Maybe China’s GDP data isn’t fake after all—at least not completely

Chinese economic data is often questioned by skeptics who believe government statisticians massage the numbers to make the Communist Party look like it’s doing a good job at bringing prosperity to its many citizens. Figures like GDP growth have been called “too important a number politically to be reliable” and, more plainly, ”a fake figure.” Li Kequiang, China’s new premier, called GDP figures “‘man-made’ and therefore unreliable,” according to a US diplomatic cable released by Wikileaks.

Chinese economic data is often questioned by skeptics who believe government statisticians massage the numbers to make the Communist Party look like it’s doing a good job at bringing prosperity to its many citizens. Figures like GDP growth have been called “too important a number politically to be reliable” and, more plainly, ”a fake figure.” Li Kequiang, China’s new premier, called GDP figures “‘man-made’ and therefore unreliable,” according to a US diplomatic cable released by Wikileaks.

But a new report by the Federal Reserve Bank of San Francisco calls this received wisdom into question. Its authors find that Chinese GDP numbers do tend to reflect data provided by more independent sources—namely the exports and imports of China’s trading partners, which are immune from any Beijing manipulation.

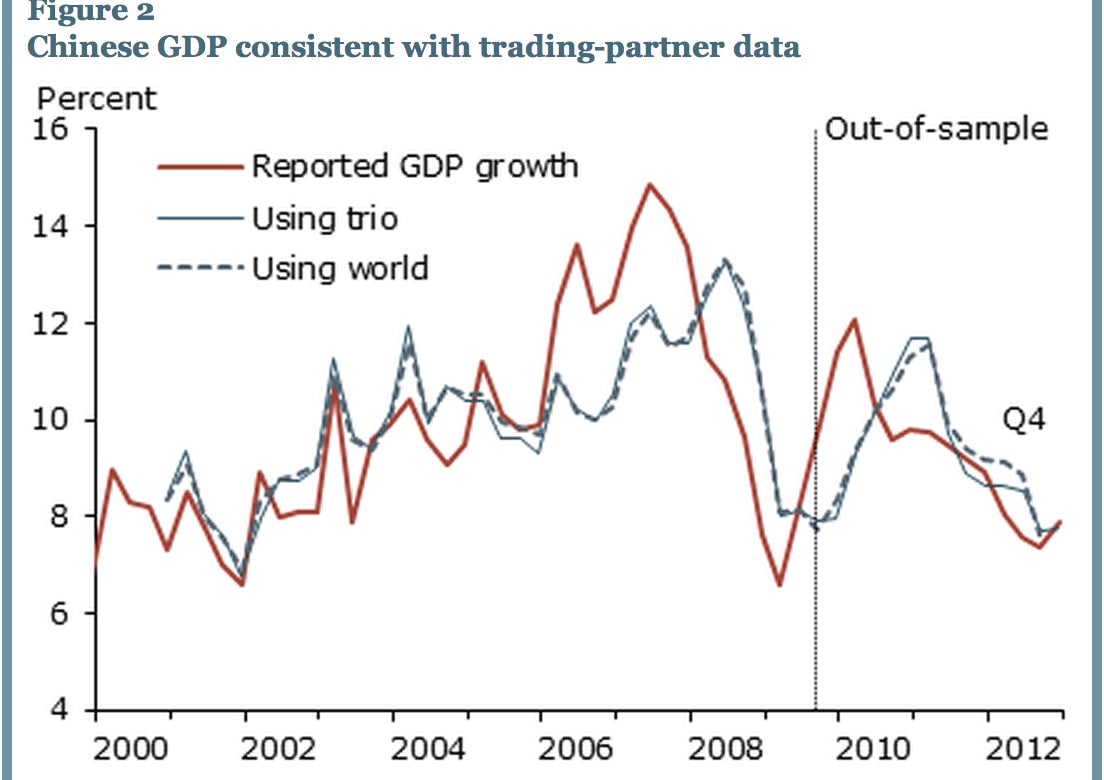

The Fed study first studied trade with China and its biggest trading partners: the US, the EU and Japan. It then compared Chinese growth and production statistics with figures from other trading partners around the world. As this chart shows, Chinese economic figures and the international data were broadly aligned, both in terms of the “trio” and the rest of the world.

“We find no evidence that China’s slowdown in 2012 was greater than officially reported,” the Fed authors concluded.

Research that only examines one economic measure should be treated with caution. There are still big reasons to be skeptical, as evidence abounds that local governments and Beijing statisticians employ a number of tricks to keep growth looking good.

Last year, Chinese provinces collectively reported economic output that was significantly larger (paywall) in aggregate than the official figure statisticians produced for the country as a whole— 57.6 trillion yuan vs. 51.9 trillion yuan, respectively. This led to jokes in the Chinese and Hong Kong media that China had a “missing province” somewhere that was obviously doing very well.

Meanwhile, Standard Chartered economist Stephen Green has said that China’s official GDP figures were boosted by government statisticians underestimating inflation, which results in an overestimate of actual growth. And the New York Times recently discovered that some Chinese power plant managers were inflating output figures to hide the extent of a big slowdown in usage from the central government.

The study’s authors themselves offer only a qualified judgment as to the truthfulness of Chinese GDP. Rather than offering a whole-hearted exculpation, they conclude: “We find no evidence that recently reported Chinese GDP figures are less reliable than usual.”