Here’s what Kuroda and the BoJ have to do to make Abenomics start working

To many, Abenomics seems like alchemy, albeit a dull, pinstriped kind that bows a lot. The concept involves lot of abstruse, scholarly talk about a process that will probably change nothing in the end. After all, if quantitative easing were easy, why didn’t Japan take steps to turn deflation into inflation two decades ago?

To many, Abenomics seems like alchemy, albeit a dull, pinstriped kind that bows a lot. The concept involves lot of abstruse, scholarly talk about a process that will probably change nothing in the end. After all, if quantitative easing were easy, why didn’t Japan take steps to turn deflation into inflation two decades ago?

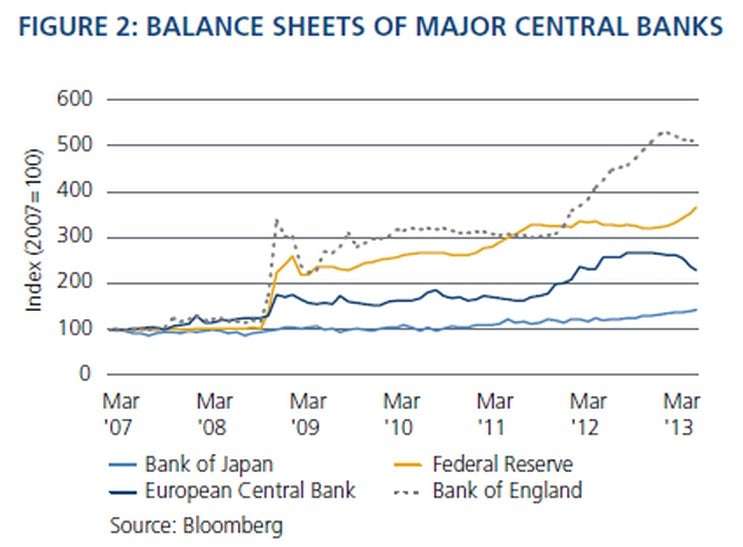

The simple reason is it never mastered the most crucial component: clear, decisive action. If investors, households and businesses don’t know what to expect, you can quantitatively ease until kingdom comes and no one will change their behavior. And that’s pretty much what governor after governor of the Bank of Japan (BoJ) has done: hemmed and hawed. Check out this comparison of the BoJ’s actions compared to other central banks, courtesy of Pimco:

Haruhiko Kuroda, BoJ’s new governor, gets that this has to change. And because we all know it, market expectations seem high as he wraps up the first BoJ policy meeting of his tenure, the results of which will be announced in a few hours.

The most important thing the BoJ must do is to communicate its intent in clear and forceful terms. Here’s a checklist of the things the BoJ will need to do, plus one additional move that would be nice to have.

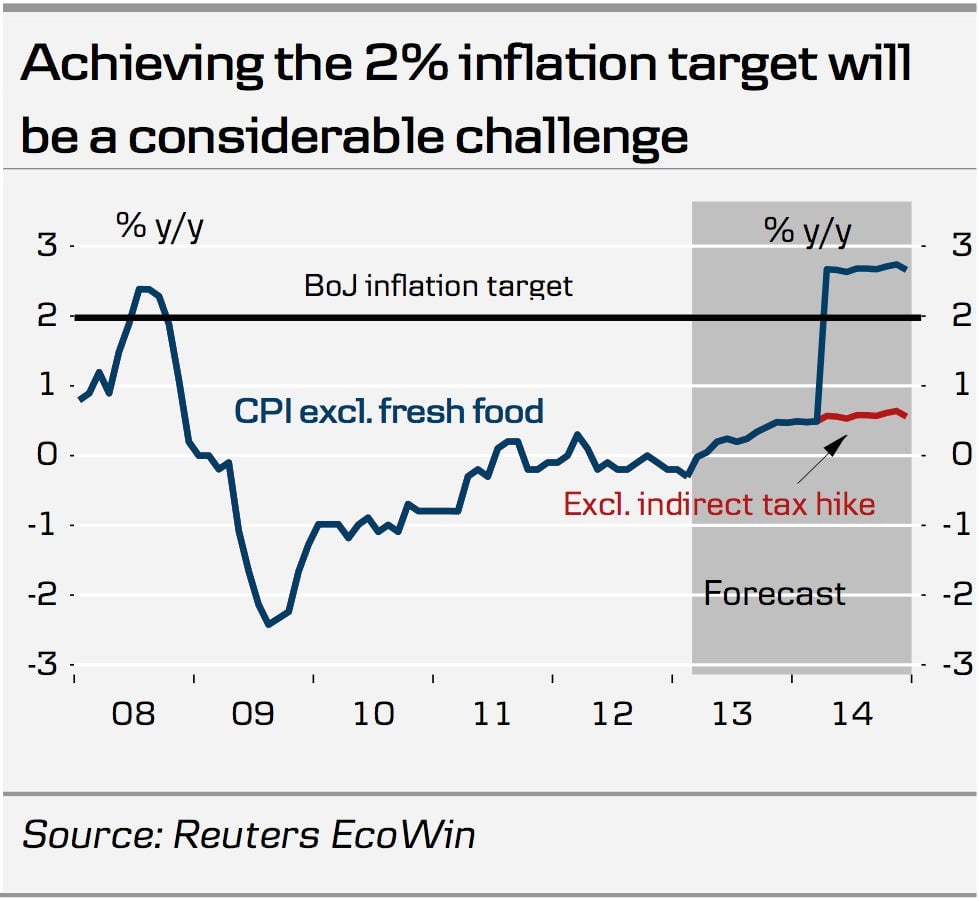

Commit to immediate open-ended purchasing until the 2% inflation target is hit. With open-ended asset-purchasing currently slated for 2014, accelerating the schedule is a no-brainer.

Up the amount of securities it will purchase by a couple trillion per month. BoJ currently purchases about ¥2 trillion a month in Japanese government bonds (JGBs). In order to convey its commitment to the 2% target, the BoJ will need to increase that by at least an additional ¥1 trillion to ¥2 trillion a month, probably as part of the open-ended asset-purchasing program.

Combine its two asset-purchase programs. The newer asset-purchase program (APP), is focused on 1-3-year bonds and asset-backed securities. The rinban, as the older asset-purchase program is known, lets the bank can buy bonds of up to 30 years in maturity. Merging the two will let the BoJ buy longer-dated bonds, which it needs to do to encourage investment in housing and infrastructure.

Give up the self-imposed “bank note rule.” This limits how much the rinban program can purchase, confining it the amount of bank notes in circulation. Though it’s already been dodged as a way to buy long-term JGBs (paywall), removing the rule entirely is what BoJ-watchers are hoping for. And, yes, that means “printing money” or “monetizing the debt”—the bugbear of the QE era. Here’s a look at why this needs to happen:

Invest in riskier assets. Many are hoping for aggressive purchasing of assets like REITs, corporate bonds or exchange-traded funds, which would expose BoJ to potential losses. While announcing this type of program would fall in the “forceful” column, this probably isn’t a must-have for Kuroda’s first meeting.

Though Kuroda can be counted on for decisive action, vintage BoJ indecision could still prevail. Reuters reports that the governor is having trouble forming consensus among the BoJ governors. If BoJ kicks the can down the road yet again, the loss of credibility would be incredibly damaging to Kuroda—and, by extension, to Abenomics.