Student debt isn’t delaying millenials from buying homes

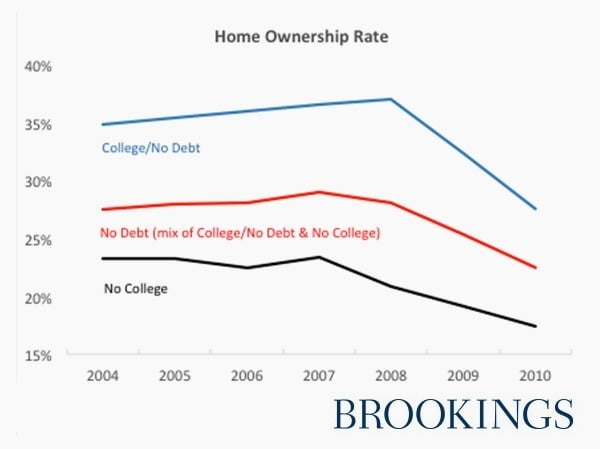

The stereotypical millennial is noncommittal, debt-burdened, and either rents or lives their parents’ basement. They are eschewing home ownership at unprecedented rates. Before the recession more than 41% of under 35-year-olds owned a home; by 2014 only 36% did. Meanwhile student debt has exploded, more than doubling from about $500 billion in 2007 to over a $1.2 trillion in 2015. The correlation would seem to suggest that the burden of student debt is keeping millennials from buying their first home. But research from the Federal Reserve Board of governors suggests student debt isn’t undermining home ownership. Even millennials without debt aren’t buying homes.

The stereotypical millennial is noncommittal, debt-burdened, and either rents or lives their parents’ basement. They are eschewing home ownership at unprecedented rates. Before the recession more than 41% of under 35-year-olds owned a home; by 2014 only 36% did. Meanwhile student debt has exploded, more than doubling from about $500 billion in 2007 to over a $1.2 trillion in 2015. The correlation would seem to suggest that the burden of student debt is keeping millennials from buying their first home. But research from the Federal Reserve Board of governors suggests student debt isn’t undermining home ownership. Even millennials without debt aren’t buying homes.

Millennials may not be buying homes because they are having a harder time starting a career, marrying older, are living in expensive cities where it’s hard to afford a home, or they can’t get a mortgage. There may be a generation shift that doesn’t value ownership as much as their parents did.

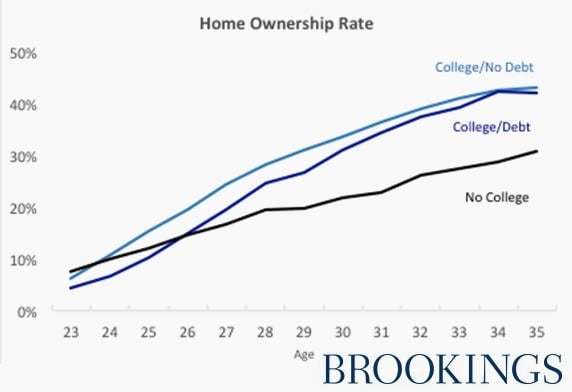

But there is evidence that even millennials eventually settle down. As they reach their thirties, millennials who can afford homes are buying them, regardless of student debt.

Education and debt expert, economist Sue Dynarski argues the real divide in home ownership does not come from debt but whether you have a college degree. Lacking a degree in this labor market means higher rates of unemployment and much lower earnings. Men with a bachelor’s degree earn $35,000 more a year than those without one. Financial insecurity and low earnings appear to be undermining homeownership more than student debt.

The cost of college may be going up, but assuming you finish your degree and go to a decent school, college is still a good bet—even if you have to take out debt to pay for it. Education not only pays for itself in terms of earnings, but it is also associated with homeownership.