Yes, startup funding really is slowing in San Francisco

For a long time, it felt like Silicon Valley was the only place to build a successful startup.

For a long time, it felt like Silicon Valley was the only place to build a successful startup.

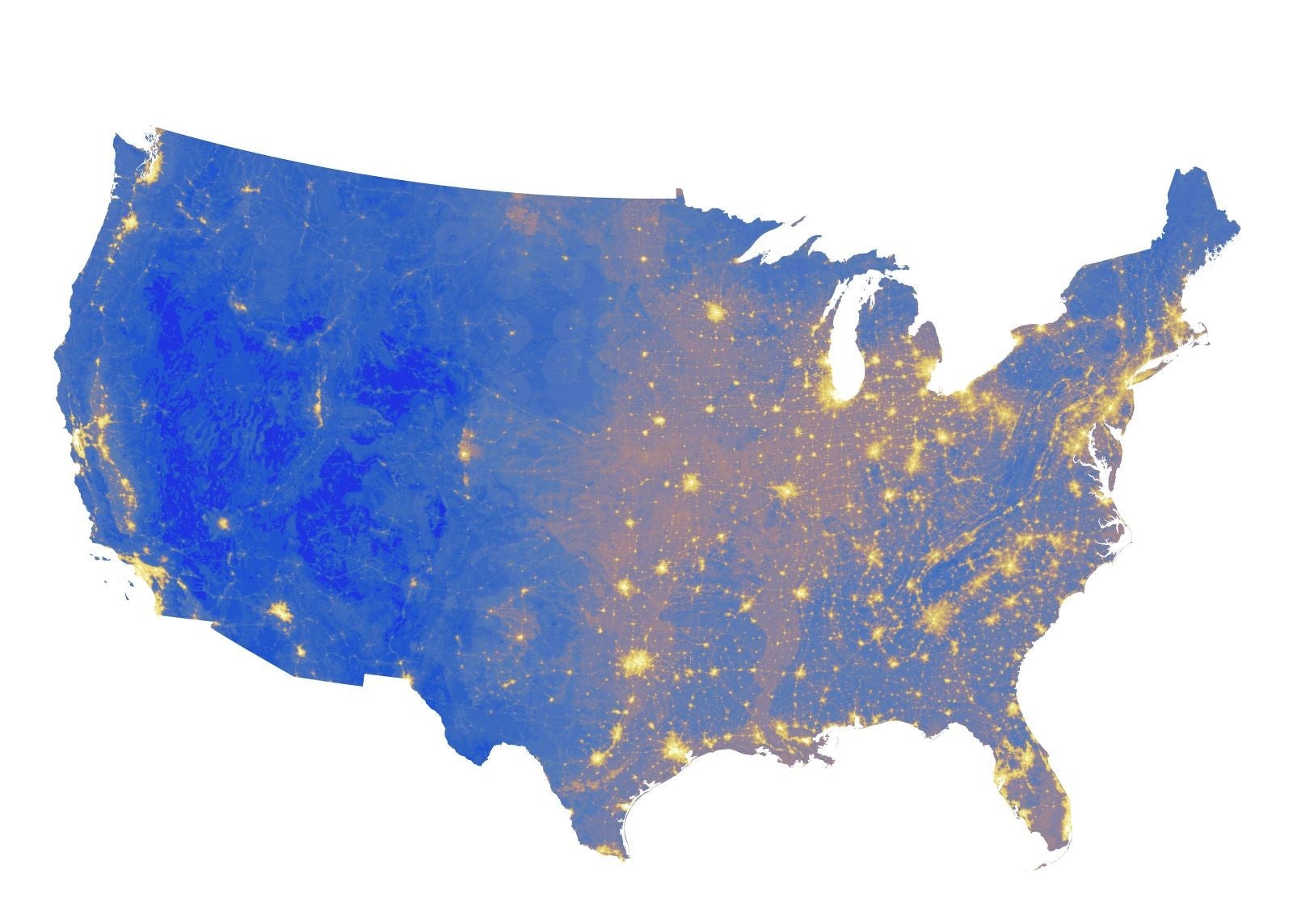

Now, dozens of other cities are getting in on the game. Yes, the Bay Area, New York, and Boston remain the undisputed centers of the startup world. But new growth in early-stage investment activity, while still small, shifted toward outlying cities in the last year, according to recently released data from Mattermark, which crunched data on 583 early-stage investments (seed, Series A, and Series B).

Overall, the first quarter’s fundraising was a “rollercoaster mostly pointed down” for early-stage startups, wrote Mattermark editor-in-chief Alex Wilhelm in an email to Quartz. The total number of early-stage deals, and the total dollars invested, fell by about 5% across the board (the analysis focused mostly on technology companies). Those declines were concentrated in old-guard startup hubs, which saw double-digit downturns in early stage venture capital compared to the same quarter last year. If you stripped out the Bay Area and its nearly 20% decline, investment rose about 6% in the first quarter. Areas with the biggest declines were:

The biggest winners, by contrast, tended to be much smaller, less coastal, and low-cost cities just starting to incubate their own ecosystem of new companies and investors, says Mattermark. (Many of these companies were building off a small base, with Boston being the biggest exception as it’s been riding the biotech wave). The dollar amount of deals, rather than the quantity of them, was the biggest driver of the increase. Notably, a significant share of new investment went to startups closing their second or third round of financing. In the past, many companies had to relocate to Silicon Valley to secure such financing. The biggest winners were:

To be sure, the numbers outside the Bay Area are still relatively small. More capital was invested in Bay Area startups in the first three months of the year—$1.7 billion—than Boston and New York combined. The 25 other top cities didn’t come close either. And these other cities need more time to demonstrate they can nurture their new startups.

It is clear, however, that successful startups lay the groundwork for new ones after employees and investors reinvest their earnings after a successful exit. The most famous example is Silicon Valley’s “PayPal Mafia,” the nickname for PayPal alumni who went on to seed many of Silicon Valley’s most successful companies following the company’s IPO and acquisition by eBay in 2002.

A similar process is now underway in other parts of the country. Southern California has seen a number of large IPOs and acquisitions in the last five years that have pumped more than $6 billion into the hands of employees and investors from hometown firms such as Maker Studios, Oculus, and Demand Media. A new generation of connected startups and angel investors has emerged on the scene. In Chicago, Cleversafe sold to IBM last year for $1.3 billion, minting an estimated 80 new millionaires, many of them in the city. The company’s CEO, Chris Gladwin, had rebuffed Silicon Valley investors who wanted to move the company to the Bay Area. Gladwin said the company was better off finding its talent and money in its hometown. The city could continue to gain from that.