jobs, additional fiscal revenues, investments and capital inflows to the British economy. After the economic stimulus of the Queen’s Jubilee and the Olympics, the forecast is not good and a triple dip seems to be a certainty. Whether it was the electoral calendar of fiscal adjustment, public investments, the way cuts and taxes are distributed among every segment of the economy, or the effects of the EU partners’ recession, dismal future growth is clear.

A bear trap?

When, in the first half of February, speculators began to focus on the pound to open short positions, they were making a technical formation similar to the dangerous flag figure (see chart below), which usually breaks up. But with all those rumors it did the opposite signaling a possible rally against the pound.

But was it a false flag? Maybe, but under a disclaimer that the responsibility of your investment is yours, what is clear to me is that the conditions for a Soros Event against the pound (second red oval first chart) are not in place. Even with poor future macro data, the British pound has solid ground at $1.4 (dotted blue line first chart) and €1 (dotted black line) and only a major geopolitical event would break such levels. Meanwhile, we continue under this seemingly dangerous flag formation that may very well be a bear trap.