Best-selling business books—the only place Atari and Circuit City are held up as model companies

There’s a formula to the typical business book: look at some successful companies, analyze them, make some true generalizations of those companies, and then advise others to do the same.

There’s a formula to the typical business book: look at some successful companies, analyze them, make some true generalizations of those companies, and then advise others to do the same.

The trouble is, this is basically useless.

Here’s why: In a pool of thousands of companies, inevitably some are going to end up highly successful purely through luck—and by looking just at performance, you’ve got no way of distinguishing luck and solid business strategy. Take a distinctive and successful company—you’ve got no idea if the factors that make them distinctive helped them, hindered them, or were completely irrelevant to their success.

Consider three of the best-selling and most renowned business books in the marketplace:

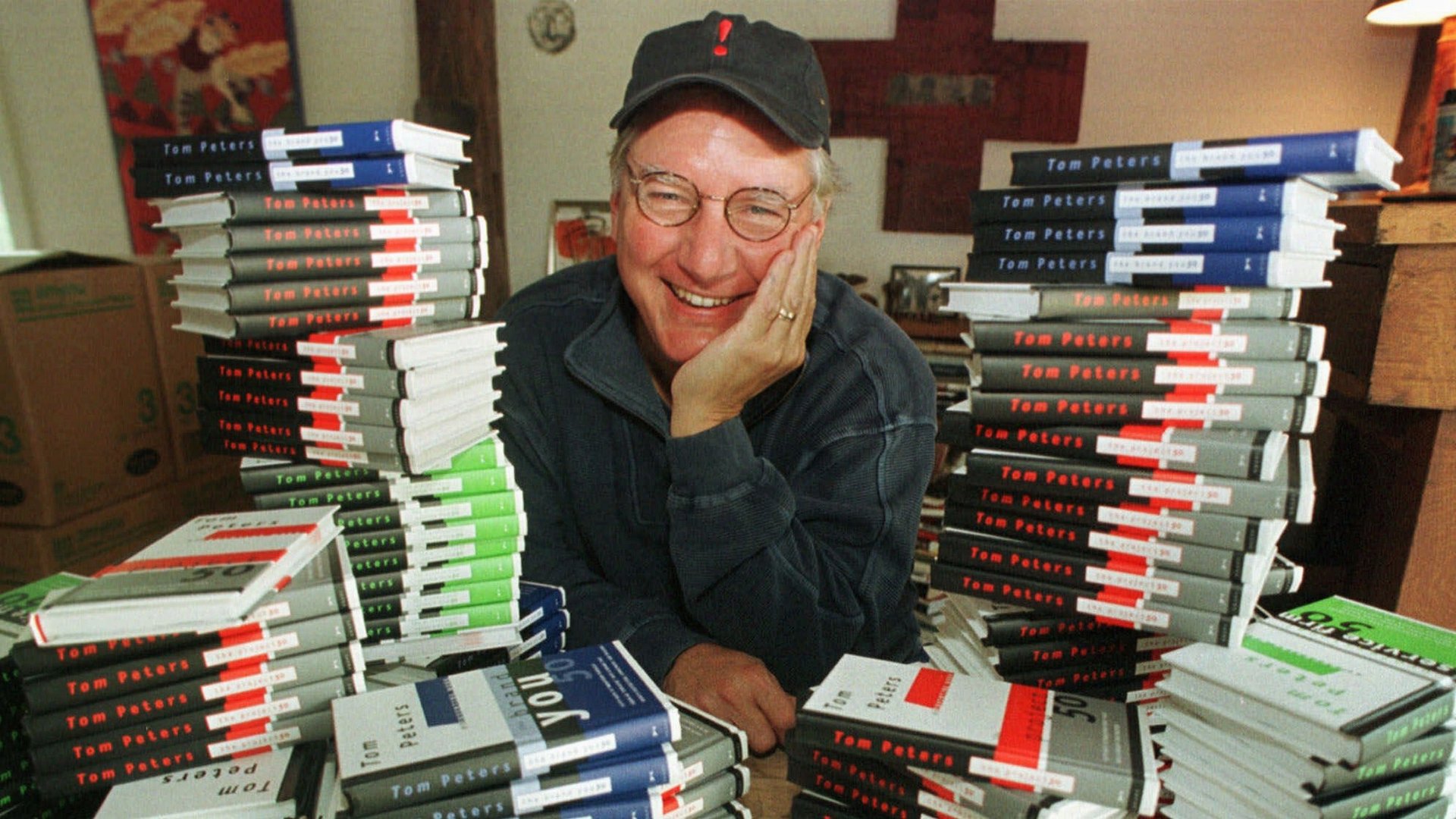

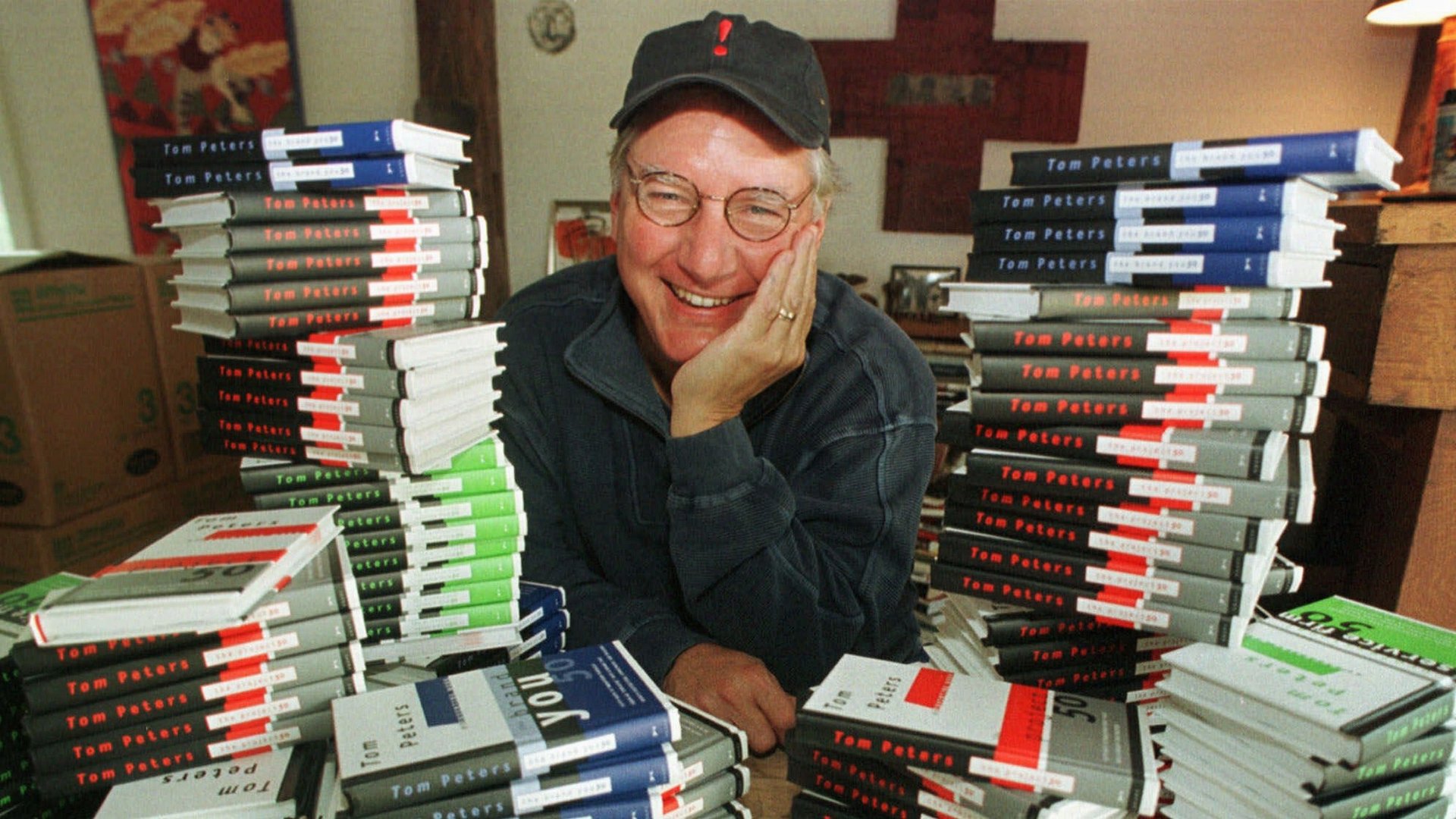

In Search of Excellence, by Tom Peters and Robert Waterman. Model companies included Atari, which ran into financial disaster and was taken over, and Wang Labs, which ultimately went bankrupt. Overall, subsequent performance was dramatically worse than previous performance.

Built to Last, by Jim Collins and Jerry Porras. Out of 17 model companies, only eight subsequently outperformed the market average.

Good to Great, by Collins. Model companies included Circuit City, which went bankrupt, and Fannie Mae, which went bankrupt and nationalised. Subsequent performance was below the market average.

If these companies were so great, why did they do so poorly post-publication? Given how these companies were selected for inclusion in the books, it’s hardly surprising. It’s akin to the authors examining the past performance of 1,000 people playing roulette, selecting those people who’d made a lot of money (and there would be some who’d done extremely well), then asked what made them special. Despite their “great performance,” we should expect those players to do no better than average in subsequent games. And even though business success does involve skill, making it more like poker than roulette, there’s just so much random noise that, for any single successful company, it’s hard to tell whether skill or chance made the difference.

What’s funny in the case of Good to Great, published in 2005, was that the true explanation of why his “great” companies had done so well was staring Jim Collins in the face. The winners told him success was due to luck, as did the losers:

The good-to-great executives talked a lot about luck in our interviews… we began to notice a contrasting pattern in the comparison executives: they credited substantial blame to bad luck…

Rather than concluding that the CEOs were spot-on in their diagnoses, Collins concludes that modesty is the key to success:

The Level 5 leaders… apportion credit to things outside themselves when things go well… The comparison leaders did just the opposite.

It’s easy to laugh at this and dismiss those books years after the fact—but we make mistakes like this all the time. We read Steve Jobs’ biography and wonder if his caustic nature was what made him successful—but ignore his early lucky breaks, and forget about all the successful yet affable CEOs there are. Or we look at our higher-performing competitors and try to figure out what made them different — forgetting that two people can roll exactly the same dice but end up with very different outcomes.

In general, humans have a remarkable tendency to see patterns everywhere, even when they don’t exist. But this doesn’t mean that all business strategy is useless. Unlike in other games of chance, in life and business, you can control how many opportunities you get—how many rolls of the die. And if you can manage more die-rolls than your competitors, on average you’ll do better.