The Bank of England did nothing today—but new UK data hint that maybe it didn’t have to

Mervyn King, the outgoing Bank of England governor and fan of increased stimulus, lost to other BOE committee members, as the Bank of England sat tight again this morning:

Mervyn King, the outgoing Bank of England governor and fan of increased stimulus, lost to other BOE committee members, as the Bank of England sat tight again this morning:

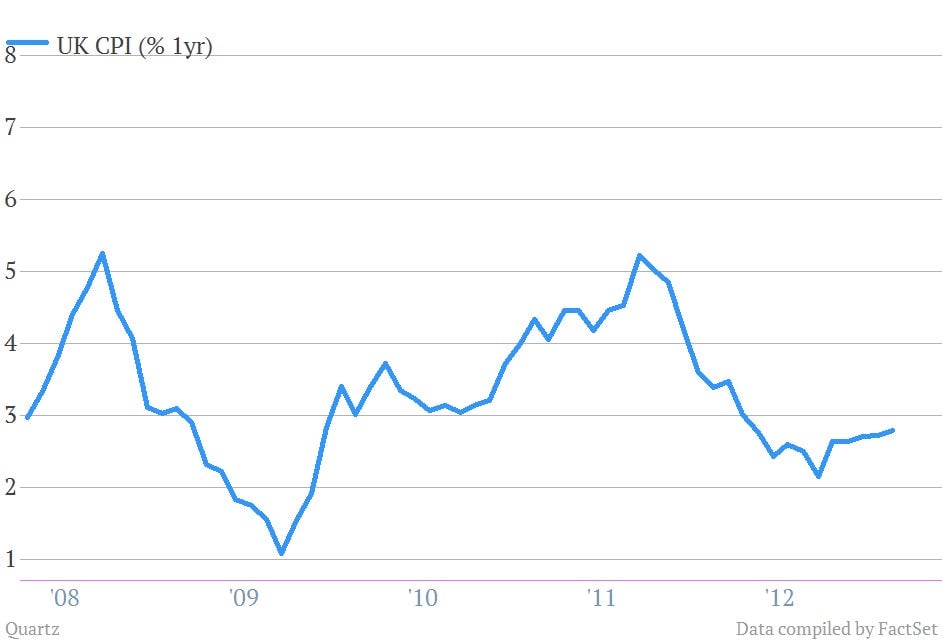

That 0.5% interest rate is where it’s been since March 2009. At issue is whether looser money would cheapen the sterling and fuel inflation. At 2.8% in February, inflation was above the central bank target of 2%. Here’s a look at that trend:

Unlike the US’s Federal Reserve, the BOE has a narrower mandate to fight inflation. However, two weeks ago, UK finance minister George Osborne adjusted that somewhat, giving the central bank a reprieve from having to battle temporary upticks in inflation. Though this was done in the hopes of shifting some of the six members of the Monetary Policy Committee to King’s pro-QE side, it was evidently not sufficiently persuasive.

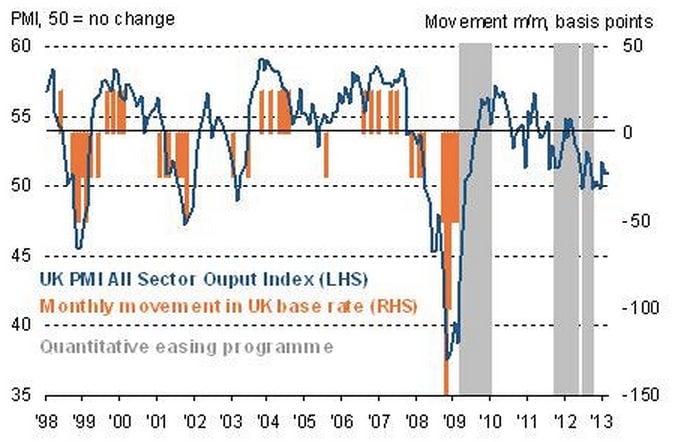

Many have lamented BOE torpor, attributing the weak UK economy and the looming threat of recession in some part to its refusal to resume quantitative easing. However, Markit chief economist Chris Williamson just popped up an interesting chart on Twitter The orange lines show the slashing of interest rates, while the left-hand side corresponds to the purchasing managers’ index (PMI), the measure of business activity for all sectors of the UK economy. “PMI still clearly in stimulus territory,” Williamson captioned it:

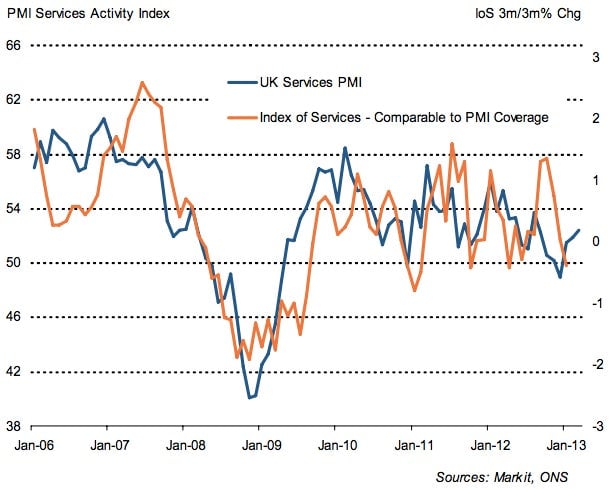

Maybe so. Data out earlier today showed the UK’s service-sector—as opposed to the previous chart, which also includes construction and manufacturing—PMI growing at the swiftest pace since the Olympics buoyed the metric last August. Business activity hit 52.4 in March, up from 51.8 in February (pdf). Here’s a look at that:

Markit, which collects and analyzes the data, said that a lot of this came from a pickup in new business, which, in turn, drove a third consecutive month of increases in jobs.

That’s big. Services contribute around three-quarters of the UK’s GDP. After its economy shrank 0.3% in Q4 2012, a slide back into recession looked inevitable.

The service sector recovery might be enough to offset grim activity in manufacturing and construction, said Markit’s Williamson. “The government and Bank of England will breathe sighs of relief in seeing signs of a gathering upturn in the service sector during March, which looks set to have helped the UK avoid a triple-dip recession by the narrowest of margins,” he wrote.