Wall Street banks don’t have many bankers on their boards

It’s a heavy responsibility being a company board member, and it’s an even heavier one being on the board of a bank. So says the independent review of Barclays released yesterday, which recommends that because of the higher risks and complex regulation around banking, a decent number of a bank’s directors ought to have worked in finance themselves. But in practice, not many directors at the biggest banks have.

It’s a heavy responsibility being a company board member, and it’s an even heavier one being on the board of a bank. So says the independent review of Barclays released yesterday, which recommends that because of the higher risks and complex regulation around banking, a decent number of a bank’s directors ought to have worked in finance themselves. But in practice, not many directors at the biggest banks have.

After a scandal, boards are often accused of being too complacent or acting as rubber stamps for management. The Barclays review, which was commissioned after the Libor interest-rate rigging affair that landed the bank with a record fine, says a board, and especially its chairman, should create an atmosphere that welcomes differing views.

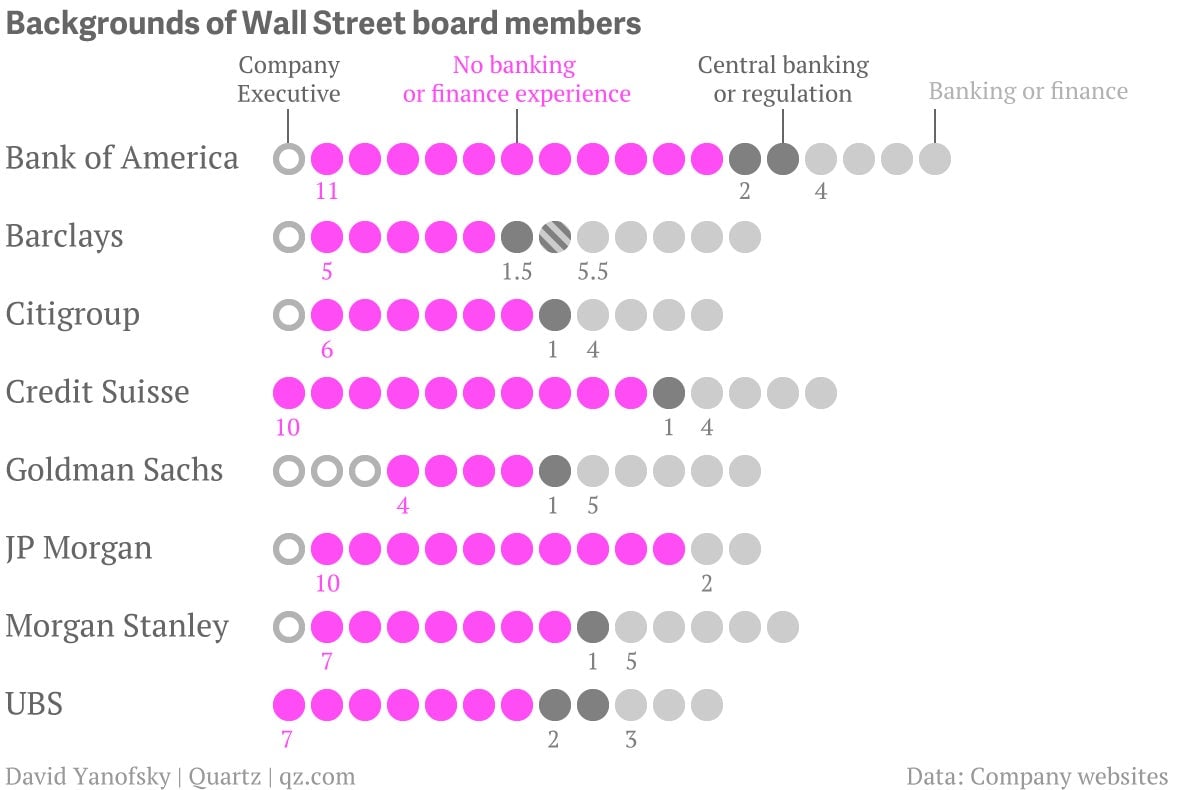

In 2010, Barclays set a goal of having 50% of its non-executive directors come from a banking or financial background. It has now exceeded that target. Quartz examined the boards of the world’s largest banks using the bios provided on their web sites, and found most of them have a few directors with a background at financial firms. Some also have government central banking or regulatory experience. But most of the directors come from outside finance. As on other company boards, many are executives of other corporations in diverse sectors, former government officials, and academics.

The chart above shows how many non-executive members of the biggest banks’ boards came from banking or finance (a broad definition that includes private equity, accounting and investments funds), or a related government background. Only senior-level experience was counted.